WeightWatchers 2010 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2010 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIE

S

NO

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

(

IN THOUSANDS, EXCEPT PER SHARE AMOUNTS

)

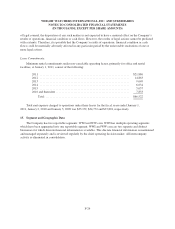

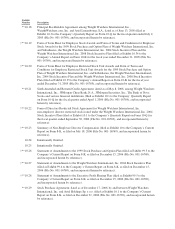

The Company is hedging forecasted transactions for periods not exceeding the next five years. At January 1,

2011, given the current configuration of its debt, the Company estimates that no derivative gains or losse

s

r

e

p

orted in accumulated other com

p

rehensive income (loss) will be reclassified to the Statement of Incom

e

within the next 12 months due to hedge ineffectiveness

.

A

so

f

Januar

y

1, 2011 an

d

Januar

y

2, 2010, cumu

l

at

i

ve

l

osses

f

or qua

lifyi

n

gh

e

dg

es were reporte

d

as a

component of accumulated other comprehensive income (loss) in the amounts of

$

24,119 (

$

39,539 before taxes)

and

$

23,735 (

$

38,910 before taxes), respectivel

y

. For the fiscal

y

ears ended Januar

y

1, 2011, Januar

y

2, 2010 an

d

Januar

y

3, 2009, t

h

ere were no

f

a

i

rva

l

ue a

dj

ustments recor

d

e

di

nt

h

e Statements o

f

Income s

i

nce a

ll h

e

dg

es were

cons

id

ere

d

qua

lifyi

n

g

an

d

e

ff

ect

i

ve.

The Compan

y

expects approximatel

y

$15,860 ($26,000 before taxes) of derivative losses included i

n

accumu

l

ate

d

ot

h

er compre

h

ens

i

ve

i

ncome/(

l

oss) at Januar

y

1, 2011,

b

ase

d

on current mar

k

et rates, w

ill b

e

r

ec

l

ass

ifi

e

di

nto earn

i

n

g

sw

i

t

hi

nt

h

e next 12 mont

h

s.

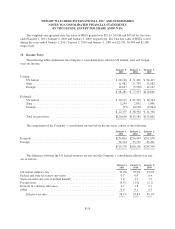

1

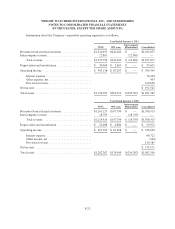

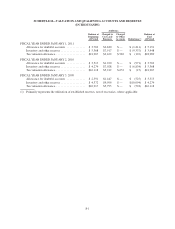

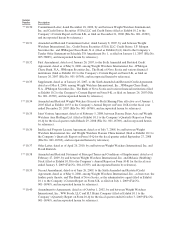

8. Quarterl

y

Financial Information

(

Unaudited

)

T

h

e

f

o

ll

ow

i

ng

i

s a summary o

f

t

h

e unau

di

te

d

quarter

l

y conso

lid

ate

d

resu

l

ts o

f

operat

i

ons

f

or t

h

e

fi

sca

l

years

en

d

e

d

January 1, 2011 an

d

January 2, 2010

.

F

or the F

i

scal

Q

uarters Ende

d

Apr

i

l3,

2

010

July

3,

201

0

O

ctober 2

,

201

0

J

anuary

1

,

2

01

1

F

i

scal year ended January 1, 2011

R

evenues

,

net .........................................

$

387

,

997

$

376

,

742

$

330

,

606

$

356

,

692

G

ross pro

fi

t

.

..........................................

2

11

,

683 211

,

671 178

,5

09 188

,

76

7

Operat

i

ng

i

ncom

e

...................................... 91

,

427 112

,

1

5

890

,

447 96

,

313

Net

i

ncome attr

ib

uta

bl

etot

h

e Company

.

................... 44

,

577 56

,

306 44

,

437 48

,

91

5

B

as

i

c EPS attr

ib

uta

bl

etot

h

e Company .....................

$

0

.58

$

0.73

$

0.59

$

0.6

6

D

il

ute

d

EPS attr

ib

uta

bl

etot

h

e Company

.

...................

$

0

.58

$

0.73

$

0.59

$

0.6

6

F

or the Fiscal

Q

uarters Ende

d

April 4,

2009

July 4

,

2

009

October 3

,

2

009

J

anuary 2,

20

1

0

F

i

scal

y

ear ended Januar

y

2, 201

0

R

evenues, net

.........................................

$

390,578

$

372,526

$

324,494

$

311,31

5

G

ross

p

rofit

...........................................

2

12,173 207,469 177,99

5

130,33

7

Operating incom

e

......................................

93,84

5

111,340 101,240

5

0,22

5

Net income attributable to the Company

....................

47,306

5

8,762

5

2,

5

69 18,70

7

B

asic EPS attributable to the Company .....................

$

0

.61

$

0.76

$

0.68

$

0.24

Diluted EPS attributable to the Company

.

...................

$

0

.61

$

0.76

$

0.68

$

0.24

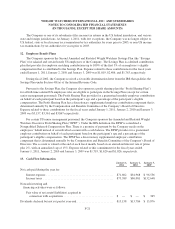

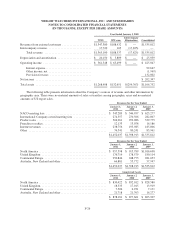

Bas

i

can

d dil

ute

d

EPS are compute

di

n

d

epen

d

ent

l

y

f

or eac

h

o

f

t

h

e per

i

o

d

s presente

d

. Accor

di

ng

l

y, t

h

esu

m

of

t

h

e quarter

l

y EPS amounts may not agree to t

h

e tota

lf

or t

h

e year

.

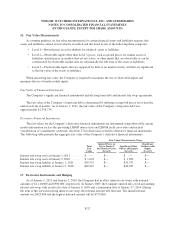

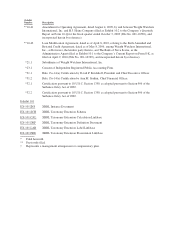

A

s

di

scusse

di

n

f

urt

h

er

d

eta

il i

n Note 14, t

h

e Compan

y

rece

i

ve

d

an a

d

verse tax ru

li

n

g

t

h

at

i

ts UK

l

ea

d

er

s

s

h

ou

ld h

ave

b

een c

l

ass

ifi

e

d

as emp

l

o

y

ees

f

or UK tax purposes an

d

, as suc

h

,t

h

e Compan

y

s

h

ou

ld h

ave w

i

t

hh

e

ld

F-

28