WeightWatchers 2010 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2010 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

p

reviously reported, this charge, which reduced revenues in fiscal 2008 for current and prior year periods, an

d

which has now been paid, was related to an adverse ruling the Company received with respect to the impositio

n

o

f UK VAT on meeting fees collected by our UK subsidiary. After adjusting for this charge, 2010 revenue

s

increased by

$

51.1 million, or 3.7%, versus the prior year.

Our fiscal 2010 cost of revenues decreased b

y

1.4%, or $9.5 million, from $671.0 million in fiscal 2009 to

$

661.4 million in fiscal 2010. As previousl

y

reported, the Compan

y

recorded a char

g

e of $32.5 million in the

f

ourt

h

quarter o

ffi

sca

l

2009 re

l

ate

d

to pr

i

or

y

ears, as a resu

l

to

f

an a

d

verse UK se

lf

-emp

l

o

y

ment tax ru

li

n

g

r

e

l

ate

d

to t

h

ese

lf

-emp

l

o

y

ment status o

fi

ts UK

l

ea

d

ers. As t

h

eta

bl

ea

b

ove s

h

ows, a

f

ter a

dj

ust

i

n

gfi

sca

l

2009

f

o

r

this char

g

e, our cost of revenues in fiscal 2010 would have increased b

y

3.

6

% versus fiscal 2009.

S

ellin

g

,

g

eneral and administrative expenses were $183.2 million in fiscal 2010, an increase of $12.3

million, or 7.2%, versus fiscal 2009. In fiscal 2009, the Compan

y

recorded $5.5 million of restructurin

g

char

g

es

assoc

i

ate

d

w

i

t

h

t

h

e prev

i

ous

ly di

sc

l

ose

d

cost sav

i

n

g

s

i

n

i

t

i

at

i

ves. A

f

ter exc

l

u

di

n

g

t

h

e restructur

i

n

g

c

h

ar

g

es

f

ro

m

f

iscal 2009, fiscal 2010 sellin

g

,

g

eneral and administrative expenses would have increased b

y

$17.8 million, or

10.7%

,

versus

fi

sca

l

2009

.

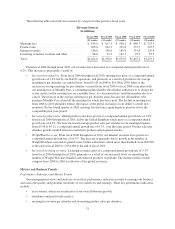

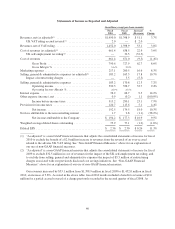

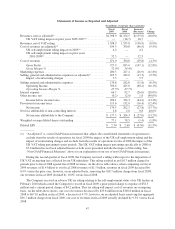

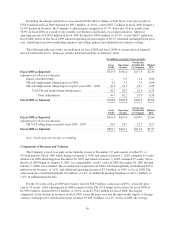

The following summary table sets forth the reconciliation of selected financial data for both fiscal 2010 an

d

f

iscal 2009 on a comparable basis, after the three adjustments noted and discussed above are reflected:

(

in millions, exce

p

t

p

er share amounts

)

Revenues

,

n

e

t

Gross

Pro

fi

t

G

ros

s

Profit

%

O

peratin

g

I

ncome

O

perat

i

n

g

I

n

co

m

e

Margin %

N

et

I

ncom

e

A

ttri

bu

t

ab

l

e

to

C

om

p

an

y

Dil

u

t

ed

EP

S

F

i

scal 2010

.....................

$

1,452.0

$

790.6 54.4%

$

390.3 26.9%

$

194.2

$

2.5

6

Adjustments to Reported Amount

s

UK VAT Ruling Accrua

l

R

eversa

l

.................

(2

.

0) (2

.

0) (2

.

0) (1

.

3) (0

.

02)

T

ota

l

A

dj

ustment

s

........

(2

.

0) (2

.

0) (2

.

0) (1

.

3) (0

.

02)

Fiscal 2010, as ad

j

usted

(

1

)

.........

$1,450.0 $788.6 54.4%

$

388.3 2

6

.8% $192.9 $ 2.54

Fi

sca

l 2009

.....................

$1,398.9 $727.9 52.0%

$

356.7 25.5% $177.3 $ 2.30

A

d

justments to Reporte

d

Amount

s

Restructur

i

n

g

C

h

ar

g

e

.

........ — —

5

.

53

.

3

0

.

0

4

UK Se

lf

-emp

l

o

y

ment Tax

R

u

li

n

g

...................

— 32.5 32.5 22.7 0.2

9

T

otal Adjustment

s

.

.......

—

32.

5

38.0 26.0 0.33

Fiscal 2009, as ad

j

usted

(

1)

.........

$

1

,

398.9

$

760.

4

54.4%

$

394.6 28.2%

$

203.4

$

2.64

Note: Totals may not sum due to rounding

(1) “As adjusted” is a non-GAAP financial measure that adjusts certain selected financial data for fiscal 2010

and 2009. See “Non-GAAP Financial Measures” above for an ex

p

lanation of our use of non-GAA

P

financial measures.

N

et income attributable to the Compan

y

for fiscal 2010 of $194.2 million increased b

y

$16.9 million, or

9.5%, from $177.3 million in the prior

y

ear period. On an ad

j

usted basis, as noted in the table above, net incom

e

attributable to the Compan

y

would have been $192.9 million for fiscal 2010 as compared to $203.4 million for

f

iscal 2009, a decrease in 2010 of $10.4 million or 5.1%. Diluted earnin

g

s per share of $2.56 for fiscal 2010

increased b

y

$0.26, or 11.3%, from $2.30 in the prior

y

ear. After ad

j

ustin

g

fiscal 2010 and 2009 for the items as

noted in the table above, diluted earnin

g

s per share for fiscal 2010 would have been $2.54, as compared to $2.6

4

in fiscal 2009, a decrease in 2010 of $0.10 or 3.6% versus the prior

y

ear. Included in the fiscal 2010 diluted

earnin

g

s per share is a $0.05 char

g

e associated with the settlement of the California labor liti

g

ation.

41