WeightWatchers 2010 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2010 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIE

S

NO

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

(

IN THOUSANDS, EXCEPT PER SHARE AMOUNTS

)

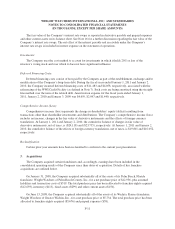

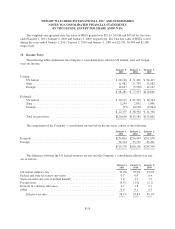

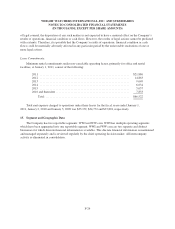

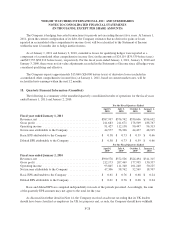

The deferred tax assets (liabilities) recorded on the Company’s consolidated balance sheets are as follows:

January 1

,

2011

January 2

,

2010

Provision for estimated ex

p

enses ....................................

$

6

,807

$

5,14

3

Operating loss carryforward

s

.......................................

2

9,0

6

8 27,00

7

S

alaries and wages

...............................................

4

,

104 3

,

8

7

0

S

hare-based com

p

ensation

.........................................

8,9

6

0 9,329

Other com

p

rehensive income

.......................................

2

,

811 4

,

834

Othe

r

..........................................................

6

,4

5

1 3,429

L

ess: valuation allowance

.........................................

(24,989) (21,9

6

7)

Tota

ld

e

f

erre

d

tax asset

s

...........................................

$

33

,

212

$

31

,

645

Deprec

i

at

i

o

n

.................................................... $

(

165) $ (2,529)

Prepa

id

expenses

................................................

—

(

187)

De

f

erre

di

ncom

e

.................................................

— (31)

A

mort

i

zat

i

o

n

...................................................

(76,054) (45,280)

T

ota

l

de

f

e

rr

ed ta

xli

ab

ili

t

i

es

........................................

$

(76,219)

$

(48,027)

N

et

d

e

f

erre

d

tax

li

a

bili

t

i

e

s

.........................................

$(

43,007

)$(

16,382

)

Certain forei

g

n operations of the Compan

y

have

g

enerated net operatin

g

loss carr

y

forwards. If it has bee

n

determined that it is more likel

y

than not that the deferred tax assets associated with these net operatin

g

los

s

carr

y

forwards will not be utilized, a valuation allowance has been recorded. As of Januar

y

1, 2011 and Januar

y

2

,

2010, various forei

g

n subsidiaries had net operatin

g

loss carr

y

forwards of approximatel

y

$107,411 and $95,808,

r

espectivel

y

, most of which can be carried forward indefinitel

y.

The Company’s undistributed earnings of foreign subsidiaries are not considered to be reinvested

p

ermanently. Accordingly, the Company has recorded all taxes, after taking into account foreign tax credits, o

n

the undistributed earnings of foreign subsidiaries.

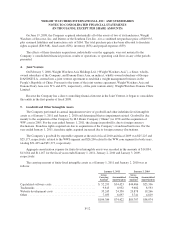

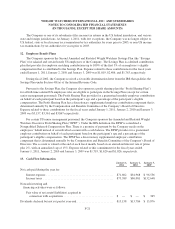

A

reconc

ili

at

i

on o

f

t

h

e

b

e

gi

nn

i

n

g

an

d

en

di

n

g

amount o

f

unreco

g

n

i

ze

d

tax

b

ene

fi

ts

i

sas

f

o

ll

ows:

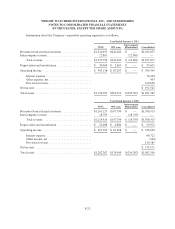

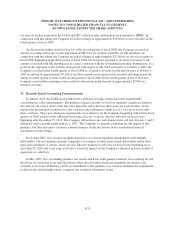

January

1,

2

01

1

January

2,

2

010

January

3,

2

009

Ba

l

ance at

b

eg

i

nn

i

ng o

f

year

.

...........................

.

$

12

,

897

$

11

,

086

$

9

,

455

Addi

t

i

ons

b

ase

d

on tax pos

i

t

i

ons re

l

ate

d

to t

h

e current yea

r

.....

2

,

115 1

,

811 2

,

169

Addi

t

i

ons

b

ase

d

on tax pos

i

t

i

ons o

f

pr

i

or year

s

.

............. 7

82

—

493

Re

d

uct

i

ons

f

or tax pos

i

t

i

ons o

f

pr

i

or years .................. — —

(

361

)

S

ett

l

ements ..........................................

——

(

670

)

Balance at end of

y

ea

r

..................................

$

15,794 $12,897 $11,086

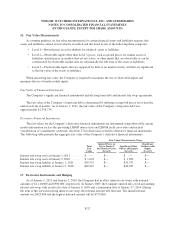

A

t January 1, 2011, the total amount of unrecognized tax benefits that, if recognized, would affect our

effective tax rate is

$

7,040. As of January 1, 2011, given the nature of the Company’s uncertain tax positions, it

is reasonably possible that there will not be a significant change in the Company’s uncertain tax benefits withi

n

the next twelve months

.

T

h

e Company recogn

i

zes

i

nterest an

d

pena

l

t

i

es re

l

ate

d

to unrecogn

i

ze

d

tax

b

ene

fi

ts

i

n

i

ncome tax expense

.

T

he Company had

$

2,838 and

$

2,059 of accrued interest and penalties at January 1, 2011 and January 2, 2010,

r

espectively. The Company recognized

$

780,

$

403 and

$

431 in interest and penalties during the fiscal years

en

d

e

d

January 1, 2011, January 2, 2010 an

d

January 3, 2009, respect

i

ve

l

y.

F-

20