Western Union 2012 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2012 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.41

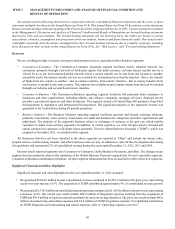

Our consolidated balance sheet may not contain sufficient amounts or types of regulatory capital to meet the changing

requirements of our various regulators worldwide, which could adversely affect our business, financial condition and results

of operations.

Our regulators expect us to possess sufficient financial soundness and strength to adequately support our regulated subsidiaries.

We have substantial indebtedness as of December 31, 2012, which could make it more difficult to meet these requirements if such

requirements are increased. In addition, although we are not a bank holding company for purposes of United States law or the law

of any other jurisdiction, as a global provider of payments services and in light of the changing regulatory environment in various

jurisdictions, we could become subject to new capital requirements introduced or imposed by our regulators that could require us

to issue securities that would qualify as Tier 1 regulatory capital under the Basel Committee accords or retain earnings over a

period of time. Also, our regulators specify the amount and composition of settlement assets that certain of our subsidiaries must

hold in order to satisfy our outstanding settlement obligations. These regulators could further restrict the type of instruments that

qualify as settlement assets or these regulators could require our regulated subsidiaries to maintain higher levels of settlement

assets. For example, we have seen increased scrutiny from government regulators regarding the sufficiency of our capitalization

and the appropriateness of our investments held in order to comply with state and other licensing requirements. Any change or

increase in these regulatory requirements could have a material adverse effect on our business, financial condition and results of

operations.

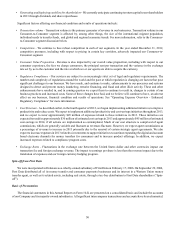

Risks Relating to the Spin-Off

We were incorporated in Delaware as a wholly-owned subsidiary of First Data on February 17, 2006. On September 29, 2006,

First Data distributed 100% of its money transfer and consumer payments businesses and its interest in a Western Union money

transfer agent, as well as related assets, including real estate, through a tax-free distribution to First Data shareholders (“Spin-off”)

through this previously owned subsidiary.

If the Spin-off does not qualify as a tax-free transaction, First Data and its stockholders could be subject to material amounts

of taxes and, in certain circumstances, we could be required to indemnify First Data for material taxes pursuant to

indemnification obligations under the tax allocation agreement.

First Data received a private letter ruling from the IRS to the effect that the Spin-off (including certain related transactions)

qualifies as a tax-free transaction to First Data, us and First Data stockholders for United States federal income tax purposes under

sections 355, 368 and related provisions of the Internal Revenue Code, assuming, among other things, the accuracy of the

representations made by First Data to the IRS in the private letter ruling request. If the factual assumptions or representations made

in the private letter ruling request were determined to be untrue or incomplete, then First Data and ourselves would not be able to

rely on the ruling.

The Spin-off was conditioned upon First Data's receipt of an opinion of Sidley Austin LLP, counsel to First Data, to the effect

that, with respect to requirements on which the IRS did not rule, those requirements would be satisfied. The opinion was based

on, among other things, certain assumptions and representations as to factual matters made by First Data and us which, if untrue

or incomplete, would jeopardize the conclusions reached by counsel in its opinion. The opinion is not binding on the IRS or the

courts, and the IRS or the courts may not agree with the opinion.

If, notwithstanding receipt of the private letter ruling and opinion of tax counsel, the Spin-off were determined to be a taxable

transaction, each holder of First Data common stock who received shares of our common stock in connection with the Spin-off

would generally be treated as receiving a taxable distribution in an amount equal to the fair value of our common stock received.

First Data would recognize taxable gain equal to the excess of the fair value of the consideration received by First Data in the

contribution over First Data's tax basis in the assets contributed to us in the contribution. If First Data were unable to pay any taxes

for which it is responsible under the tax allocation agreement, the IRS might seek to collect such taxes from Western Union.

Even if the Spin-off otherwise qualified as a tax-free distribution under section 355 of the Internal Revenue Code, the Spin-

off may result in significant United States federal income tax liabilities to First Data if 50% or more of First Data's stock or our

stock (in each case, by vote or value) is treated as having been acquired, directly or indirectly, by one or more persons as part of

a plan (or series of related transactions) that includes the Spin-off. For purposes of this test, any acquisitions, or any understanding,

arrangement or substantial negotiations regarding an acquisition, within two years before or after the Spin-off are subject to special

scrutiny.