WeightWatchers 2010 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2010 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

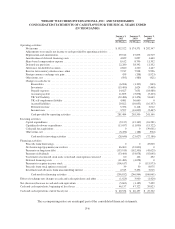

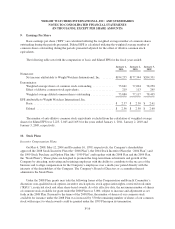

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIE

S

CO

N

SO

LIDATED

S

TATEMENT

SO

F

C

A

S

HFL

O

W

S

F

O

R THE FI

SC

AL YEAR

S

ENDED

(

IN THOUSANDS

)

Januar

y1,

2011

J

anuar

y2

,

2010

J

anuar

y3,

2009

(

52 Weeks

)(

52 Weeks

)(

53 Weeks

)

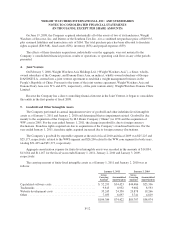

Operating activities

:

Net

i

ncom

e

.

.......................................................

$

192,522

$

174,571

$

202,34

7

Ad

j

ustments to reconcile net income to cash provided b

y

operatin

g

activities: . .

.

Deprec

i

at

i

on an

d

amort

i

zat

i

on

.........................................

29,012 27,87

5

24,

5

19

Amortization of deferred financin

g

costs

................................

4

,

659 2

,

097 1

,

440

Share-based com

p

ensation ex

p

ense

.....................................

8

,

612 8

,

796 11

,

30

2

De

f

erre

d

tax prov

i

s

i

o

n

...............................................

22,280 38,392 11,3

5

2

Allo

w

ance for doubtful accounts

.......................................

2

,

840 1

,

220 1

,

447

Reserve

f

or

i

nventory o

b

so

l

escence, ot

h

er

...............................

7,917 7,928 9,99

6

Forei

g

n currenc

y

exchan

g

e rate

g

ai

n

.

................................... 43

9

(

208

)(

1,923

)

Other items

,

ne

t

....................................................

(

595

)(

480

)(

421

)

C

h

anges

i

n cas

hd

ue to

:

..............................................

Recei

v

able

s

...................................................

(

6,964

)(

1,322

)(

343

)

Inventor

i

es

....................................................

(1

5

,490) 1,624 (7,469)

Pre

p

aid ex

p

ense

s

...............................................

14,027 7,651

(

18,489

)

Accounts pa

y

abl

e

...............................................

11,855

(

5,878

)(

5,423

)

UK VAT

li

a

bili

t

y

...............................................

(32,48

6

) (13,474) 31,

6

43

UK self-emplo

y

ment liabilit

y

.....................................

4

,

081 36

,

660 0

Accrue

dli

a

bili

t

i

es

..............................................

29,822 (10,0

55

) (16,3

5

7

)

Deferred re

v

enu

e

...............................................

5

,

356 6

,

118 3

,

01

2

In

co

m

eta

x

es

..................................................

3,597

(

16,009

)(

5,467

)

Cash provided b

y

operatin

g

activities

...............................

281

,

484 265

,

506 241

,

166

Investin

g

activities:

Cap

i

ta

l

expen

di

tures

................................................

(9,137) (12,349) (1

6

,281)

Cap

i

ta

li

ze

d

so

f

tware expen

di

tures

......................................

(

13,0

5

7

)(

11,090

)(

1

5

,322

)

Cash

p

aid for ac

q

uisitions

.

...........................................

00

(

39,661

)

O

t

h

er

i

tems, net

....................................................

(

6,4

5

2) (188) (922

)

Cash used for investing activities

..................................

(

28,646

)(

23,627

)(

72,186

)

Financing activities

:

Procee

d

s

f

rom

b

orrow

i

ng

s

.

...........................................

00

45

,000

N

et borrowin

g

s/(pa

y

ments) on revolver

.................................

46,000

(

32,000

)

0

P

ayments on

l

ong-term

d

e

b

t

..........................................

(133,91

5

) (162,

5

00) (4

5

,62

5)

P

a

y

ment of dividends

...............................................

(

53,409

)(

54,078

)(

55,045

)

T

ax

b

ene

fi

to

f

restr

i

cte

d

stoc

k

un

i

ts veste

d

an

d

stoc

k

opt

i

ons exerc

i

se

d

.

.......

6

012

6

492

D

e

f

erre

dfi

nanc

i

ng costs

.............................................

(11,483) (4,0

5

8) 0

P

a

y

ments to acquire treasur

y

stock

.....................................

(

106,617

)

0

(

115,973

)

P

rocee

d

s

f

rom stoc

k

opt

i

ons exerc

i

se

d

.

................................. 39

5

0

8

,07

5

I

nvestment and advances from noncontrollin

g

interest

......................

2

,

513 5

,

496 3

,

015

Cas

h

use

df

or

fi

nanc

i

ng act

i

v

i

t

i

e

s

..................................

(2

5

6,812) (246,964) (160,061

)

E

ff

ect o

f

exc

h

ange rate c

h

anges on cas

h

an

d

cas

h

equ

i

va

l

ents an

d

ot

h

e

r

............

(1,

6

29) 3,900 (1,420)

Net (

d

ecrease)/

i

ncrease

i

n cas

h

an

d

cas

h

equ

i

va

l

ent

s

...........................

(

5

,603) (1,18

5

) 7,499

C

as

h

an

d

cas

h

equ

i

va

l

ents,

b

eg

i

nn

i

ng o

ffi

sca

l

year

............................

4

6

,137 47,322 39,823

Cas

h

an

d

cas

h

equ

i

va

l

ents, en

d

o

ffi

sca

l

yea

r

.

................................

$

40,534

$

46,137

$

47,32

2

The accompan

y

in

g

notes are an inte

g

ral part of the consolidated financial statements.

F-6