Western Union 2012 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2012 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

101

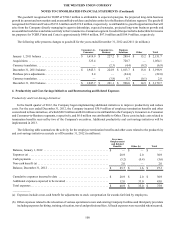

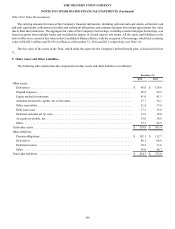

2010 Restructuring

On May 25, 2010 and as subsequently revised, the Company's Board of Directors approved a restructuring plan (the

“Restructuring Plan”) designed to reduce the Company's overall headcount and migrate positions from various facilities, primarily

within North America and Europe, to regional operating centers. Details of the expenses incurred are included in the tables below.

Included in these expenses are approximately $2 million of non-cash expenses related to fixed asset and leasehold improvement

write-offs and accelerated depreciation at impacted facilities. As of December 31, 2011, the Company had incurred all of the

expenses related to the Restructuring Plan.

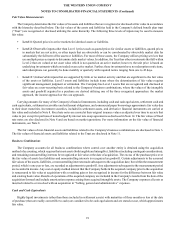

The following table summarizes the activity for the restructuring and related expenses discussed above and the related

restructuring accruals as of and for the years ended December 31, 2012, 2011 and 2010 (in millions):

Severance,

Outplacement

and Related

Benefits

Fixed Asset

Write-Offs and

Accelerated

Depreciation

Lease

Terminations Other (b) Total

Balance, January 1, 2010 . . . . . . . . . . . . . . . . . . . $—$—$—$—$—

Expenses (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48.7 0.9 — 9.9 59.5

Cash payments . . . . . . . . . . . . . . . . . . . . . . . . . . . (13.7)— —

(8.8)(22.5)

Non-cash charges (a) . . . . . . . . . . . . . . . . . . . . . . (0.7)(0.9)— —

(1.6)

Balance, December 31, 2010 . . . . . . . . . . . . . . . . $ 34.3 $ — $ — $ 1.1 $ 35.4

Expenses (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26.1 1.3 3.5 15.9 46.8

Cash payments . . . . . . . . . . . . . . . . . . . . . . . . . . . (48.1)—

(3.5)(16.8)(68.4)

Non-cash charges (a) . . . . . . . . . . . . . . . . . . . . . . 1.4 (1.3) — — 0.1

Balance, December 31, 2011 . . . . . . . . . . . . . . . . $ 13.7 $ — $ — $ 0.2 $ 13.9

Cash payments . . . . . . . . . . . . . . . . . . . . . . . . . . . (11.9)— —

(0.2)(12.1)

Balance, December 31, 2012 . . . . . . . . . . . . . . . . $1.8$—$—$—$1.8

Total expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 74.8 $ 2.2 $ 3.5 $ 25.8 $ 106.3

_____________

(a) Expenses include non-cash write-offs and accelerated depreciation of fixed assets and leasehold improvements. However,

these amounts were recognized outside of the restructuring accrual.

(b) Other expenses related to the relocation of various operations to new and existing Company facilities including expenses

for hiring, training, relocation, travel and professional fees. All such expenses were recorded when incurred.

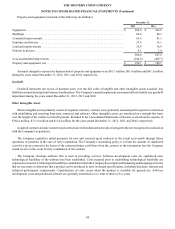

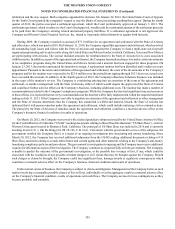

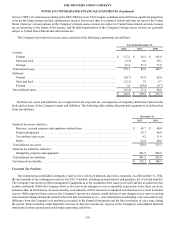

The following table presents productivity and cost-savings initiatives and restructuring and related expenses as reflected in

the Consolidated Statements of Income (in millions):

Year Ended December 31,

2012 2011 2010

Productivity and

Cost-Savings

Initiatives Restructuring and Related Expenses

Cost of services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 5.5 $ 10.6 $ 15.0

Selling, general and administrative . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25.4 36.2 44.5

Total expenses, pre-tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 30.9 $ 46.8 $ 59.5

Total expenses, net of tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 20.2 $ 32.0 $ 39.3

There were no restructuring and related expenses incurred during the year ended December 31, 2012.