Western Union 2012 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2012 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

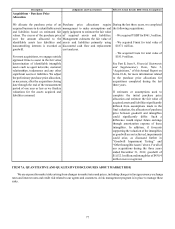

Description Judgments and Uncertainties Effect if Actual Results Differ from Assumptions

Other Intangible Assets

We capitalize acquired intangible assets as

well as certain initial payments for new

and renewed agent contracts and software.

We evaluate such intangible assets for

impairment on an annual basis and

whenever events or changes in

circumstances indicate the carrying

amount of such assets may not be

recoverable. In such reviews, estimated

undiscounted cash flows associated with

these assets or operations are compared

with their carrying amounts to determine

if a write-down to fair value (normally

measured by the present value technique)

is required.

The capitalization of initial payments for

new and renewed agent contracts is

subject to strict accounting policy criteria

and requires management judgment as to

the amount to capitalize and the related

period of benefit. Our accounting policy

is to limit the amount of capitalized costs

for a given agent contract to the lesser of

the estimated future cash flows from the

contract or the termination fees we would

receive in the event of early termination

of the contract.

The estimated undiscounted cash flows

associated with each asset requires us to

make estimates and assumptions,

including, among other things, revenue

growth rates, and operating margins based

on our budgets and business plans.

Disruptions to contractual relationships,

significant declines in cash flows or

transaction volumes associated with

contracts, or other issues significantly

impacting the future cash flows associated

with the contract would cause us to

evaluate the recoverability of the asset.

If an event described above occurs and

causes us to determine that an asset has

been impaired, that could result in an

impairment charge.

The net carrying value of our other

intangible assets as of December 31, 2012

was $878.9 million.