Western Union 2012 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2012 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

Other

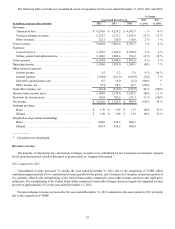

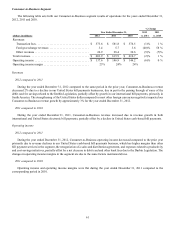

The following table sets forth other results for the years ended December 31, 2012, 2011 and 2010.

% Change

Year Ended December 31, 2012 2011

(dollars in millions) 2012 2011 2010 vs. 2011 vs. 2010

Revenues . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 109.2 $ 106.0 $ 91.9 3% 15%

Operating loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (19.7)$ (21.5)$ (5.7)* *

____________

* Calculation not meaningful

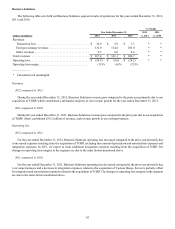

Revenues

2012 compared to 2011

Other revenue increased for the year ended December 31, 2012 compared to the prior year primarily due to increases in our

prepaid business, partially offset by a decrease in investment income in our money order business.

2011 compared to 2010

Other revenue grew for the year ended December 31, 2011 compared to the prior year primarily due to volume increases in

our prepaid business.

Operating loss

2012 compared to 2011

During the year ended December 31, 2012, the decrease in operating loss was due to costs associated with acquisition activity

that occurred in the prior year, partially offset by declines in our money order business, including a decrease in investment income,

and expenses related to productivity and cost-savings initiatives.

2011 compared to 2010

During the year ended December 31, 2011, the increase in operating loss compared to the prior year was primarily due to deal

costs associated with the TGBP acquisition.

Capital Resources and Liquidity

Our primary source of liquidity has been cash generated from our operating activities, primarily from net income and

fluctuations in working capital. Our working capital is affected by the timing of interest payments on our outstanding borrowings,

timing of income tax payments, including our tax deposit described further in “Cash Flows from Operating Activities,” and

collections on receivables, among other items. The majority of our interest payments are due in the second and fourth quarters

which results in a decrease in the amount of cash provided by operating activities in those quarters and a corresponding increase

to the first and third quarters.

Our future cash flows could be impacted by a variety of factors, some of which are out of our control, including changes in

economic conditions, especially those impacting the migrant population and changes in income tax laws or the status of income

tax audits, including the resolution of outstanding tax matters.