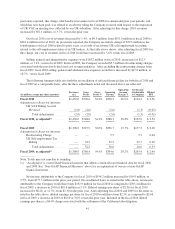

WeightWatchers 2010 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2010 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.p

ositive end to the 2010 year, with solid growth in the fourth quarter in both paid weeks and attendance, up 4.2%

and

6

.8%, respectively, versus the fourth quarter of 2009. Attendance growth outpaced paid weeks growth as a

r

esult of increased propensity of our existing Monthly Pass members, who were drawn in by the new program, t

o

attend meetings

.

United Kingdom Meeting Metrics and Business Trend

s

I

nt

h

eUn

i

te

d

K

i

ng

d

om, Mont

hl

y Pass was

i

ntro

d

uce

di

nt

h

et

hi

r

d

quarter o

f

2007, resu

l

t

i

ng

i

npa

id

wee

k

s

growth of 9.7% in 2007 to 12.8 million from 11.6 million in 2006. Meeting attendance began a declining trend in

200

5

as a result of negative member and leader reaction to a new program innovation launched in January 200

5

.

As a result of actions taken in 2006 to simplify the program and improve the meeting experience, attendanc

e

grew mo

d

est

l

y

i

n 2007, up 1.9% versus t

h

epr

i

or year.

I

n fiscal 2008, paid weeks grew 17.4% versus the prior year, on the strength of increasing Monthly Pass

p

enetration. Although the United Kingdom launched a new program in January 2008, full year meetin

g

attendance declined 2.4% versus the prior year. The UK market responded positively to its new program, but like

the North American market, the United Kingdom experienced a worsening economy over the course of the year

which negatively impacted meeting enrollment and attendance. Economic conditions worsened in 2009, although

effective marketing and promotional activity helped mitigate the negative trend. As a result, paid weeks

continued to improve, up 8.1% in fiscal 2009 as compared to the prior year, reflecting increased penetration of

Monthly Pass in that market, and attendance declined slightly, down 1.

5

% versus the prior year.

I

n

fi

sca

l

2010, pa

id

wee

k

s

g

rowt

hd

ece

l

erate

d

,

b

r

i

n

gi

n

g

pa

id

wee

k

s near

ly

on par w

i

t

h

t

h

epr

i

or

y

ear,

d

own

0.4%; however, meetin

g

attendance performance in the United Kin

g

dom was weak, declinin

g

10.5% for the

y

ea

r

versus pr

i

or. As w

i

t

h

NACO,

fi

rst quarter 2010 UK vo

l

umes were s

ig

n

ifi

cant

ly i

mpacte

dby

weat

h

er an

d

c

y

c

li

n

g

a

g

a

i

nst a pro

g

ram

i

nnovat

i

on

i

nt

h

epr

i

or

y

ear. A

b

sent a new mar

k

et

i

n

g

campa

ig

n

i

nt

h

e spr

i

n

g

to

d

raw

enro

ll

ments, t

h

eUn

i

te

d

K

i

n

gd

om cont

i

nue

d

to exper

i

ence

d

eep

d

ec

li

nes

i

n atten

d

ance

i

n 2010 versus t

h

epr

i

o

r

y

ear, down 8.5% in the second quarter and 9.4% in the third quarter. The United Kin

g

dom launched its new

p

ro

g

ram

,

ProPo

i

nts

,

i

n ear

ly

Novem

b

er 2010, an

d

saw atten

d

ance

g

rowt

h

as a resu

l

to

f

t

h

e

l

aunc

h

. However,

b

ecause of a decision to si

g

nificantl

y

limit marketin

g

in the fall campai

g

n prior to the new pro

g

ram launch and as

r

esult of bad weather durin

g

the pro

g

ram launch period, fourth quarter 2010 attendances were down 11.3%

versus the fourth

q

uarter of 2009.

C

ontinenta

l

Europe Meetin

g

Metrics an

d

Business Tren

ds

A

fter several years of attendance growth in Continental Europe, full year 200

6

experienced a 4.4% declin

e

in meeting attendance versus the prior year, and was the start of a negative trend that has continued. In 2007,

meeting attendance declined by 8.

5

% versus the prior year, and we began the process of strengthening the local

management teams in our Continental European countries. We saw some improvement in the negative attendanc

e

trend in 2008, with attendance down 4.1% versus the prior year. Prior to the launch of Monthly Pass, attendance

p

erformance had more closely approximated the declines in meeting paid weeks. With the introduction of

M

onthly Pass into Continental Europe, beginning with Germany in the third quarter of fiscal 2007 and then

moving into France in April 2008, paid weeks began to outpace attendances. Monthly Pass drove an overal

l

1

6.

5

% increase in paid weeks for fiscal 2008 in Continental Europe versus the prior year.

I

n

fi

sca

l

2009, most o

f

our Cont

i

nenta

l

European mar

k

ets were

d

eep

ly

a

ff

ecte

dby

t

h

e

diffi

cu

l

t recess

i

onar

y

conditions. While Continental Europe experienced paid weeks

g

rowth of 1.

6

% versus the prior

y

ear as the marke

t

cont

i

nue

d

to

b

ene

fi

t

f

rom

i

ncrease

d

Mont

hly

Pass penetrat

i

on, meet

i

n

g

atten

d

ance

d

ec

li

ne

d

11.8% versus t

h

e

p

r

i

or

y

ear. Dur

i

n

g

t

h

e 2009

y

ear, we too

k

t

h

e step o

f

re-eva

l

uat

i

n

g

t

h

e meet

i

n

gb

ase

i

n a num

b

er o

f

countr

i

es

,

i

nc

l

u

di

n

g

German

y

,c

l

os

i

n

g

wea

k

er meet

i

n

g

san

db

u

ildi

n

g

on stron

g

er meet

i

n

g

s

f

or a

b

etter meet

i

n

g

exper

i

ence

f

or our mem

b

ers. T

hi

s

i

n

i

t

i

at

i

ve resu

l

te

di

n

b

etter compensat

i

on

f

or our serv

i

ce prov

id

ers an

d high

er

g

ros

s

34