WeightWatchers 2010 Annual Report Download - page 61

Download and view the complete annual report

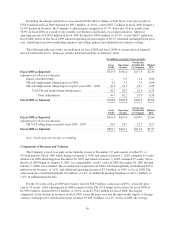

Please find page 61 of the 2010 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.discounting, both prior to the innovation launches to clear inventory and during the launches to encourage the

p

urchase of enrollment-related products. As indicated above in our discussion of in-meeting product sales, thes

e

discounting strategies were nevertheless successful in driving in-meeting product sales per attendee

.

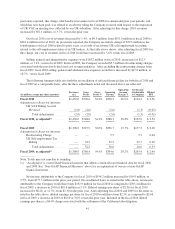

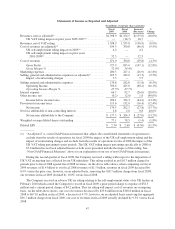

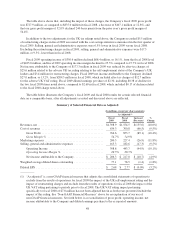

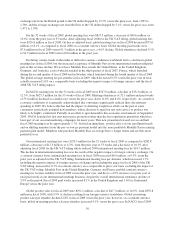

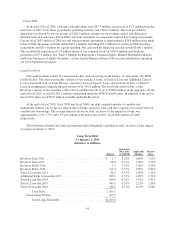

Gross

p

rofit for fiscal 2010 of

$

790.6 million, increased

$

62.7 million, or 8.6%, from

$

727.9 million i

n

f

iscal 2009, but after the adjustment to 2010 gross profit for the UK VAT accrual reversal and the adjustment to

2009 for the UK leader self-employment tax ruling, fiscal 2010 gross profit would have been

$

788.6 million, a

n

increase of 3.7% versus

$

760.4 million in the prior year. The Company’s gross margin was 54.4% in fiscal 201

0

as compared to

5

2.0% in fiscal 2009, but after the UK VAT accrual reversal and UK self-employment tax rulin

g

adjustments, the comparable gross margin in both years was

5

4.4%. WeightWatchers.com grew its gross margin

in fiscal 2010 versus fiscal 2009 due to the strong revenue growth in that business, coupled with low incrementa

l

variable costs. Robust growth in WeightWatchers.com was offset by a decline in gross margin in the meeting

s

business, for the reasons related to the new program launches noted in the above description of cost of revenues.

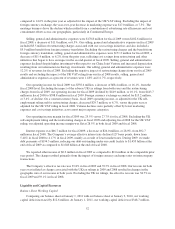

M

arketing expenses for fiscal 2010 of

$

217.1 million increased from the fiscal 2009 level of

$

200.5 millio

n

by 8.3%, but on a constant currency basis, fiscal 2010 marketing expenses increased by 7.3%, or

$

14.6 million,

versus the prior year. After disappointing results from our first quarter marketing, we adopted a new marketin

g

strategy focused on member experience in both the NACO meetings business, featuring Jennifer Hudson, and i

n

the WeightWatchers.com business. As the success of this strategy became apparent, we increased our marketing

investments in these businesses, resulting in improved recruitment trends in NACO and a strengthening o

f

already robust growth in Online sign-ups. In the first half of fiscal 2010, global marketing expenses increased b

y

2.7% versus the prior year period, while in the second half of 2010, we increased marketing expenditures versu

s

the prior year period by 18.2%. Part of the second half of fiscal 2010 increase is attributable to end of yea

r

spending for the January 2011 launch of the new P

o

int

s

Plu

s

program in NACO. Marketing expenses as

a

p

ercentage of revenues were 1

5

.0% in fiscal 2010 as compared to 14.3% in the prior year period

.

S

elling, general and administrative expenses were

$

183.2 million for fiscal 2010 versus

$

170.8 million fo

r

f

iscal 2009, an increase of

$

12.3 million, or 7.2%. On a constant currency basis and after adjusting fiscal 2009 t

o

exclude restructuring charges as noted in the table and discussions above, fiscal 2010 selling, general an

d

administrative expenses increased by 10.2%, or

$

16.9 million, versus

$

165.3 million in fiscal 2009. The increas

e

was driven primarily by expenses related to the settlement of the California labor litigation, consulting fee

s

associated with business development, and technology-related expenses, including for the development of mobil

e

applications. Selling, general and administrative expenses as a percentage of revenues for fiscal 2010 were 12.

6%

and for fiscal 2009 were 12.2%, or 11.8% on an as adjusted basis.

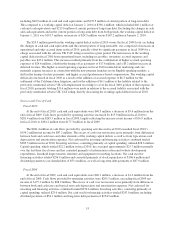

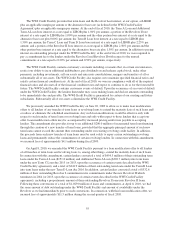

Our operating income for fiscal 2010 was

$

390.3 million, an increase of

$

33.7 million, or 9.4%, fro

m

$

356.7 million in fiscal 2009. After adjusting fiscal 2010 to exclude the revenue benefit of the UK VAT reversal,

and fiscal 2009 to exclude restructuring charges and the impact of the UK self-employment tax ruling, adjusted

o

perating income would have been

$

388.3 million in fiscal 2010 and

$

394.6 million in fiscal 2009. The decreas

e

in operating income on this adjusted basis would have been

$

6.2 million, or 1.6%, including

$

6.5 million o

f

expense associated with the settlement of the California labor litigation. Our operating income margin for fiscal

2010 was 26.9%, an increase of 140 basis

p

oints versus 2

5

.

5

% in fiscal 2009, but a decrease of 140 basis

p

oint

s

when comparing the adjusted 2010 operating income margin of 26.8% to the adjusted 2009 operating incom

e

margin of 28.2%. Of the 140 basis point decrease in adjusted operating income margin, 4

5

basis points resulte

d

f

rom the settlement of the California labor litigation. The remainder of the operating income margin decline wa

s

driven by the meetings business and its higher marketing and operating expenses related to the new progra

m

launches, and higher selling, general and administrative expenses. The impact of the decline in operating income

margin in the meetings business was partially offset by operating income margin expansion in the

W

eightWatchers.com business

.

4

5