WeightWatchers 2010 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2010 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIE

S

NO

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

(

IN THOUSANDS, EXCEPT PER SHARE AMOUNTS

)

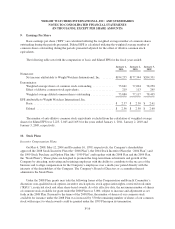

acquired franchise territory. The carrying values of these franchise rights acquired in the United States, Canada

,

U

nited Kingdom, Australia/New Zealand and other countries at January 1, 2011 were

$

656,638,

$

72,348,

$

16,593,

$

14,768 and

$

5,517, respectively, totaling

$

765,864

.

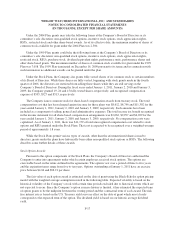

The Company estimates future cash flows for each unit of accounting by utilizing the historical cash flows

attributable to the rights in that country and then applying a growth rate using a blend of the historical operating

income growth rates for such country and expected future operating income growth rates for such country. Th

e

Company utilizes operating income as the basis for measuring its potential growth because it believes it is th

e

best indicator of the performance of its business. For fiscal 2010, the blended growth rates used in th

e

Company’s discounted cash flow analysis ranged from approximately

5

% to a growth rate of approximatel

y

2

6

%. For fiscal 2009, the blended growth rates used in the Company’s discounted cash flow analysis ranged fro

m

zero to a growth rate of approximately 11.0%. The Company then discounts the estimated future cash flows

utilizing a discount rate. The discount rate is calculated using the average cost of capital, which includes the cos

t

o

f equity and the cost of debt. The cost of equity is determined by combining a risk-free rate of return and

a

market risk premium. The risk-free rate of return is generally determined based on the average rate of long-term

T

reasury securities. The market risk premium is generally determined by reviewing external market data. When

appropriate, the Company further adjusts the resulting combined rate to account for certain entity-specific factors

such as maturity of the market in order to determine the utilized discount rate. The cost of debt is the Company’

s

average borrowing rate for the period. The discount rates used in the Company’s fiscal 2010 year-end impairmen

t

test and fiscal 2009 impairment test averaged approximately 10.

5

% and 11.

5

%, respectively.

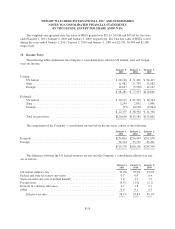

A

t the end of fiscal 2010, the Company estimated that approximately 90% of the carrying value of its

f

ranchise rights acquired had a fair value of at least three times their respective carrying amounts. In the United

States, the region which held approximately 86% of the franchise rights acquired, the aggregate fair value of th

e

Company’s franchise rights acquired was approximately three times the aggregate carrying value. Given tha

t

there is a significant difference between the fair value and carrying value of the Company’s franchise right

s

acquired, the Company believes there are currently no reasonably likely changes in assumptions that would caus

e

an im

p

airment.

The Company expenses all software costs (including website development costs) incurred during th

e

p

reliminary project stage and capitalizes all internal and external direct costs of materials and services consume

d

in developing software (including website development costs), once the development has reached the applicatio

n

development stage. Application development stage costs generally include software configuration, coding,

installation to hardware and testing. These costs are amortized over their estimated useful life of 3 years fo

r

website development costs and from 3 to

5

years for all other software costs. All costs incurred for upgrades,

maintenance and enhancements, including the cost of website content, which does not result in additional

f

unctionality, are expensed as incurred.

R

evenue Recognition

:

WWI earns revenue by conducting meetings, selling products in its meetings and to its franchisees,

collecting commissions from franchisees, collecting royalties related to licensing agreements and sellin

g

advertising space in and copies of its magazines. WWI charges non-refundable registration fees in exchange for

an introductory information session and materials it provides to new members in its meetings business. Revenu

e

f

rom these registration fees is recognized when the service and products are provided, which is generally at the

same time payment is received from the customer. Revenue from meeting fees, product sales, commissions and

r

oyalties is recognized when services are rendered, products are shipped to customers and title and risk of loss

p

ass to the customer, and commissions and royalties are earned. Advertising revenue is recognized whe

n

F-

9