WeightWatchers 2010 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2010 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIE

S

NO

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

(

IN THOUSANDS, EXCEPT PER SHARE AMOUNTS

)

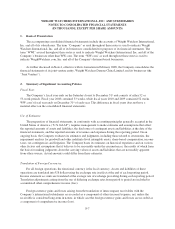

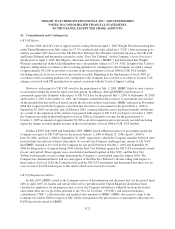

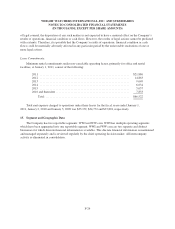

“Additional Term A Loan”), a tranche B loan (“Term B Loan”), a tranche C loan (“Term C Loan”), and a tranche

D loan (“Term D Loan”), in an aggregate original principal amount of

$

1,550,000. The revolving credit facility

(the “Revolver”) consists of two tranches (“Revolver I” and “Revolver II”) of up to

$

500,000 in the aggregate. A

t

January 1, 2011, the Company had

$

1,365,085 outstanding under the WWI Credit Facility. In addition, at

January 1, 2011, there was

$

325,000 available under the Revolver

.

A

t the end of fiscal 2010, the Term A Loan and Additional Term A Loan bore interest at a rate e

q

ual t

o

LIBOR

p

lus 1.00%

p

er annum; a

p

ortion of the Revolver I bore interest at a rate e

q

ual to LIBOR

p

lus 1.00%

p

e

r

annum and the other

p

ortion bore interest at a rate e

q

ual to the alternate base rate

p

lus 0.00%

p

er annum; th

e

T

erm B Loan bore interest at a rate e

q

ual to LIBOR

p

lus 1.

5

0%

p

er annum; the Term C Loan and Term D Loan

bore interest at a rate e

q

ual to LIBOR

p

lus 2.2

5

%

p

er annum; and a

p

ortion of the Revolver II bore interest at

a

r

ate e

q

ual to LIBOR

p

lus 2.

5

0%

p

er annum and the other

p

ortion bore interest at a rate e

q

ual to the alternate bas

e

r

ate plus 1.

5

0% per annum. In addition to paying interest on outstanding principal under the WWI Credit

Facility, at the end of fiscal 2010, the Company was required to pay a commitment fee to the lenders under th

e

R

evolver I and Revolver II with res

p

ect to the unused commitments at a rate e

q

ual to 0.20%

p

er annum and

0.

5

0% per annum, respectively.

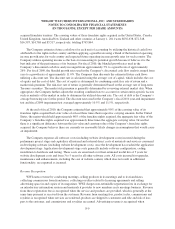

The WWI Credit Facility contains customary covenants including covenants that, in certain circumstances

,

r

estrict the Company’s ability to incur additional indebtedness, pay dividends on and redeem capital stock, mak

e

o

ther payments, including investments, sell its assets and enter into consolidations, mergers and transfers of all o

r

substantially all of its assets. The WWI Credit Facility also requires the Company to maintain specified financial

r

atios and satisfy certain financial condition tests. At the end of fiscal 2010, the Company was in complianc

e

with all of the re

q

uired financial ratios and also met all of the financial condition tests and ex

p

ects to continue to

do so for the foreseeable future. The WWI Credit Facility contains customary events of default. Upon th

e

o

ccurrence of an event of default under the WWI Credit Facility, the lenders thereunder may cease making loan

s

and declare amounts outstanding to be immediately due and payable. The WWI Credit Facility is guaranteed by

certain of the Company’s existing and future subsidiaries. Substantially all the assets of the Company

collateralize the WWI Credit Facility.

The Company previously amended the WWI Credit Facility on June 2

6

, 2009 to allow it to make loan

modification offers to all lenders of any tranche of term loans or revolving loans to extend the maturity date of

such loans and/or reduce or eliminate the scheduled amortization. Any such loan modifications would b

e

effective only with respect to such tranche of term loans or revolving loans and only with respect to those lenders

that accept the Company’s offer. Loan modification offers may be accompanied by increased pricing and/or fee

s

p

ayable to accepting lenders. This amendment also provides for up to an additional

$

200,000 of incremental term

loan financing through the creation of a new tranche of term loans, provided that the aggregate principal amount

o

f such new term loans cannot exceed the amount then outstanding under the Company’s existing revolving

credit facility. In addition, the proceeds from such new tranche of term loans must be used solely to repay certain

o

utstanding revolving loans and permanently reduce the commitments of certain revolving lenders. In connection

with this amendment, the Company incurred fees of approximately

$

4,058 during fiscal 2009.

On April 8, 2010, the Company amended the WWI Credit Facility pursuant to a loan modification offer t

o

all lenders of all tranches of term loans and revolving loans to, among other things, extend the maturity date of

such loans. In connection with this amendment, certain lenders converted a total of

$

454,480 of their outstandin

g

term loans under the Term A Loan (

$

151,775) and Additional Term A Loan (

$

302,705) into term loans under the

new Term C Loan which matures on June 30, 201

5

(or 2013, u

p

on the occurrence of certain events described in

the WWI Credit Facility agreement), and a total of

$

241,875 of their outstanding term loans under the Term

B

Loan into term loans under the new Term D Loan which matures on June 30, 2016. In addition, certain lenders

F-

14