WeightWatchers 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dividends

We have issued a quarterl

y

cash dividend of $0.175 per share of our common stock ever

y

quarter be

g

innin

g

with the first quarter of fiscal 200

6

. Prior to these dividends, we had not declared or paid an

y

cash dividends on

o

ur common stoc

k

s

i

nce our acqu

i

s

i

t

i

on

by

Arta

li

n 1999

.

A

n

yd

ec

i

s

i

on to

d

ec

l

are an

d

pa

ydi

v

id

en

d

s

i

nt

h

e

f

uture w

ill b

ema

d

eatt

h

e

di

scret

i

on o

f

our Boar

d

o

f

D

i

rectors, a

f

ter ta

ki

n

gi

nto account our

fi

nanc

i

a

l

resu

l

ts, cap

i

ta

l

requ

i

rements an

d

ot

h

er

f

actors

i

tma

yd

ee

m

r

e

l

evant. Our Boar

d

o

f

D

i

rectors ma

yd

ec

id

eatan

y

t

i

me to

i

ncrease or

d

ecrease t

h

e amount o

fdi

v

id

en

d

sor

di

scont

i

nue t

h

epa

y

ment o

fdi

v

id

en

d

s

b

ase

d

on t

h

ese

f

actors. T

h

e WWI Cre

di

t Fac

ili

t

y

a

l

so conta

i

ns restr

i

ct

i

on

s

o

n our a

bili

t

y

to pa

ydi

v

id

en

d

s on our common stoc

k.

T

h

e WWI Cre

di

t Fac

ili

t

y

prov

id

es t

h

at we are perm

i

tte

d

to pa

ydi

v

id

en

d

san

d

extraor

di

nar

ydi

v

id

en

d

sso

l

on

g

as we are not

i

n

d

e

f

au

l

tun

d

er t

h

e WWI Cre

di

t Fac

ili

t

y

a

g

reements. However, pa

y

ment o

f

extraor

di

nar

y

dividends shall not exceed $150.0 million in an

y

fiscal

y

ear if net debt to EBITDA (as defined in the WWI Credi

t

Facilit

y

a

g

reement) is

g

reater than 3.75:1 and an investment

g

rade ratin

g

date (as defined in the WWI Credit

Fac

ili

t

y

a

g

reement)

h

as not occurre

d

.We

d

o not expect t

hi

s restr

i

ct

i

on to

i

mpa

i

r our a

bili

t

y

to pa

ydi

v

id

en

d

s,

b

ut

i

t cou

ld d

oso

.

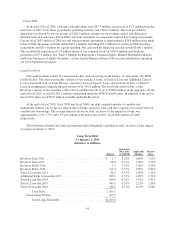

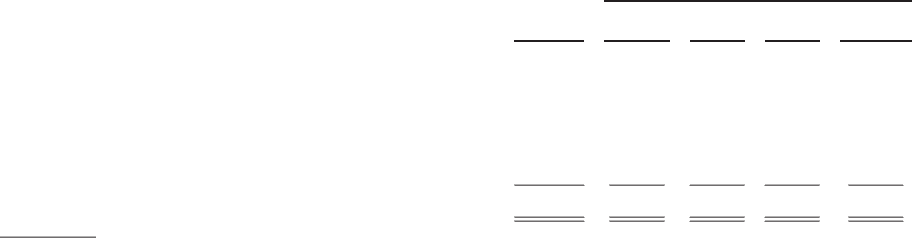

Contractual Obligations

We are o

blig

ate

d

un

d

er non-cance

l

a

bl

e operat

i

n

gl

eases pr

i

mar

ily f

or o

ffi

ce an

d

rent

f

ac

ili

t

i

es. Conso

lid

ate

d

r

ent expense char

g

ed to operations under all our leases for fiscal 2010 was approximatel

y

$35.2 million.

T

h

e

f

o

ll

ow

i

n

g

ta

bl

e summar

i

zes our

f

uture contractua

l

o

blig

at

i

ons as o

f

t

h

een

d

o

ffi

sca

l

2010:

T

o

t

al

Payment Due by Per

i

od

L

ess t

h

a

n

1

Y

ear

1

-

3

Y

ea

r

s

3

-5

Y

ea

r

s

M

ore t

h

a

n

5

Y

ea

r

s

(

in millions

)

Long-Term Debt

(1)

Princi

p

a

l

......................................

$

1,365.1

$

197.5

$

210.9

$

728.1

$

228.

6

I

n

te

r

est

.......................................

10

9

.1 22.2

5

6.0 28.0 2.

9

Operating lease

s

....................................

66.

5

21.

9

24.

5

12.3 7.8

Other long-term obligations

(2)

......................... 4.2 0.6 1.3 1.2 1.1

Tota

l

.........................................

$

1

,

544.9

$

242.2

$

292.7

$

769.6

$

240.4

(1) Due to the fact that all of our debt is variable rate based, we have assumed for

p

ur

p

oses of this table that th

e

interest rate on all of our debt as of the end of fiscal 2010 remains constant for all

p

eriods

p

resented.

(2) “Other long-term obligations” primarily consist of deferred rent costs. The provision for income ta

x

contingencies included in other long-term liabilities on the consolidated balance sheet is not included in th

e

table above due to the fact that the Company is unable to estimate the timing of payment for this liability

.

We currently plan to meet our long-term debt obligations by using cash flows provided by operating

activities and opportunistically using other means to repay or refinance our obligations as we determin

e

appropriate. We believe that cash flows from operating activities, together with borrowings available under our

R

evolver, will be sufficient for the next 12 months to fund currently anticipated capital expenditure requirements,

debt service requirements and working capital requirements.

F

ranc

h

ise Ac

q

uisitions

The following are our key franchise acquisitions since fiscal 2007:

I

n June 2008, we acquired substantiall

y

all of the assets of two of our franchisees, Wei

g

ht Watchers o

f

S

y

racuse, Inc. and Dieters of the Southern Tier, Inc., for a combined purchase price of approximatel

y

$20.9 million

.

56