Western Union 2012 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2012 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

102

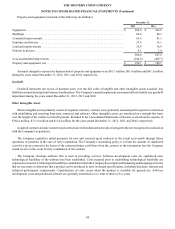

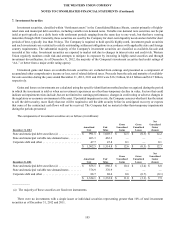

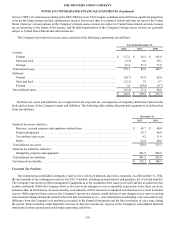

The following table summarizes the restructuring and related expenses incurred by reportable segment (in millions).

Restructuring and related expenses have not been allocated to the Company's segments disclosed in Note 17. While these items

are identifiable to the Company's segments, these expenses have been excluded from the measurement of segment operating profit

provided to the chief operating decision maker (“CODM”) for purposes of assessing segment performance and decision making

with respect to resource allocation.

Activity

Consumer-

to-Consumer

Consumer-

to-Business

Business

Solutions Other Total

2010 Restructuring and Related Expenses . . . . . . . . . . . . . . . . . . $ 44.7 $ 9.8 $ 3.0 $ 2.0 $ 59.5

2011 Restructuring and Related Expenses . . . . . . . . . . . . . . . . . . 33.7 6.2 5.0 1.9 46.8

Total expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 78.4 $ 16.0 $ 8.0 $ 3.9 $ 106.3

5. Related Party Transactions

The Company has ownership interests in certain of its agents accounted for under the equity method of accounting. The

Company pays these agents, as it does its other agents, commissions for money transfer and other services provided on the

Company’s behalf. Commission expense recognized for these agents for the years ended December 31, 2012, 2011 and 2010

totaled $66.1 million, $131.9 million and $183.5 million, respectively. Commission expense recognized for Finint prior to October

31, 2011 and Costa prior to April 20, 2011, the date of the acquisitions (see Note 3), was considered a related party transaction.

The Company has a director who is also a director for a company that previously held significant investments in two of the

Company's existing agents. As of December 31, 2012, this company holds a significant investment in one agent. These agents had

been agents of the Company prior to the director being appointed to the board. The Company recognized commission expense of

$28.9 million, $58.8 million, and $52.9 million for the years ended December 31, 2012, 2011 and 2010, respectively, related to

these agents during the period the agents were affiliated with the Company's director.

6. Commitments and Contingencies

Letters of Credit and Bank Guarantees

The Company had approximately $100 million in outstanding letters of credit and bank guarantees as of December 31, 2012

with expiration dates through 2016, the majority of which contain a one-year renewal option. The letters of credit and bank

guarantees are primarily held in connection with lease arrangements and certain agent agreements. The Company expects to renew

the letters of credit and bank guarantees prior to expiration in most circumstances.

Litigation and Related Contingencies

The Company and one of its subsidiaries are defendants in two purported class action lawsuits: James P. Tennille v. The

Western Union Company and Robert P. Smet v. The Western Union Company, both of which are pending in the United States

District Court for the District of Colorado. The original complaints asserted claims for violation of various consumer protection

laws, unjust enrichment, conversion and declaratory relief, based on allegations that the Company waits too long to inform

consumers if their money transfers are not redeemed by the recipients and that the Company uses the unredeemed funds to generate

income until the funds are escheated to state governments. The Tennille complaint was served on the Company on April 27, 2009.

The Smet complaint was served on the Company on April 6, 2010. On September 21, 2009, the Court granted the Company's

motion to dismiss the Tennille complaint and gave the plaintiff leave to file an amended complaint. On October 21, 2009, Tennille

filed an amended complaint. The Company moved to dismiss the Tennille amended complaint and the Smet complaint. On

November 8, 2010, the Court denied the motion to dismiss as to the plaintiffs' unjust enrichment and conversion claims. On

February 4, 2011, the Court dismissed plaintiffs' consumer protection claims. On March 11, 2011, the plaintiffs filed an amended

complaint that adds a claim for breach of fiduciary duty, various elements to its declaratory relief claim and Western Union Financial

Services, Inc. as a defendant. On April 25, 2011, the Company and Western Union Financial Services, Inc. filed a motion to dismiss

the breach of fiduciary duty and declaratory relief claims. Western Union Financial Services, Inc. also moved to compel arbitration

of the plaintiffs' claims and to stay the action pending arbitration. On November 21, 2011, the Court denied the motion to compel