WeightWatchers 2010 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2010 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIE

S

NO

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

(

IN THOUSANDS, EXCEPT PER SHARE AMOUNTS

)

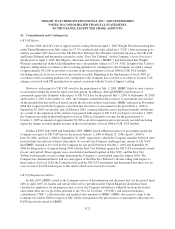

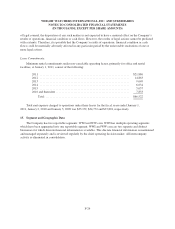

tax from its leaders

p

ursuant to the PAYE and NIC collection rules and remitted such amounts to HMRC. I

n

connection with this ruling, the Company recorded a charge of approximately

$

36,660 to cost of revenues in the

f

ourth

q

uarter of fiscal 2009.

A

s discussed in further detail in Note 14, in the second quarter of fiscal 2008, the Company received an

adverse tax ruling with respect to the imposition of UK VAT on revenues earned by its UK subsidiary. In

connection with this ruling, the Company recorded a charge of approximately

$

27,900 as an offset to revenue i

n

f

iscal 2008. Beginning in the third quarter of fiscal 2008, the Company recorded as an offset to revenue VAT

charges associated with UK meeting fees as earned, consistent with the aforementioned ruling. Furthermore, as a

r

esult of the expiration of the statutory time period with respect to UK VAT owed prior to October 1, 200

5

,th

e

Company recorded in the fourth quarter of fiscal 2008 as a benefit to revenue for the periods prior to October 1

,

2005 an amount of approximately

$

9,200 as an offset against reserves previously recorded including in part the

charge recorded against revenue in the second quarter of fiscal 2008. In the fourth quarter of fiscal 2010, th

e

Company reversed the remaining reserve related to this matter in the amount of approximately

$

2,028 as a

benefit to revenue

.

1

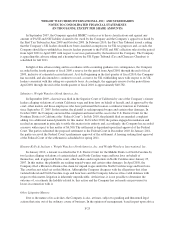

9. Recently Issued Account

i

ng Pronouncement

s

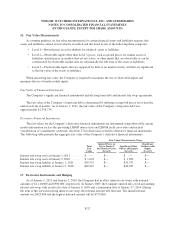

I

n January 2010, the FASB issued authoritative guidance revising certain disclosure requirements

concerning fair value measurements. The guidance requires an entity to disclose separately significant transfer

s

into and out of Levels 1 and 2 of the fair value hierarchy and to disclose the reasons for such transfers. It also

r

equires the presentation of purchases, sales, issuances and settlements within Level 3, on a gross basis rathe

r

than a net basis. These new disclosure requirements were effective for the Company beginning with its first fiscal

quarter of 2010, except for the additional disclosure of Level 3 activity, which is effective for fiscal year

s

beginning after December 1

5

, 2010. The Company did not have any such transfers into and out of Levels 1 and 2

during the twelve months ended January 1, 2011. The Company is currently evaluating the full impact of this

guidance, but does not expect it to have a material impact on the disclosures in its consolidated financia

l

statements in future filings.

I

n October 2009, new revenue recognition guidance was issued regarding arrangements with multiple

deliverables. The new guidance permits companies to recognize revenue from certain deliverables earlier than

p

reviously permitted, if certain criteria are met. The new guidance is effective for fiscal years beginning on o

r

after June 1

5

, 2010 and is not expected to have a material impact on the Company’s financial position, results o

f

op

erations or cash flows.

I

n May 2009, new accounting guidance was issued which sets forth general standards of accounting for an

d

disclosure of events that occur after the balance sheet date but before financial statements are issued or are

available to be issued. In February 2010, an amendment to this guidance was issued to eliminate the requiremen

t

to disclose the date through which a company has evaluated subsequent events

.

F-

29