WeightWatchers 2010 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2010 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIE

S

NO

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

(

IN THOUSANDS, EXCEPT PER SHARE AMOUNTS

)

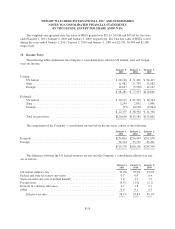

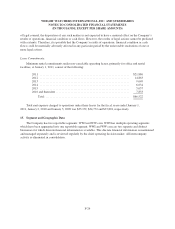

The Company or one of its subsidiaries files income tax returns in the US federal jurisdiction, and various

state and foreign jurisdictions. At January 1, 2011, with few exceptions, the Company was no longer subject to

U

S federal, state or local income tax examinations by tax authorities for years prior to 200

5

, or non-US income

tax examinations by tax authorities for years prior to 2003.

1

2. Em

p

lo

y

ee Benefit Plans

T

h

e Compan

y

sponsors t

h

e Secon

d

Amen

d

e

d

an

d

Restate

d

We

igh

t Watc

h

ers Sav

i

n

g

sP

l

an (t

h

e “Sav

i

n

g

s

P

l

an”)

f

or sa

l

ar

i

e

d

an

d

certa

i

n

h

our

ly

US emp

l

o

y

ees o

f

t

h

e Compan

y

.T

h

e Sav

i

n

g

sP

l

an

i

sa

d

e

fi

ne

d

contr

ib

ut

i

on

pl

an t

h

at prov

id

es

f

or emp

l

o

y

er matc

hi

n

g

contr

ib

ut

i

ons up to 100% o

f

t

h

e

fi

rst 3% o

f

an emp

l

o

y

ee’s e

ligible

compensat

i

on t

h

at

i

s contr

ib

ute

d

to t

h

e Sav

i

n

g

sP

l

an. Expense re

l

ate

d

to t

h

ese contr

ib

ut

i

ons

f

or t

h

e

fi

sca

ly

ears

ended Januar

y

1, 2011, Januar

y

2, 2010 and Januar

y

3, 2009 was

$

1,819,

$

2,486, and

$

1,763, respectivel

y.

Dur

i

n

gfi

sca

l

2002, t

h

e Compan

y

rece

i

ve

d

a

f

avora

bl

e

d

eterm

i

nat

i

on

l

etter

f

rom t

h

e IRS t

h

at qua

lifi

es t

he

Sav

i

n

g

sP

l

an un

d

er Sect

i

on 401(a) o

f

t

h

e Interna

l

Revenue Co

d

e.

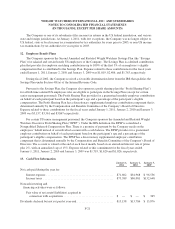

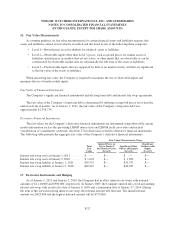

Pursuant to the Savings Plan, the Company also sponsors a profit sharing plan (the “Profit Sharing Plan”

)

f

or all full-time salaried US employees who are eligible to participate in the Savings Plan (except for certai

n

senior management personnel). The Profit Sharing Plan provides for a guaranteed monthly employer contribution

o

n behalf of each participant based on the participant’s age and a percentage of the participant’s eligible

compensation. The Profit Sharing Plan has a discretionary supplemental employer contribution component that is

determined annually by the Compensation and Benefits Committee of the Company’s Board of Directors

.

Expense related to these contributions for the fiscal years ended January 1, 2011, January 2, 2010 and January 3

,

2009 was

$

3,157,

$

3,361 and

$

3,867 respectively

.

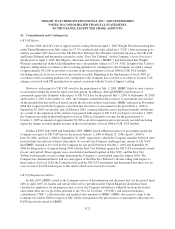

F

or certa

i

n US sen

i

or management personne

l

,t

h

e Company sponsors t

h

e Amen

d

e

d

an

d

Restate

d

We

i

g

ht

W

atc

h

ers Execut

i

ve Pro

fi

tS

h

ar

i

ng P

l

an (“EPSP”). Un

d

er t

h

e IRS

d

e

fi

n

i

t

i

on, t

h

e EPSP

i

s cons

id

ere

da

Nonqua

lifi

e

d

De

f

erre

d

Compensat

i

on P

l

an. T

h

ere

i

s a prom

i

se o

f

payment

b

yt

h

e Company ma

d

eont

h

e

emp

l

oyees’

b

e

h

a

lf i

nstea

d

o

f

an

i

n

di

v

id

ua

l

account w

i

t

h

a cas

hb

a

l

ance. T

h

e EPSP prov

id

es

f

or a guarantee

d

emp

l

oyer contr

ib

ut

i

on on

b

e

h

a

lf

o

f

eac

h

part

i

c

i

pant

b

ase

d

on t

h

e part

i

c

i

pant’s age an

d

a percentage o

f

t

he

p

art

i

c

i

pant’s e

li

g

ibl

e compensat

i

on. T

h

e EPSP

h

as a

di

scret

i

onary supp

l

ementa

l

emp

l

oyer contr

ib

ut

i

on

component t

h

at

i

s

d

eterm

i

ne

d

annua

ll

y

b

yt

h

e Compensat

i

on an

d

Bene

fi

ts Comm

i

ttee o

f

t

h

e Company’s Boar

d

o

f

D

i

rectors. T

h

e account

i

sva

l

ue

d

at t

h

een

d

o

f

eac

hfi

sca

l

mont

h

,

b

ase

d

on an annua

li

ze

di

nterest rate o

f

pr

i

me

p

lus 2%, with an annualized cap of 1

5

%. Expense related to this commitment for the fiscal years ended

January 1, 2011, January 2, 2010 and January 3, 2009 was

$

1,719,

$

1,620 and

$

1,026, respectively.

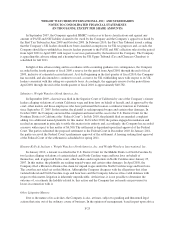

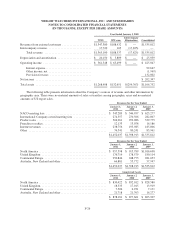

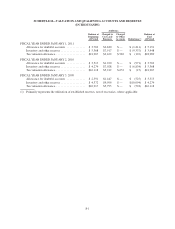

1

3.

C

ash Flow In

f

ormat

i

o

n

January

1,

2

01

1

J

anuary

2

,

201

0

J

anuary

3

,

2

009

Net cas

h

pa

id d

ur

i

ng t

h

e year

f

or:

I

nterest expens

e

..............................................

$

71

,

602 $81

,

968 $ 96

,

55

6

I

ncome taxes

................................................

$

75

,

389 $86

,

081 $132

,

648

Noncas

hi

nvest

i

ng an

d

fi

nanc

i

n

g

act

i

v

i

t

i

es were as

f

o

ll

ows:

F

a

i

rva

l

ue o

f

net assets/(

li

a

bili

t

i

es) acqu

i

re

di

n

connect

i

on w

i

t

h

acqu

i

s

i

t

i

on

s

..................................

$

—

$

—

$

34

5

D

i

v

id

en

d

s

d

ec

l

are

db

ut not

y

et pa

id

at

y

ear-en

d

.........................

$

13

,

158 $13

,

786 $ 13

,

87

6

F-

21