WeightWatchers 2010 Annual Report Download - page 97

Download and view the complete annual report

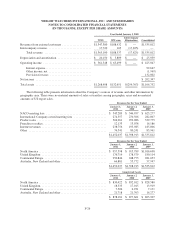

Please find page 97 of the 2010 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIE

S

NO

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

(

IN THOUSANDS, EXCEPT PER SHARE AMOUNTS

)

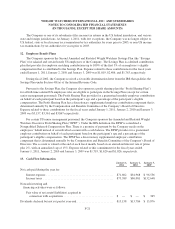

Under the 2004 Plan, grants may take the following forms at the Company’s Board of Directors or its

committee’s sole discretion: non-qualified stock options, incentive stock options, stock appreciation rights

,

R

SUs, restricted stock and other share-based awards. As of its effective date, the maximum number of shares of

common stock available for grant under the 2004 Plan was 2,

5

00.

Un

d

er t

h

e 1999 P

l

an,

g

rants cou

ld

ta

k

et

h

e

f

o

ll

ow

i

n

gf

orms at t

h

e Compan

y

’s Boar

d

o

f

D

i

rectors or

i

ts

comm

i

ttee’s so

l

e

di

scret

i

on: non-qua

lifi

e

d

stoc

k

opt

i

ons,

i

ncent

i

ve stoc

k

opt

i

ons, stoc

k

apprec

i

at

i

on r

igh

ts

,

r

estr

i

cte

d

stoc

k

, RSUs, purc

h

ase stoc

k

,

di

v

id

en

d

equ

i

va

l

ent r

igh

ts, per

f

ormance un

i

ts, per

f

ormance s

h

ares an

d

o

t

h

er s

h

are-

b

ase

dg

rants. T

h

e max

i

mum num

b

er o

f

s

h

ares o

f

common stoc

k

ava

il

a

bl

e

f

or

g

rant un

d

er t

h

e 1999

Plan was 7,058. The 1999 Plan terminated on December 16, 2009 pursuant to its terms and in connection with

suc

h

term

i

nat

i

on no a

ddi

t

i

ona

l

awar

d

s can

b

e

g

rante

d

un

d

er t

h

ep

l

an.

Un

d

er t

h

e Stoc

k

P

l

ans, t

h

e Company a

l

so grants

f

u

ll

y-veste

d

s

h

ares o

fi

ts common stoc

k

to certa

i

n mem

b

er

s

of i

ts Boar

d

o

f

D

i

rectors. W

hil

et

h

ese s

h

ares are

f

u

ll

y veste

d

,

b

eg

i

nn

i

ng w

i

t

h

stoc

k

grants ma

d

e

i

nt

h

e

f

ourt

h

quarter of 2006, the directors are restricted from selling these shares while they are still serving on th

e

Company’s Boar

d

o

f

D

i

rectors. Dur

i

ng t

h

e

fi

sca

l

years en

d

e

d

January 1, 2011, January 2, 2010 an

d

January 3,

2009, the Company granted 19, 20 and 1

5

fully-vested shares, respectively, and recognized compensation

expense of

$

595,

$

527 and

$

513, respectively.

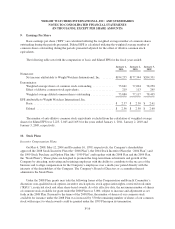

The Company issues common stock for share-based compensation awards from treasury stock. The tota

l

compensation cost that has been charged against income for these plans was

$

8,612,

$

8,796 and

$

11,302 for th

e

y

ears ended January 1, 2011, January 2, 2010 and January 3, 2009, respectively. Such amounts have been

included as a component of selling, general and administrative expenses. The total income tax benefit recognized

in the income statement for all share-based compensation arrangements was

$

2,662,

$

2,997 and

$

4,029 for th

e

y

ears ended January 1, 2011, January 2, 2010 and January 3, 2009, respectively. No compensation costs wer

e

capitalized. As of January 1, 2011, there was

$

11,179 of total unrecognized compensation cost related to stoc

k

o

ptions and RSUs granted under the Stock Plans. That cost is expected to be recognized over a weighted-average

p

eriod of approximately 1.8 years.

W

hil

et

h

e Stoc

k

P

l

ans perm

i

t var

i

ous t

y

pes o

f

awar

d

s, ot

h

er t

h

an t

h

ea

f

orement

i

one

d

s

h

ares

i

ssue

d

to

di

rectors,

g

rants un

d

er t

h

ep

l

ans

h

ave

hi

stor

i

ca

lly b

een e

i

t

h

er non-qua

lifi

e

d

stoc

k

opt

i

ons or RSUs. T

h

e

f

o

ll

ow

i

n

g

d

escr

ib

es some

f

urt

h

er

d

eta

il

so

f

t

h

ese a

w

ar

d

s

.

S

tock O

p

tion Awards

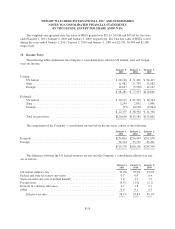

Pursuant to the option components of the Stock Plans, the Company’s Board of Directors authorized the

Company to enter into agreements under which certain employees received stock options. The options are

exercisable based on the terms outlined in the agreements. The options vest over a period of three to five years

and the expiration terms range from five to ten years. Options outstanding at January 1, 2011 have an exercis

e

p

rice between

$

4.04 and

$

56.21

p

er share.

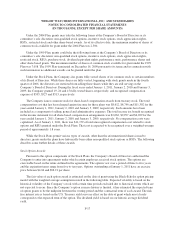

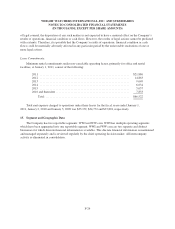

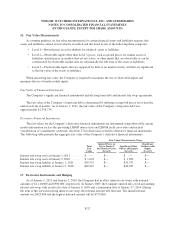

The fair value of each option award is estimated on the date of

g

rant usin

g

the Black-Scholes option pricin

g

model with the wei

g

hted avera

g

e assumptions noted in the followin

g

table. Expected volatilit

y

is based on th

e

historical volatilit

y

of the Compan

y

’s stock with certain time periods excluded due to historical events which are

not expected to recur. Since the Compan

y

’s option exercise histor

y

is limited, it has estimated the expected ter

m

o

f option

g

rants to be the midpoint between the vestin

g

period and the contractual term of each award. The ris

k

f

ree interest rate is based on the U.S. Treasur

yy

ield curve in effect on the date of

g

rant which most closel

y

corresponds to the expected term of the option. The dividend

y

ield is based on our historic avera

g

e dividend

y

ield.

F-

1

7