WeightWatchers 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Di

v

i

dends

We have issued a quarterly cash dividend of

$

0.175 per share of our common stock every quarter beginnin

g

with the first quarter of fiscal 2006. Prior to these dividends, we had not declared or paid any cash dividends on

o

ur common stock since our acquisition by Artal in 1999

.

A

ny decision to declare and pay dividends in the future will be made at the discretion of our Board of

Directors, after taking into account our financial results, capital requirements and other factors it may dee

m

r

elevant. Our Board of Directors may decide at any time to increase or decrease the amount of dividends or

discontinue the payment of dividends based on these factors. The WWI Credit Facility (as defined below) als

o

contains restrictions on our ability to pay dividends on our common stock. See “Item 7. Management’s

Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—

Long-Term Debt” in Part II of this Annual Report on Form 10-K for a description of the WWI Credit Facility

.

I

tem 6.

S

elected Financial Dat

a

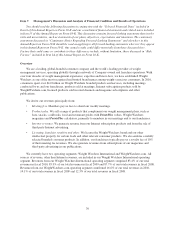

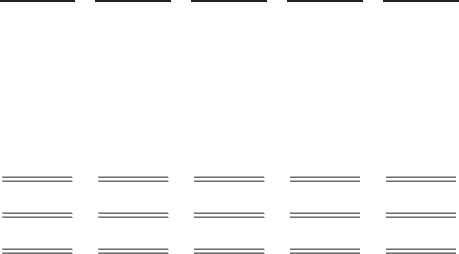

The following schedule sets forth our selected financial data for the last five fiscal years.

S

ELE

C

TED FINAN

C

IAL DATA

(

in millions, exce

p

t

p

er share amounts

)

Fiscal 2010

(

52 weeks

)

F

iscal 200

9

(

52 weeks

)

Fiscal 2008

(

53 weeks

)

Fiscal 200

7

(

52 weeks

)

F

iscal 200

6

(

52 weeks

)

R

evenues, net

................................

$1,452.0 $1,398.9 $1,535.8 $1,467.2 $1,233.3

Net

i

ncome attr

ib

uta

bl

etot

h

e Compan

y

.

..........

$

194.2 $ 177.3 $ 204.3 $ 201.2 $ 209.

8

W

or

ki

n

g

cap

i

ta

l

(

d

e

fi

c

i

t)

.

...................... $

(

348.7) $ (336.1) $ (270.1) $ (172.1) $ (64.3)

T

ota

l

asset

s

.................................

$1,092.0 $1,087.5 $1,106.8 $1,046.2 $1,000.7

L

on

g

-term

d

e

b

t

..............................

$1,167.6 $1,238.0 $1,485.0 $1,602.5 $ 830.

2

E

arn

i

n

g

s per s

h

are

:

Bas

i

c .................................. $ 2.57 $ 2.30 $ 2.61 $ 2.50 $ 2.13

Diluted ................................. $ 2.56 $ 2.30 $ 2.60 $ 2.48 $ 2.1

1

Dividends declared

p

er common share ............

$

0.70 $ 0.70 $ 0.70 $ 0.70 $ 0.70

I

tems Affectin

g

Comparability

S

evera

l

events occurre

dd

ur

i

n

g

eac

h

o

f

t

h

e

l

ast

fi

ve

fi

sca

ly

ears t

h

at a

ff

ect t

h

e compara

bili

t

y

o

f

our

fi

nanc

i

a

l

statements. T

h

e nature o

f

t

h

ese events an

d

t

h

e

i

r

i

mpact on un

d

er

lyi

n

gb

us

i

ness tren

d

s are as

f

o

ll

ows

:

UK V

A

T Matter

I

nt

h

e secon

d

quarter o

ffi

sca

l

2008, we rece

i

ve

d

an a

d

verse ru

li

n

gi

nt

h

eUn

i

te

d

K

i

n

gd

om w

i

t

h

respect t

o

t

h

e

i

mpos

i

t

i

on o

f

UK VAT on meet

i

n

gf

ees earne

di

nt

h

eUn

i

te

d

K

i

n

gd

om. In connect

i

on w

i

t

h

t

hi

sru

li

n

g

,we

r

ecorded a net char

g

e of approximatel

y

$18.7 million pertainin

g

to periods prior to fiscal 2008 as an offset to

r

evenue in fiscal 2008. In fiscal 2010, we determined that there was an over-accrual of $2.0 million with respect

to this matter which was reversed to revenue. See “Item 3. Le

g

al Proceedin

g

s—UK VAT Matter” in Part I of this

Annual Report on Form 10-K for further details on this matter.

UK Se

l

f-Emp

l

oyment Matter

We rece

i

ve

d

an a

d

verse tax ru

li

n

gi

nt

h

eUn

i

te

d

K

i

n

gd

om t

h

at our UK

l

ea

d

ers s

h

ou

ld h

ave

b

een c

l

ass

ifi

e

d

as emp

l

o

y

ees

f

or UK tax purposes an

d

, as suc

h

,wes

h

ou

ld h

ave w

i

t

hh

e

ld

tax

f

rom our

l

ea

d

ers pursuant to t

he

PAYE an

d

NIC co

ll

ect

i

on ru

l

es an

d

rem

i

tte

d

suc

h

amounts to HMRC. In connect

i

on w

i

t

h

t

hi

sru

li

n

g

,we

2

6