WeightWatchers 2010 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2010 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On April 8, 2010, we amended the WWI Credit Facility pursuant to a loan modification offer to all lender

s

o

f all tranches of term loans and revolving loans to, among other things, extend the maturity date of such loans

.

In connection with this amendment, certain lenders converted a total of

$

454.5 million of their outstanding term

loans under the Term A Loan (

$

151.8 million) and Additional Term A Loan (

$

302.7 million) into term loan

s

under the new Term C Loan due 201

5

(or 2013, u

p

on the occurrence of certain events described in the WWI

Credit Facility agreement), and a total of

$

241.9 million of their outstanding term loans under the Term B Loa

n

into term loans under the new Term D Loan due 201

6

(each as defined hereafter). In addition, certain lenders

converted a total of

$

332.6 million of their outstanding Revolver I commitments into commitments under the

new Revolver II which terminates in 2014 (or 2013, u

p

on the occurrence of certain events described in the WWI

Credit Facility agreement) (each as defined hereafter), including a proportionate amount of their outstandin

g

R

evolver I loans into Revolver II loans. Following these conversions of a total of

$

1,029.0 million of loans an

d

commitments, at April 8, 2010, we had the same amount of debt outstanding under the WWI Credit Facility and

amount of availability under the Revolver (as defined hereafter) as we had immediately prior to such

conversions. In connection, with this loan modification offer, we incurred fees of approximately

$

11.5 million

during the second quarter of fiscal 2010.

F

or additional details on the WWI Credit Facility, see “Item 7. Management’s Discussion and Analysis o

f

Financial Condition and Results of Operations—Liquidity and Capital Resources—Long-Term Debt” in Part II

o

f this Annual Re

p

ort on Form 10-K.

W

orking Capital

The increase in the working capital deficit is primarily the result of year-over-year increases related to

p

ayables in connection with operations, the shift in timing of tax payments and accruals related to our litigatio

n

matters, which are offset by year-over-year decreases in the accrual for the UK adverse tax ruling related to the

U

K VAT matter and in the current portion of debt obligations.

F

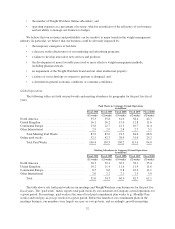

ranchise Acquisitions

T

he following are our key acquisitions since January 1, 200

6

:

A

cquisitions of Palm Beach, Wichita and Syracuse. On January 31, 2008, we acquired substantially all o

f

the assets of our Palm Beach, Florida franchisee for a net purchase price of approximately

$

12.9 million. O

n

June 13, 2008, we acquired substantially all of the assets of our Wichita, Kansas franchisee for a net purchas

e

p

rice of approximately

$

5.7 million. On June 19, 2008, we acquired substantially all of the assets of two of our

f

ranchisees, Weight Watchers of Syracuse, Inc. and Dieters of the Southern Tier, Inc., for a combined ne

t

p

urchase price of approximately

$

20.9 million. These acquisitions were financed through cash from operations.

T

hese acquisitions have been accounted for as purchases and earnings have been included in our consolidate

d

o

perating results since their respective dates of acquisition

.

A

cquisition of British Columbia. On June 3, 2007, we acquired substantially all of the assets of our British

Columbia franchisee for a net purchase price of approximately

$

15.8 million, which was financed through cash

f

rom operations. This acquisition has been accounted for as a purchase and earnings have been included in our

consolidated operating results since the date of acquisition

.

A

cquisitions of Indiana, Eastern Canada, Suffolk, Western Michigan, Greece and Italy

.

O

n July 27, 200

6,

w

e acquired substantially all of the assets of our Indiana franchisee for a net purchase price of approximately

$

25.0 million. On August 17, 2006, we acquired substantially all of the assets of our eastern Canadian franchisee

and of Vale Printing Limited for a net purchase price of approximately

$

51.2 million. On November 2, 2006, we

acquired substantially all of the assets of our Suffolk County, New York franchisee for a net purchase price of

approximately

$

24.5 million. On December 11, 2006, we acquired substantially all of the assets of our Wester

n

M

ichigan franchisee for a net purchase price of approximately

$

39.5 million, and reacquired our franchise right

s

28