Western Union 2012 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2012 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

120

14. Derivatives

The Company is exposed to foreign currency exchange risk resulting from fluctuations in exchange rates, primarily the euro,

and to a lesser degree the Canadian dollar, British pound, Australian dollar, and other currencies, related to forecasted money

transfer revenues and on money transfer settlement assets and obligations. The Company is also exposed to risk from derivative

contracts written to its customers arising from its cross-currency Business Solutions payments operations. Additionally, the

Company is exposed to interest rate risk related to changes in market rates both prior to and subsequent to the issuance of debt.

The Company uses derivatives to (a) minimize its exposures related to changes in foreign currency exchange rates and interest

rates and (b) facilitate cross-currency Business Solutions payments by writing derivatives to customers.

The Company executes derivatives with established financial institutions, with the substantial majority of these financial

institutions having credit ratings of “A-” or better from a major credit rating agency. The Company also writes Business Solutions

derivatives mostly with small and medium size enterprises. The primary credit risk inherent in derivative agreements represents

the possibility that a loss may occur from the nonperformance of a counterparty to the agreements. The Company performs a

review of the credit risk of these counterparties at the inception of the contract and on an ongoing basis. The Company also monitors

the concentration of its contracts with any individual counterparty. The Company anticipates that the counterparties will be able

to fully satisfy their obligations under the agreements, but takes action (including termination of contracts) when doubt arises

about the counterparties' ability to perform. The Company's hedged foreign currency exposures are in liquid currencies;

consequently, there is minimal risk that appropriate derivatives to maintain the hedging program would not be available in the

future.

Foreign Currency — Consumer-to-Consumer

The Company’s policy is to use longer-term foreign currency forward contracts, with maturities of up to 36 months at inception

and a targeted weighted-average maturity of approximately one year, to mitigate some of the risk that changes in foreign currency

exchange rates compared to the United States dollar could have on forecasted revenues denominated in other currencies related

to its business. As of December 31, 2012, the Company’s longer-term foreign currency forward contracts had maturities of a

maximum of 24 months with a weighted-average maturity of approximately one year. These contracts are accounted for as cash

flow hedges of forecasted revenue, with effectiveness assessed based on changes in the spot rate of the affected currencies during

the period of designation. Accordingly, all changes in the fair value of the hedges not considered effective or portions of the hedge

that are excluded from the measure of effectiveness are recognized immediately in “Derivative gains/(losses), net” within the

Company’s Consolidated Statements of Income.

The Company also uses short duration foreign currency forward contracts, generally with maturities from a few days up to

one month, to offset foreign exchange rate fluctuations on settlement assets and obligations between initiation and settlement. In

addition, forward contracts, typically with maturities of less than one year, are utilized to offset foreign exchange rate fluctuations

on certain foreign currency denominated cash positions. None of these contracts are designated as accounting hedges.

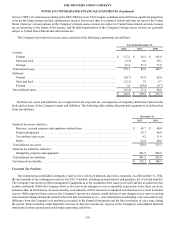

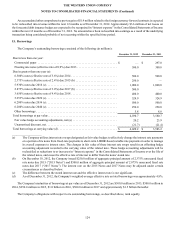

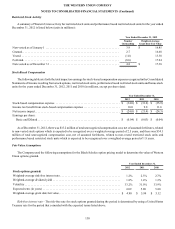

The aggregate equivalent United States dollar notional amounts of foreign currency forward contracts as of December 31,

2012 were as follows (in millions):

Contracts not designated as hedges:

Euro . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 254.9

Canadian dollar . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47.3

British pound . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40.8

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 179.8

Contracts designated as hedges:

Euro . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 485.2

Canadian dollar . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 126.7

British pound . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 95.6

Australian dollar. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48.1

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 83.3