WeightWatchers 2010 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2010 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIE

S

NO

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

(

IN THOUSANDS, EXCEPT PER SHARE AMOUNTS

)

1

4.

C

omm

i

tments and

C

ont

i

ngenc

i

es

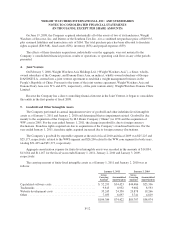

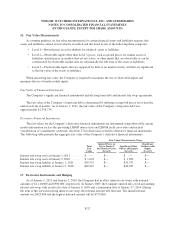

UK VAT Matter

I

n June 2008, the UK Court of Appeal issued a ruling that from April 1, 200

5

Weight Watchers meeting fee

s

in the United Kingdom were fully subject to 17.

5

% standard rated value added tax (“VAT”), thus reversing in its

entirety an earlier 2007 decision of the UK First Tier Tribunal (Tax Chamber) (formerly known as the UK VA

T

and Duties Tribunal and hereinafter referred to as the “First Tier Tribunal”) in the Company’s favor. For over

a

decade prior to April 1, 200

5

, Her Majesty’s Revenue and Customs (“HMRC”) had determined that Weigh

t

W

atchers meeting fees in the United Kingdom were only partially subject to 17.

5

% VAT. In light of the Court o

f

Appeal’s ruling and in accordance with accounting guidance for contingencies, the Company recorded a charge

o

f approximately

$

32,500 as an offset to revenue in the second quarter of fiscal 2008 for UK VAT liabilit

y

(including interest) in excess of reserves previously recorded. Beginning in the third quarter of fiscal 2008, i

n

accordance with accounting guidance for contingencies, the Company has recorded as an offset to revenue VA

T

charges associated with UK meeting fees as earned, consistent with the Court of Appeal’s ruling

.

However, with respect to UK VAT owed for the period prior to July 1, 200

5

, HMRC failed to raise a notic

e

o

f assessment within the statutory three-year time period. In addition, although HMRC raised notices o

f

assessment against the Company with respect to UK VAT due for the periods July 1, 200

5

to September 30, 200

5

and October 1, 200

5

to December 31, 200

5

, the Company asserted that these notices of assessment were invalid

o

n the grounds that they had been raised outside the relevant statutory time limits. HMRC indicated in Novembe

r

2008 that it agreed with the Company’s assertion that the notice of assessment for the period July 1, 200

5

to

September 30, 200

5

was invalid, and, in February 2009, confirmed that this notice had been formally withdrawn.

As a result of the expiration of the statutory time period with respect to UK VAT owed prior to October 1, 200

5

,

the Company recorded in the fourth quarter of fiscal 2008 as a benefit to revenue for the periods prior t

o

October 1, 2005 an amount of approximately

$

9,200 as an offset against reserves previously recorded includin

g

in part the charge recorded against revenue in the second quarter of fiscal 2008 for UK VAT liability.

I

n March 2009, June 2009 and September 2009, HMRC raised additional notices of assessment against the

Company in respect of UK VAT due for the periods January 1, 200

6

to March 31, 200

6

, April 1, 200

6

to

June 30, 200

6

, and July 1, 200

6

to September 30, 200

6

, respectively, which the Company similarly believed wer

e

r

aised outside the relevant statutory time limits. As a result, the Company challenged any amount of UK VA

T

that HMRC claimed to be owed by the Company for any period between October 1, 200

5

and September 30

,

2006 by filing notices of appeal during 2009 with the First Tier Tribunal against the UK VAT assessments issued

f

or any such period. These appeals were consolidated and heard together in May 2010, and the First Tie

r

T

ribunal subsequently issued a ruling dismissing the Company’s consolidated appeal in August 2010. Th

e

Company has determined that it will not seek appeal of the First Tier Tribunal’s adverse ruling with respect to

these matters. In fiscal 2010, the Company fully paid the UK VAT assessment and determined that there was a

n

o

ver-accrual of

$

2,028 with res

p

ect to this matter which was reversed to revenue

.

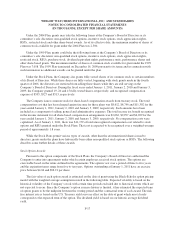

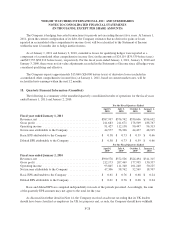

UK Self-Employment Matter

I

n July 2007, HMRC issued to the Company notices of determination and decisions that, for the period April

2001 to April 2007, its leaders and certain other service providers in the United Kingdom should have bee

n

classified as employees for tax purposes and, as such, the Company should have withheld tax from the leader

s

and certain other service providers pursuant to the “Pay As You Earn” (“PAYE”) and national insurance

contributions (“NIC”) collection rules and remitted such amounts to HMRC. HMRC also issued a claim to th

e

Company in October 2008 in respect of NIC which corresponds to the prior notices of assessment with respect to

PAYE previously raised by HMRC.

F-

22