WeightWatchers 2010 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2010 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.margins, and created a stronger foundation from which to grow. In addition, during 2009, the management team

s

in Continental Europe prepared for the launch of a major new innovative program, Pr

o

P

oi

nt

s

,

which launched in

the fourth

q

uarter of fiscal 2009.

F

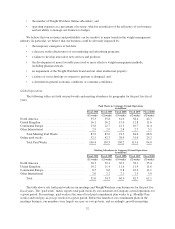

or fiscal year 2010, meeting paid weeks, benefiting from enrollment growth early in the year and a

n

increase in Monthly Pass penetration, grew

6

.9% versus the prior year, while attendance in Continental Europe

declined 1.

6

% versus the prior year. In the first half of 2010 the Continental European market experienced

meeting attendance growth as a result of the Pr

o

P

oi

nt

s

program, which drove an influx of returning members t

o

o

ur meetings who were attracted by the new program. The marketing of this new program, however, was not

successful in capturing the attention of new members and, as a result, attendance began to decline

.

W

eightWatchers.com

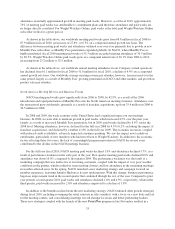

The continued success of WeightWatchers.com resulted in the number of Online paid weeks more than

doubling over the period from 2006 through 2010, from 2

5

.2 million to

5

2.

5

million, a compound average growth

r

ate of over 20%. End-of-period active Online subscribers totaled over 1 million at January 1, 2011. This success

r

esults from a combination of new subscribers in the United States and launches of WeightWatchers.co

m

subscription products in new markets globally. Currently, Weight Watchers Online has a presence in the United

States, Canada, United Kingdom, Germany, France, Netherlands, Sweden, Belgium, Spain, Australia and China

.

W

eightWatchers.com has also continued its product development efforts with the launch of an iPhone

®

a

pp

lication in Se

p

tember of 2009 and the launch of an iPa

d

®

application in early 2011

.

I

n addition to generating revenues from its subscription based offerings, WeightWatchers.com also provides

a means for companies to advertise on our website. This advertising revenue has increased at a compound annual

growth rate of 38.1% from fiscal 2006 through fiscal 2010

.

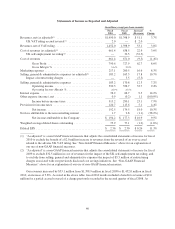

Gross Margi

n

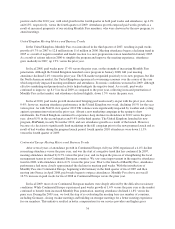

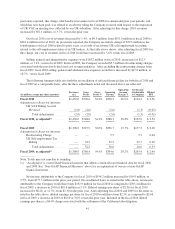

The Company has maintained an annual gross margin of

5

0% or more since fiscal 2001. In the period from

2006 through 2010, our gross margin ranged from a high of

55

.

5

% in 2007 to a low of

5

4.4% in 2010. Ou

r

meetings staff is usually paid on a commission basis and space is rented as needed in most instances. When i

t

becomes more cost effective to do so, in various geographies (particularly, North America), we rent centers at

r

easonable rates with relatively short lease terms. Moreover, we adjust the number of meetings according t

o

demand, including seasonal fluctuations. This variable cost structure has enabled us to maintain high margin

s

even as we have experienced a decline in the number of attendances per meeting. When attendances per meetin

g

grow, our gross margins typically improve. As WeightWatchers.com continues to grow, we expect margins to

continue to expand in this business which is primarily comprised of fixed costs.

Operating Margin

I

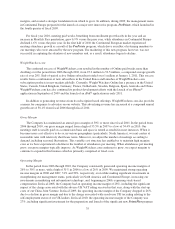

n the period from 2006 through 2010, the Company consistently generated operating income margins o

f

26% to 30% or more, with a high of 31% in 2006 to a low of 26% in 2009. We maintained strong operating

income margins in 2006 and 2007, 31% and 30%, respectively, even while making significant investments i

n

strengthening our management teams, particularly in North America and Continental Europe, increasing our

investments in marketing and information technology, and, beginning in 200

6

, expensing stock-base

d

compensation. In fiscal 2008, the Company had an operating income margin of 28%, including the significant

impact of the charge associated with the adverse UK VAT ruling received in that year, along with the start-up

costs of our China Joint Venture. In fiscal 2009, the operating income margin of the Company dropped to 26%

,

due to a decline in gross margin and due to the charge associated with an adverse UK tax ruling relating to th

e

self-employment status of our UK leaders. In fiscal 2010, the operating income margin of the Company wa

s

27%, including significant investment for the preparation and launch of the significant ne

w

P

o

int

s

Plu

s

program

35