Western Union 2012 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2012 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

121

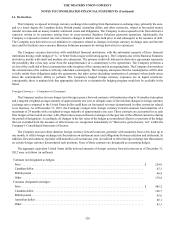

Foreign Currency — Business Solutions

The Company writes derivatives, primarily foreign currency forward contracts and option contracts, mostly with small and

medium size enterprises and derives a currency spread from this activity as part of its Business Solutions operations. The Company

aggregates its Business Solutions payments foreign currency exposures arising from customer contracts, including the derivative

contracts described above, and hedges the resulting net currency risks by entering into offsetting contracts with established financial

institution counterparties (economic hedge contracts). The derivatives written are part of the broader portfolio of foreign currency

positions arising from its cross-currency Business Solutions payments operations, which primarily include spot exchanges of

currency in addition to forwards and options. Foreign exchange revenues from the total portfolio of positions were $332.0 million,

$154.6 million, and $105.0 million for the years ended December 31, 2012, 2011 and 2010, respectively. None of the derivative

contracts used in Business Solutions operations are designated as accounting hedges. The duration of these derivative contracts

at inception is generally less than one year.

The aggregate equivalent United States dollar notional amounts of foreign currency derivative customer contracts held by the

Company in its Business Solutions operations as of December 31, 2012 were approximately $3.9 billion. The significant majority

of customer contracts are written in major currencies such as the Canadian dollar, euro, British pound, and Australian dollar.

Interest Rate Hedging — Corporate

The Company utilizes interest rate swaps to effectively change the interest rate payments on a portion of its notes from fixed-

rate payments to short-term LIBOR-based variable rate payments in order to manage its overall exposure to interest rates. The

Company designates these derivatives as fair value hedges utilizing the short-cut method, which permits an assumption of no

ineffectiveness if certain criteria are met. The change in fair value of the interest rate swaps is offset by a change in the carrying

value of the debt being hedged within “Borrowings” in the Consolidated Balance Sheets and “Interest expense” in the Consolidated

Statements of Income has been adjusted to include the effects of interest accrued on the swaps.

The Company, at times, utilizes derivatives to hedge the forecasted issuance of fixed-rate debt. These derivatives are designated

as cash flow hedges of the variability in the fixed-rate coupon of the debt expected to be issued. The effective portion of the change

in fair value of the derivatives is recorded in “Accumulated other comprehensive loss” in the Consolidated Balance Sheets.

As of December 31, 2012 and 2011, the Company held interest rate swaps in an aggregate notional amount of $800.0 million

and $500.0 million, respectively. Of this aggregate notional amount held at December 31, 2012, $500.0 million related to notes

due in 2014 and $300.0 million related to notes due in 2018.