Western Union 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2012

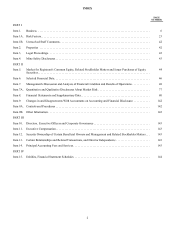

Table of contents

-

Page 1

ANNUAL REPORT 2012 -

Page 2

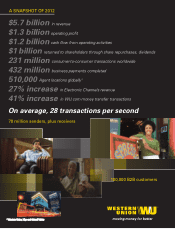

... 432 million business payments completed 510,000 Agent locations globally 27% increase in Electronic Channels revenue 41% increase in WU.com money transfer transactions 1 On average, 28 transactions per second 70 million senders, plus receivers 100,000 B2B customers 1 Western Union, Vigo and... -

Page 3

... need-quickly and conveniently-to meet their financial needs and achieve their full potential. Western Union is a global brand with extensive customer relationships, vast payment capabilities and local market expertise. We operate through a network of more than 500,000 Agent locations and 100,000... -

Page 4

... implementing pricing investments to enhance our value proposition. And we are working to add Agent locations, expanding in Europe, Latin America and Asia, and paving the way to formalize money transfer services in markets such as newly opened Myanmar. Western Union is strongly positioned to become... -

Page 5

FORM 10-K -

Page 6

... Englewood, Colorado 80112 (Address of principal executive offices) Registrant's telephone number, including area code: (866) 405-5012 Securities registered pursuant to Section 12(b) of the Act: Title of each class Common Stock, $0.01 Par Value Name of each exchange on which registered The New York... -

Page 7

...II Item 5. Item 6. Item 7. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities ...Selected Financial Data...Management's Discussion and Analysis of Financial Condition and Results of Operations ...Properties ...Legal Proceedings ...Mine Safety... -

Page 8

... new services and enhancements, and gain market acceptance of such services; changes in, and failure to manage effectively, exposure to foreign exchange rates, including the impact of the regulation of foreign exchange spreads on money transfers and payment transactions; interruptions of United... -

Page 9

... and prevent money laundering, terrorist financing, fraud and other illicit activity, and increased costs or loss of business associated with compliance with those laws and regulations; changes in United States or foreign laws, rules and regulations including the Internal Revenue Code, governmental... -

Page 10

... regarding consumer privacy and data use and security; effects of unclaimed property laws; failure to maintain sufficient amounts or types of regulatory capital to meet the changing requirements of our regulators worldwide; changes in accounting standards, rules and interpretations; Other Events... -

Page 11

... use the services of a well-recognized brand to transfer funds. Our Consumer-toConsumer money transfer service enables people to send money around the world, usually within minutes. As of December 31, 2012, our services were available through a global network of approximately 510,000 agent locations... -

Page 12

... to send money over the Internet or phone using a credit or debit card, or through a withdrawal directly from a consumer's bank account. All agent locations accept cash to initiate a transaction, and some also accept debit cards. We offer consumers several options to receive a money transfer. While... -

Page 13

... minutes, while still offering the convenience, reliability and ease of use that our consumers expect. Online money transfer service. Our websites allow consumers to send funds online, generally using a credit or debit card, for pay-out at most Western Union branded agent locations around the world... -

Page 14

... can pay in multiple currencies at a single location. Our agents provide the physical infrastructure and staff required to complete the transfers. Western Union provides central operating functions such as transaction processing, settlement, marketing support and customer relationship management to... -

Page 15

... payments fees are typically less than the fees charged in our Consumer-to-Consumer segment. Consumers may make a cash payment at an agent or owned location or may make an electronic payment over the phone or on the Internet using their credit or debit card, through the automated clearing house... -

Page 16

... to send funds to businesses and government agencies, primarily across the United States and Canada, using cash and, in certain locations, a debit card. This service is offered primarily at Western Union agent locations, but may be provided via our westernunion.com website in limited situations... -

Page 17

...wire transfers and ACH, but in some situations, checks are remitted. The majority of Business Solutions' business relates to exchanges of currency at the spot rate which enables customers to make cross-currency payments. In addition, in certain countries, we write foreign currency forward and option... -

Page 18

... consumers send and receive money. We offer money transfer services under the Western Union, Orlandi ValutaSM and Vigo® brands. We also provide various payment and other services under brands such as Western Union Payments, Quick Collect, Convenience PaySM, Quick Pay, Quick Cash, Speedpay, Equity... -

Page 19

... global financial institutions. A key component of the Western Union business model is our ability to manage financial risk associated with conducting transactions worldwide. We settle accounts with the majority of our agents in United States dollars or euros. We utilize foreign currency exchange... -

Page 20

...and consumer protection, currency controls, money transfer and payment instrument licensing, payment services, credit and debit cards, electronic payments, foreign exchange hedging services and the sale of spot, forward and option currency contracts, unclaimed property, the regulation of competition... -

Page 21

..., limitations on the number of money transfers that may be sent or received by a consumer and controls on the rates of exchange between currencies. They also include laws and regulations intended to detect and prevent money laundering or terrorist financing, including obligations to collect and... -

Page 22

... a negative impact on our business, financial condition, and results of operations. Government agencies both inside and outside the United States may impose new or additional rules on money transfers affecting us or our agents or their subagents, including regulations that prohibit transactions in... -

Page 23

...FATCA, which is intended to address tax compliance issues related to U.S. taxpayers holding non-U.S. accounts, will require certain of our licensed financial institutions and other entities outside the United States to report to the United States Internal Revenue Service ("IRS"), directly or through... -

Page 24

...notice and reporting requirements. Financial Services Department approval is required under the New York Banking Law and the Agreement of Supervision prior to any change in control of the Article XII investment company. Since these subsidiaries do not operate any banking offices in the United States... -

Page 25

... to accepting credit cards. We are subject to annual reviews to ensure compliance with PCI regulations worldwide and are subject to fines if we are found to be non-compliant. Stored-value services offered by Western Union are subject to United States federal and state laws and regulations, as... -

Page 26

... Business Units, from August 2010 to November 2010. Previously, Mr. Agrawal served as Senior Vice President of Finance of the Company's Europe, Middle East, and Africa and Asia Pacific regions from July 2008 to August 2010, and as Senior Vice President and Treasurer of Western Union from June 2006... -

Page 27

... Manager, Domestic Money Transfer. Ms. Scott joined Western Union in 2001. J. David Thompson is our Executive Vice President, Global Operations (from November 2012) and Chief Information Officer (from April 2012). Prior to April 2012, Mr. Thompson was Group President, Services & Support and Global... -

Page 28

... in turn adversely impact our business, financial condition and results of operations. A number of factors could adversely affect consumers' confidence in our business, or in traditional money transfer and payment service providers generally, many of which are beyond our control, and could have an... -

Page 29

...reduced sales or business as a result of a deterioration in economic conditions. As a result, our agents could reduce their numbers of locations or hours of operation, or cease doing business altogether. Businesses using our services may make fewer cross-currency payments or may have fewer customers... -

Page 30

...exchanges and traditional money transfer companies. These services are differentiated by features and functionalities such as brand recognition, customer service, trust and reliability, distribution network and channel options, convenience, price, speed, variety of payment methods, service offerings... -

Page 31

...are closed, when currency devaluation makes exchange rates difficult to manage or when natural disasters or civil unrest makes access to agent locations unsafe. These risks could negatively impact our ability to offer our services, to make payments to or receive payments from international agents or... -

Page 32

Many of our agents outside the United States are post offices, which are usually owned and operated by national governments. These governments may decide to change the terms under which they allow post offices to offer remittances and other financial services. For example, governments may decide to ... -

Page 33

... and results of operations. The vast majority of our global funds transfer business is conducted through third-party agents that provide our services to consumers at their retail locations. These agents sell our services, collect funds from consumers and are required to pay the proceeds from... -

Page 34

... and could damage our reputation, business, financial condition and results of operations. We collect, transfer and retain consumer, business, employee and agent data as part of our business. These activities are subject to laws and regulations in the United States and other jurisdictions, see risk... -

Page 35

... anti-money laundering regulations, anti-fraud measures, or agent registration and monitoring requirements. For example, changes to our compliance-related practices as a result of our agreement and settlement with the State of Arizona and changes to our business model, primarily related to our Vigo... -

Page 36

... name would harm our business. Similar to the Western Union trademark, the Vigo, Orlandi Valuta, Speedpay, Equity Accelerator, Pago Fácil, Western Union Payments, Quick Collect, Quick Pay, Quick Cash, Convenience Pay, Western Union Business Solutions and other trademarks and service marks are also... -

Page 37

... of Financial Condition and Results of Operations. The IRS completed its examination of the United States federal consolidated income tax returns of First Data, which include our 2005 and pre-Spin-off 2006 taxable periods, and issued its report on October 31, 2012 ("FDC 30-Day Letter"). Furthermore... -

Page 38

... of our cash flow from operations to payments on our debt, thereby reducing funds available for working capital, capital expenditures, acquisitions and other purposes. There would be adverse tax consequences associated with using certain earnings generated outside the United States to pay the... -

Page 39

...and consumer protection, currency controls, money transfer and payment instrument licensing, payment services, credit and debit cards, electronic payments, foreign exchange hedging services and the sale of spot, forward and option currency contracts, unclaimed property, the regulation of competition... -

Page 40

... settlement with the State of Arizona. See risk factor "Western Union is the subject of governmental investigations and consent agreements with or enforcement actions by regulators." Due to regulatory initiatives, we have changed our compliance related practices and business model along the United... -

Page 41

... and settlement with the State of Arizona and changes to our business model, primarily related to our Vigo and Orlandi Valuta brands, have resulted in the loss of over 7,000 agent locations in Mexico. The regulatory status of our agents could affect their ability to offer our services. For example... -

Page 42

... on our business, financial condition or results of operations. We are in the process of making or have made certain changes to our compliance program for transactions from the United States to Mexico and the Latin America and the Caribbean region, including: • • revisions to agent agreements to... -

Page 43

... of operations. On March 20, 2012, the Company was served with a federal grand jury subpoena issued by the United States Attorney's Office for the Central District of California ("USAO") seeking documents relating to Shen Zhou International ("US Shen Zhou"), a former Western Union agent located in... -

Page 44

... of our future corporate interest rate and foreign exchange hedging transactions to centralized clearing, margin, and other requirements. Also, our Business Solutions business in the United States will be subjected to increased regulatory oversight and reporting requirements relating to the foreign... -

Page 45

...the Company waits too long to inform consumers if their money transfers are not redeemed by the recipients and that we use the unredeemed funds to generate income until the funds are escheated to state governments. During the fourth quarter of 2012, the parties executed a settlement agreement, which... -

Page 46

... tax allocation agreement, the IRS might seek to collect such taxes from Western Union. Even if the Spin-off otherwise qualified as a tax-free distribution under section 355 of the Internal Revenue Code, the Spinoff may result in significant United States federal income tax liabilities to First Data... -

Page 47

...-to-Business, and Business Solutions segments and are all currently being utilized. In certain locations, our offices include customer service centers, where our employees answer operational questions from agents and customers. Our office in Dublin, Ireland serves as our international headquarters... -

Page 48

... normal course of our business. While the results of these legal proceedings cannot be predicted with certainty, management believes that the final outcome of these proceedings will not have a material adverse effect on the Company's results of operations or financial condition. ITEM 4. MINE SAFETY... -

Page 49

PART II ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES Our common stock trades on the New York Stock Exchange under the symbol "WU." There were 4,447 stockholders of record as of February 15, 2013. This figure does not include an... -

Page 50

...a holding company with no material assets other than the capital stock of our subsidiaries, our ability to pay dividends in future periods will be dependent on our receiving dividends from our operating subsidiaries. Several of our operating subsidiaries are subject to financial services regulations... -

Page 51

... with our historical consolidated financial statements and the notes to those statements included elsewhere in this Annual Report on Form 10-K. Year Ended December 31, (in millions, except per share data) 2012 2011 2010 2009 2008 Statements of Income Data: Revenues (a)...Operating expenses... -

Page 52

... consolidated financial statements. Also impacting net cash provided by operating activities during the year ended December 31, 2010 were cash payments of $71.0 million related to the agreement and settlement with the State of Arizona and other states. Capital expenditures include capitalization of... -

Page 53

...'s business relates to exchanges of currency at the spot rate which enables customers to make cross-currency payments. In addition, in certain countries, we write foreign currency forward and option contracts for customers to facilitate future payments. Travelex Global Business Payments ("TGBP... -

Page 54

... based money transfer channels delivered strong growth and new customer acquisition in 2012, and actions are planned to accelerate usage in 2013 through added capabilities, enhanced value propositions, and expanded reach. • Driving growth in customers and usage in Western Union Business Solutions... -

Page 55

...money transfer and consumer payments businesses and its interest in a Western Union money transfer agent, as well as its related assets, including real estate, through a tax-free distribution to First Data shareholders ("Spinoff"). Basis of Presentation The financial statements in this Annual Report... -

Page 56

... the money transfer and the locations from and to which the funds are sent and received. Transaction fees represented 74% of our total consolidated revenues for the year ended December 31, 2012. Foreign exchange revenues - In certain Consumer-to-Consumer money transfer and Business Solutions payment... -

Page 57

... components of the Consolidated Statements of Income. All significant intercompany accounts and transactions between our segments have been eliminated. During the year ended December 31, 2011, we reached an agreement with the United States Internal Revenue Service ("IRS") resolving substantially all... -

Page 58

... Year Ended December 31, 2012 2011 2010 Revenues: Transaction fees...Foreign exchange revenues ...Other revenues...Total revenues...Expenses: Cost of services ...Selling, general and administrative ...Total expenses ...Operating income ...Other income/(expense): Interest income ...Interest expense... -

Page 59

...by the acquisition of TGBP and revenue growth experienced in our existing Business Solutions business. Fluctuations in the exchange rate between the United States dollar and currencies other than the United States dollar resulted in a benefit to transaction fees and foreign exchange revenues for the... -

Page 60

... marketing-related expenditures together with opportunities for fee adjustments, as discussed in "Segment Discussion," for Consumer-to-Consumer revenues and other initiatives in order to best maximize the return on these investments. Enhanced Regulatory Compliance We regularly review our compliance... -

Page 61

... 31, 2012, our effective tax rate was also impacted by benefits from favorable tax settlements and changes in the mix of foreign and U.S. income and applicable tax rates, and for the year ended December 31, 2011, our effective tax rate was also impacted by higher taxes associated with the Finint and... -

Page 62

... accounting policies. Corporate and other overhead is allocated to the segments primarily based on a percentage of the segments' revenue compared to total revenue. Costs incurred for the investigation and closing of acquisitions are included in "Other." There were no restructuring and related... -

Page 63

..., 2012 2011 2010 % Change 2012 2011 vs. 2011 vs. 2010 (dollars and transactions in millions) Revenues: Transaction fees ...$ 3,545.6 $ 3,580.2 $ 3,434.3 Foreign exchange revenues ...988.5 983.1 905.8 Other revenues ...50.2 45.1 43.3 Total revenues ...$ 4,584.3 $ 4,608.4 $ 4,383.4 Operating income... -

Page 64

... due to changes in our compliance related practices as a result of our agreement and settlement with the State of Arizona and changes to our business model, primarily for our Vigo brand to Latin America, and price reductions. Revenue in our Middle East and Africa, APAC, and LACA regions increased in... -

Page 65

... ended December 31, 2011. Our Mexico business was affected by changes to our compliance procedures related to the agreement and settlement with the State of Arizona and other states. Our Middle East and Africa, APAC, and LACA regions all experienced revenue and transaction growth in the year ended... -

Page 66

...the debit card fee savings related to the Durbin Legislation, partially offset by growth in our international bill payments, primarily in South America. The strengthening of the United States dollar compared to most other foreign currencies negatively impacted our Consumer-to-Business revenue growth... -

Page 67

...sets forth our Business Solutions segment results of operations for the years ended December 31, 2012, 2011 and 2010. % Change 2012 2011 vs. 2011 vs. 2010 (dollars in millions) Year Ended December 31, 2012 2011 2010 Revenues: Transaction fees ...$ 34.9 $ 5.9 $ 1.3 Foreign exchange revenues ...332... -

Page 68

... and fluctuations in working capital. Our working capital is affected by the timing of interest payments on our outstanding borrowings, timing of income tax payments, including our tax deposit described further in "Cash Flows from Operating Activities," and collections on receivables, among other... -

Page 69

... federal and state tax rate in the United States. We expect to use foreign funds to expand and fund our international operations and to acquire businesses internationally. In many cases, we receive funds from money transfers and certain other payment services before we settle the payment of those... -

Page 70

..., cash provided by operating activities was $1,185.3 million, $1,174.9 million and $994.4 million, respectively. During 2012, we made tax payments of $92.4 million as a result of the IRS Agreement. In the first quarter of 2010, we made a $250 million tax deposit relating to United States federal tax... -

Page 71

...calculated using a selected LIBOR rate plus an interest rate margin of 100 basis points. A facility fee of 12.5 basis points is also payable quarterly on the total facility, regardless of usage. Both the interest rate margin and facility fee percentage are based on certain of our credit ratings. The... -

Page 72

... ratings include earnings, cash flow generation, leverage, available liquidity and the overall business. Our Revolving Credit Facility contains an interest rate margin and facility fee which are determined based on certain of our credit ratings. In addition, the interest rates payable on our 2015... -

Page 73

... cash balances, cash flows from operating activities, access to the commercial paper markets and our Revolving Credit Facility available to support the needs of our business. Capital Expenditures The total aggregate amount paid for contract costs, purchases of property and equipment and purchased... -

Page 74

... our Revolving Credit Facility or commercial paper program, and cash, including cash generated from operations and proceeds from our 2015 and 2017 borrowings to meet our debt obligations as they come due. Our ability to continue to grow the business, make acquisitions, return capital to shareholders... -

Page 75

...2012. The calculation of the funded status and net periodic benefit income is dependent upon two primary assumptions: 1) expected long-term return on plan assets; and 2) discount rate. We employ a building block approach in determining the long-term rate of return for plan assets. Historical markets... -

Page 76

...outside our control. (e) Represents the liability position of our foreign currency and interest rate derivative contracts as of December 31, 2012, which will fluctuate based on market conditions. (f) This line item relates to accrued and unpaid initial payments for new and renewed agent contracts as... -

Page 77

...with accounting principles generally accepted in the United States of America. The preparation of these consolidated financial statements requires that management make estimates and assumptions that affect the amounts reported for revenues, expenses, assets, liabilities and other related disclosures... -

Page 78

... on the technical merits of the position, that the tax position will be sustained upon examination, including the resolution of any related appeals or litigation. The tax benefits recognized in the consolidated financial statements from such a position are measured as the largest benefit that has... -

Page 79

... Differ from Assumptions Derivative Financial Instruments We use derivatives to (a) minimize our exposures related to changes in foreign currency exchange rates and interest rates and (b) facilitate cross-currency Business Solutions payments by writing derivatives to customers. We recognize all... -

Page 80

...for new new and renewed agent contracts is and renewed agent contracts and software. subject to strict accounting policy criteria and requires management judgment as to We evaluate such intangible assets for the amount to capitalize and the related impairment on an annual basis and period of benefit... -

Page 81

... our Business Solutions impairment valuation analysis relate to projected revenue and EBITDA margins. For example, a decrease of 200 basis points in the ten-year projected compound annual growth rate of either revenue or EBITDA margin, assuming all other elements of the cash flow model remain... -

Page 82

... DISCLOSURES ABOUT MARKET RISK We are exposed to market risks arising from changes in market rates and prices, including changes in foreign currency exchange rates and interest rates and credit risk related to our agents and customers. A risk management program is in place to manage these risks... -

Page 83

... Rates We provide Consumer-to-Consumer money transfer services in more than 200 countries and territories. We manage foreign exchange risk through the structure of the business and an active risk management process. We settle with the vast majority of our agents in United States dollars or euros... -

Page 84

... among global financial institutions. We also limit our investment level in any individual money market fund to no more than $100 million. We are also exposed to credit risk related to receivable balances from agents in the money transfer, walk-in bill payment and money order settlement process... -

Page 85

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA THE WESTERN UNION COMPANY Index To Consolidated Financial Statements Management's Report on Internal Control Over Financial Reporting ...Reports of Independent Registered Public Accounting Firm ...Consolidated Statements of Income for each of the ... -

Page 86

... Internal Control Over Financial Reporting Our management is responsible for establishing and maintaining adequate internal control over financial reporting as defined in Rule 13a-15(f) under the Securities Exchange Act of 1934. The Western Union Company's ("Western Union" or the "Company") internal... -

Page 87

...internal control over financial reporting as of December 31, 2012, based on the COSO criteria. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of The Western Union Company as of December 31, 2012... -

Page 88

... accordance with the standards of the Public Company Accounting Oversight Board (United States), The Western Union Company's internal control over financial reporting as of December 31, 2012, based on criteria established in Internal Control-Integrated Framework issued by the Committee of Sponsoring... -

Page 89

THE WESTERN UNION COMPANY Consolidated Statements of Income (in millions, except per share amounts) Year Ended December 31, 2012 2011 2010 Revenues: Transaction fees ...Foreign exchange revenues ...Other revenues ...Total revenues ...Expenses: Cost of services ...Selling, general and administrative... -

Page 90

THE WESTERN UNION COMPANY Consolidated Statements of Comprehensive Income (in millions) Year Ended December 31, 2012 2011 2010 Net income ...$ Other comprehensive income/(loss): Unrealized gains/(losses) on investment securities: Unrealized gains/(losses) ...Tax (expense)/benefit ...... -

Page 91

THE WESTERN UNION COMPANY Consolidated Balance Sheets (in millions, except per share amounts) December 31, 2012 2011 Assets Cash and cash equivalents ...$ Settlement assets ...Property and equipment, net of accumulated depreciation of $384.5 and $429.7, respectively...Goodwill ...Other intangible ... -

Page 92

... of property and equipment ...Acquisition of businesses, net of cash acquired (Note 3) ...Net proceeds from settlement of foreign currency forward contracts related to acquisitions ...Proceeds from receivable for securities sold ...Repayments of notes receivable issued to agents...Net cash used in... -

Page 93

...employee stock option plans ...Unrealized losses on investment securities, net of tax ...Unrealized losses on hedging activities, net of tax ...Foreign currency translation adjustment, net of tax ...Defined benefit pension plan liability adjustment, net of tax Balance, December 31, 2010...Net income... -

Page 94

...'s business relates to exchanges of currency at the spot rate which enables customers to make cross-currency payments. In addition, in certain countries, the Company writes foreign currency forward and option contracts for customers to facilitate future payments. Travelex Global Business Payments... -

Page 95

... of its money transfer and consumer payments businesses and its interest in a Western Union money transfer agent, as well as its related assets, including real estate, through a tax-free distribution to First Data shareholders (the "Spin-off"). Effective on September 29, 2006, First Data completed... -

Page 96

... assets, the Company utilizes pricing services that use multiple prices as inputs to determine daily market values. In addition, the Trust has other investments that fall within Level 2 that are valued at net asset value which is not quoted on an active market; however, the unit price is based on... -

Page 97

...currency exchange contracts is largely mitigated, as in most cases the Company requires the receipt of funds from customers before releasing the associated cross-currency payment. Settlement obligations consist of money transfer, money order and payment service payables and payables to agents. Money... -

Page 98

... 31, 2012 2011 Settlement assets: Cash and cash equivalents ...$ Receivables from selling agents and Business Solutions customers ...Investment securities ...$ Settlement obligations: Money transfer, money order and payment service payables ...$ Payables to agents ...$ Property and Equipment 574... -

Page 99

... in connection with the Company's acquisitions. The Company capitalizes initial payments for new and renewed agent contracts to the extent recoverable through future operations or penalties in the case of early termination. The Company's accounting policy is to limit the amount of capitalized costs... -

Page 100

... of the money transfer and the locations from and to which funds are transferred. The Company also offers several global payments services, including payments from consumers or businesses to other businesses. Transaction fees are set by the Company and recorded as revenue at the time of sale. In... -

Page 101

... was incurred. Derivatives The Company uses derivatives to (a) minimize its exposures related to changes in foreign currency exchange rates and interest rates and (b) facilitate cross-currency Business Solutions payments by writing derivatives to customers. The Company recognizes all derivatives in... -

Page 102

... spot exchanges of currency in addition to forwards and options. The changes in fair value related to these contracts are recorded in "Foreign exchange revenues." The fair value of the Company's derivatives is derived from standardized models that use market based inputs (e.g., forward prices for... -

Page 103

... FINANCIAL STATEMENTS (Continued) 3. Acquisitions On November 7, 2011, the Company acquired the business-to-business payment business known as Travelex Global Business Payments from Travelex Holdings Limited for cash consideration of £596 million ($956.5 million), net of a final working capital... -

Page 104

..., Finint and Costa (in millions): Travelex Global Business Payments (b) Finint S.r.l. Angelo Costa S.r.l. Assets: Cash and cash equivalents...$ Settlement assets ...Property and equipment ...Goodwill ...Other intangible assets ...Other assets ...Total assets ...$ Liabilities: Accounts payable and... -

Page 105

...-cash benefit for adjustments to stock compensation for awards forfeited by employees. (b) Other expenses related to the relocation of various operations to new and existing Company facilities and third-party providers including expenses for hiring, training, relocation, travel and professional fees... -

Page 106

...Company's overall headcount and migrate positions from various facilities, primarily within North America and Europe, to regional operating centers. Details of the expenses incurred are included in the tables below. Included in these expenses are approximately $2 million of non-cash expenses related... -

Page 107

... 46.8 106.3 5. Related Party Transactions The Company has ownership interests in certain of its agents accounted for under the equity method of accounting. The Company pays these agents, as it does its other agents, commissions for money transfer and other services provided on the Company's behalf... -

Page 108

... of operations. On March 20, 2012, the Company was served with a federal grand jury subpoena issued by the United States Attorney's Office for the Central District of California ("USAO") seeking documents relating to Shen Zhou International ("US Shen Zhou"), a former Western Union agent located in... -

Page 109

... WESTERN UNION COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) On January 26, 2006, the First Data Corporation ("First Data") Board of Directors announced its intention to pursue the distribution of all of its money transfer and consumer payments business and its interest in a Western... -

Page 110

.... The substantial majority of the Company's investment securities are classified as available-for-sale and recorded at fair value. Investment securities are exposed to market risk due to changes in interest rates and credit risk. Western Union regularly monitors credit risk and attempts to mitigate... -

Page 111

THE WESTERN UNION COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) The following summarizes contractual maturities of investment securities as of December 31, 2012 (in millions): Amortized Cost Fair Value Due within 1 year ...$ Due after 1 year through 5 years...Due after 5 years ... -

Page 112

THE WESTERN UNION COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 8. Fair Value Measurements Fair value, as defined by the relevant accounting standards, represents the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal ... -

Page 113

THE WESTERN UNION COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Other Fair Value Measurements The carrying amounts for many of the Company's financial instruments, including cash and cash equivalents, settlement cash and cash equivalents, settlement receivables and settlement ... -

Page 114

... United States Internal Revenue Service ("IRS Agreement") resolving substantially all of the issues related to the Company's restructuring of its international operations in 2003. The provision for income taxes was as follows (in millions): Year Ended December 31, 2011 2010 2012 Federal ...$ State... -

Page 115

THE WESTERN UNION COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Service ("IRS") of certain issues relating to the 2002-2004 tax years. The Company continues to benefit from a significant proportion of its profits being foreign-derived, and therefore taxed at lower rates than its ... -

Page 116

... of the deposit. The IRS completed its examination of the United States federal consolidated income tax returns of First Data, which include the Company's 2005 and pre-Spin-off 2006 taxable periods, and issued its report on October 31, 2012 ("FDC 30-Day Letter"). Furthermore, the IRS completed its... -

Page 117

... adverse effect on the Company's business, financial condition and results of operations. First Data generally will be liable for all Spin-off Related Taxes, other than those described above. 11. Employee Benefit Plans Defined Contribution Plans The Western Union Company Incentive Savings Plan ("401... -

Page 118

THE WESTERN UNION COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Defined Benefit Plan The Company has one frozen defined benefit pension plan ("Plan") for which it has recorded unfunded pension obligations of $102.1 million and $112.7 million as of December 31, 2012 and 2011, ... -

Page 119

... on fixed income securities held. Historical returns are reviewed within the context of current economic conditions to check for reasonableness and appropriateness. The Company then applies this rate against a calculated value for its plan assets. The calculated value recognizes changes in the... -

Page 120

... Hedge fund strategy types include, but are not limited to: commodities/currencies, equity long-short, global-macro, relative value, event driven, and multi-strategy. The Plan holds derivative contracts directly which consist of interest rate swap agreements, under which the Plan is committed to pay... -

Page 121

...). For information on how the Company measures fair value, refer to Note 2. December 31, 2012 Asset Class Fair Value Measurement Using Level 1 Level 2 Level 3 Total Assets at Fair Value Equity investments: Domestic ...$ International (a) ...Debt securities: Corporate debt (b) ...U.S. treasury bonds... -

Page 122

THE WESTERN UNION COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) (a) Funds included herein have redemption frequencies of daily to monthly, with redemption notice periods of one to ten business days. (b) Substantially all corporate debt securities are investment grade securities. (c)... -

Page 123

... COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 12. Operating Lease Commitments The Company leases certain real properties for use as customer service centers and administrative and sales offices. The Company also leases data communications terminals, computers and office equipment... -

Page 124

THE WESTERN UNION COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) The components of accumulated other comprehensive loss, net of tax, were as follows (in millions): Year Ended December 31, 2012 2011 2010 Unrealized gains on investment securities ...$ Unrealized gains/(losses) on ... -

Page 125

... Company uses derivatives to (a) minimize its exposures related to changes in foreign currency exchange rates and interest rates and (b) facilitate cross-currency Business Solutions payments by writing derivatives to customers. The Company executes derivatives with established financial institutions... -

Page 126

... dollar, euro, British pound, and Australian dollar. Interest Rate Hedging - Corporate The Company utilizes interest rate swaps to effectively change the interest rate payments on a portion of its notes from fixedrate payments to short-term LIBOR-based variable rate payments in order to manage... -

Page 127

..., 2012 and December 31, 2011 (in millions): Derivative Assets Fair Value Balance Sheet Location Derivatives - hedges: Interest rate fair value hedges - Corporate ...Foreign currency cash flow hedges - Consumer-to-Consumer ...Total ...Derivatives - undesignated: Foreign currency - Business Solutions... -

Page 128

... are reclassified to "Interest expense" in the Consolidated Statements of Income over the life of the related notes. (d) The Company uses foreign currency forward and option contracts as part of its Business Solutions payments operations. These derivative contracts are excluded from this table as... -

Page 129

THE WESTERN UNION COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) An accumulated other comprehensive pre-tax gain of $1.9 million related to the foreign currency forward contracts is expected to be reclassified into revenue within the next 12 months as of December 31, 2012. ... -

Page 130

... using a selected LIBOR rate plus an interest rate margin of 100 basis points. A facility fee of 12.5 basis points is also payable quarterly on the total facility, regardless of usage. Both the interest rate margin and facility fee percentage are based on certain of the Company's credit ratings... -

Page 131

... certain types of security interests or enter into sale and leaseback transactions. The Company may redeem the 2040 Notes at any time prior to maturity at the greater of par or a price based on the applicable treasury rate plus 30 basis points. On March 30, 2010, the Company exchanged $303.7 million... -

Page 132

... debt (in the case of significant subsidiaries), or enter into sale and leaseback transactions. The Company may redeem the 2036 Notes at any time prior to maturity at the greater of par or a price based on the applicable treasury rate plus 25 basis points. On September 29, 2006, the Company issued... -

Page 133

...-based awards to non-employee directors of the Company. Options granted under the 2006 Director Plan are issued with exercise prices equal to the fair market value of Western Union common stock at the grant date, have 10-year terms, and vest immediately. Since options and deferred stock units under... -

Page 134

...Union Stock-Based Award. The new Western Union and First Data Stock-Based Awards maintained their pre-conversion aggregate intrinsic values, and, in the case of stock options, their ratio of the exercise price per share to their fair value per share. After the Spin-off, the Company receives all cash... -

Page 135

THE WESTERN UNION COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Restricted Stock Activity A summary of Western Union activity for restricted stock units and performance based restricted stock units for the year ended December 31, 2012 is listed below (units in millions): Year Ended ... -

Page 136

...the world, including related transactions that can be initiated through the Company's websites and account based money transfers. The segment includes six regions whose functions are limited to generating, managing and maintaining agent relationships and localized marketing activities. These regions... -

Page 137

THE WESTERN UNION COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) The Company's reportable segments are reviewed separately below because each reportable segment represents a strategic business unit that offers different products and serves different markets. The business segment ... -

Page 138

THE WESTERN UNION COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) In the first quarter of 2012, the Company began assessing performance and allocating resources based on the segment structure described above. Segment results for the years ended December 31, 2011 and 2010 have ... -

Page 139

... regions, the Company splits the revenue between the two regions, with each region receiving 50%. For money transfers initiated and paid in the same region, 100% of the revenue is attributed to that region. The geographic split of revenue above for the Consumer-to-Business and Business Solutions... -

Page 140

THE WESTERN UNION COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) A significant majority of the Company's Consumer-to-Consumer transactions involve at least one non-United States location. Based on the method used to attribute revenue between countries described in the paragraph above... -

Page 141

...WESTERN UNION COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 18. Quarterly Financial Information (Unaudited) Summarized quarterly results for the years ended December 31, 2012 and 2011 were as follows (in millions, except per share data): Year Ended December 31, 2012 2012 by Quarter... -

Page 142

...cash amounts used to fund acquisitions of businesses with purchase prices denominated in foreign currencies, primarily for the TGBP acquisition. The fourth quarter also includes a gain of $20.5 million, recognized in connection with the remeasurement of the Company's former equity interest in Finint... -

Page 143

... 31, 2012. THE WESTERN UNION COMPANY CONDENSED BALANCE SHEETS (PARENT COMPANY ONLY) (in millions, except per share amounts) December 31, 2012 2011 Assets Cash and cash equivalents ...$ Property and equipment, net of accumulated depreciation of $14.4 and $12.3, respectively . Income tax deposit... -

Page 144

THE WESTERN UNION COMPANY CONDENSED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME (PARENT COMPANY ONLY) (in millions) For the Years Ended December 31, 2012 2011 2010 Revenues ...$ Expenses ...Operating income ...Interest income ...Interest expense...Other expense ...Loss before equity in earnings ... -

Page 145

... WESTERN UNION COMPANY CONDENSED STATEMENTS OF CASH FLOWS (PARENT COMPANY ONLY) (in millions) For the Years Ended December 31, 2012 2011 2010 Cash flows from operating activities Net cash provided by operating activities ...$ Cash flows from investing activities Purchases of property and equipment... -

Page 146

...." 3. Related Party Transactions On October 1, 2012, the Parent issued a promissory note payable to its 100% owned subsidiary First Financial Management Corporation in the amount of $268.2 million in exchange for funds distributed to the Parent. The promissory note is due on June 30, 2015, bears... -

Page 147

... allow timely decisions regarding required disclosure. Management's Annual Report on Internal Control Over Financial Reporting Management's report on Western Union's internal control over financial reporting (as such term is defined in Rules 13a-15 (f) and 15d-15(f) under the Securities Exchange Act... -

Page 148

... Reporting Compliance," and "Corporate Governance-Committees of the Board of Directors" of our definitive proxy statement for the 2013 annual meeting of stockholders. Code of Ethics The Company's Directors' Code of Conduct, Code of Ethics for Senior Financial Officers, Procedure for Accounting... -

Page 149

... documents are filed as part of this report: 1. Financial Statements (See Index to Consolidated Financial Statements in Item 8, Financial Statements and Supplementary Data, of this Annual Report on Form 10-K); 2. Financial Statement Schedule (See Index to Consolidated Financial Statements in Item... -

Page 150

... duly authorized. The Western Union Company (Registrant) February 22, 2013 By: HIKMET ERSEK Hikmet Ersek President and Chief Executive Officer /S/ Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the... -

Page 151

...as Exhibit 4.11 to the Company's Registration Statement on Form S-4 filed on December 22, 2006 and incorporated herein by reference thereto). Supplemental Indenture, dated as of September 29, 2006, among The Western Union Company, First Financial Management Corporation and Wells Fargo Bank, National... -

Page 152

...Corporation and The Western Union Company (filed as Exhibit 10.4 to the Company's Current Report on Form 8K filed on October 3, 2006 and incorporated herein by reference thereto). Settlement Agreement, dated as of February 11, 2010, by and between Western Union Financial Services, Inc. and the State... -

Page 153

... thereto).* Form of Nonqualified Stock Option Award Agreement for Non-Employee Directors Residing in the United States Under The Western Union Company 2006 Non-Employee Director Equity Compensation Plan (filed as Exhibit 10.5 to the Company's Quarterly Report on Form 10-Q filed on May 6, 2010 and... -

Page 154

... Restricted Stock Unit Award Notice for Executive Committee Members Under The Western Union Company 2006 Long-Term Incentive Plan (filed as Exhibit 10.38 to the Company's Annual Report on Form 10-K filed on February 24, 2012 and incorporated herein by reference thereto).* Employment Contract, dated... -

Page 155

... Agreement for Non-Employee Directors Residing Outside of the United States Under The Western Union Company 2006 Long-Term Incentive Plan (filed as Exhibit 10.4 to the Company's Quarterly Report on Form 10-Q filed on May 1, 2012 and incorporated herein by reference thereto).* Offer Letter, dated... -

Page 156

... to Professionally Funded, Privately Held Ventures HIKMET ERSEK President, Chief Executive Officer and Director, The Western Union Company SOLOMON D. TRUJILLO ROBERTO G. MENDOZA Director, Member of the Audit Committee and the Compensation and Benefits Committee, Senior Managing Director, Atlas... -

Page 157

...2012 CORPORATE GOVERNANCE The annual meeting of stockholders of The Western Union Company will be held at 505 Fifth Avenue, 7th Floor, New York, NY, 10017 on Thursday, May 30, 2013 at 8:00 a.m. local time. To review the company's corporate governance guidelines, board committee charters and codes... -

Page 158

12500 East Belford Avenue Englewood, CO 80112 U.S.A. westernunion.com