WeightWatchers 2010 Annual Report Download - page 66

Download and view the complete annual report

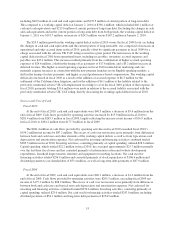

Please find page 66 of the 2010 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.exchange rate from the British pound to the US dollar dropped by 1

5

.3% versus the prior year, from 1.8

5

3to

1.

5

69, and the average exchange rate from the Euro to the US dollar dropped by

5

.1% versus the prior year, fro

m

1.471 to 1.3

96

.

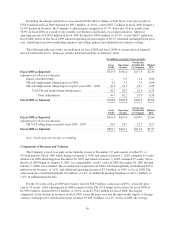

F

or the 52 weeks of fiscal 2009, global meeting fees were

$

817.5 million, a decrease of

$

90.6 million, o

r

10.0%, from the prior year of

5

3 weeks. After adjusting fiscal 2008 for the UK VAT ruling, global meeting fees

were

$

926.8 million in fiscal 2008. On this as-adjusted basis, global meeting fees in fiscal 2009 decreased

$

75.

0

million, or 8.1%, as compared to fiscal 2008 on a constant currency basis. Global meeting paid weeks were

8

7.6 million in fiscal 2009 versus 91.3 million in the prior year, a 4.0% decline. Global attendance declined 9.

5

%

to

5

4.3 million in fiscal 2009 versus 60.0 million in the prior year

.

Declining volume trends in the midst of difficult economic conditions worldwide led to a decline in globa

l

meeting fees in fiscal 2009, but the increased acceptance of Monthly Pass in our international markets mitigate

d

p

art of this revenue decline. We now have Monthly Pass outside the United States, in the United Kingdom,

G

ermany, and Australia, each of which launched in the third quarter of fiscal 2007, France, which launched

during the second quarter of fiscal 2008 and in Sweden, which launched during the fourth quarter of fiscal 2009

.

T

he global average meeting fee per attendee in fiscal 2009, which decreased 0.

5

% versus the prior year in total,

actually increased 1.6% on a comparable basis excluding the negative impact of foreign currency and the fiscal

2008 UK VAT ruling impact

.

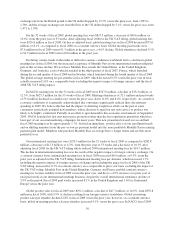

I

n NACO, meeting fees for the 52 weeks of fiscal 2009 were

$

547.0 million, a decline of

$

78.3 million, o

r

12.5%, from

$

625.3 million for the 53 weeks of fiscal 2008. Meeting attendances of 32.1 million and paid weeks

o

f

55

.8 million declined at a similar rate versus the prior year, down 11.8% and 8.4%, respectively. As a result of

economic conditions, it is generally acknowledged that consumers significantly reduced their discretionar

y

spending in 2009. We believe this has had the impact of deferring weight loss efforts on the part of some

consumers, particularly potential new members, whose decision to spend on any new service or product was

likely to be highly scrutinized. Partially in an effort to spur demand in this economic environment, in September

2009, NACO launched its first new major price promotion other than the free registration promotion which ha

s

been part of our seasonal marketing campaigns for many years. This new promotion lowered our second hal

f

f

iscal 2009 meeting fees by approximately 1.7%, but had an immediate, positive effect on our enrollment trend

s

and on shifting members from the pay-as-you-go payment model into the more profitable Monthly Pass recurrin

g

p

ayment plan model. Members who purchase Monthly Pass on average have a longer tenure and are thus more

p

rofitable to us.

Our international meeting fees were

$

270.5 million for the 52 weeks of fiscal 2009 as compared to

$

282.8

million, a decrease of

$

12.3 million, or 4.3%, from the prior year of 53 weeks and a decrease of 10.3% afte

r

adjusting fiscal 2008 for the UK VAT ruling which reduced 2008 international meeting fees by

$

18.7 million.

T

he decline in international meeting fees was the result of the negative impact of foreign currency exchange. O

n

a constant currency basis, international meeting fees in fiscal 2009 increased

$

0.9 million, or 0.3%, from the

p

rior year as adjusted for the UK VAT ruling. International meeting fees per attendee, which increased 1.7

%

including the negative impact of foreign currency exchange and including the impact in fiscal 2008 of the UK

VAT ruling, increased by 6.7% in constant currency on a comparable to prior year basis excluding the impact o

f

the UK VAT ruling. Monthly Pass in the United Kingdom, Germany and France enabled constant currenc

y

meeting fee revenue stability in fiscal 2009 versus the prior year, and drove a 4.9% increase over prior year i

n

total paid weeks in our international meetings business, despite the overall international attendance decline o

f

5

.9% in the period. Fiscal 2009 paid weeks increased 8.1% in the United Kingdom and 1.6% in Continental

Europe versus the prior year

.

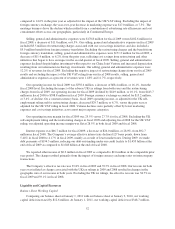

Global

p

roduct sales for fiscal 2009 were

$

292.1 million, a decline of

$

47.7 million, or 14.0%, from

$

339.

8

million in fiscal 2008, with

5

.9% of decline resulting from foreign currency translation. Global in-meetin

g

p

roduct sales per attendee declined 2.8% in fiscal 2009 versus the prior year; however, on a constant currency

basis, global in-meeting product sales per attendee increased 4.1% versus the prior year. In NACO, fiscal 2009

5

0