WeightWatchers 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIE

S

NO

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

(

IN THOUSANDS, EXCEPT PER SHARE AMOUNTS

)

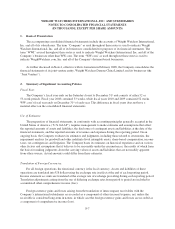

converted a total of

$

332,647 of their outstanding Revolver I commitments into commitments under the ne

w

R

evolver II which terminates on June 30, 2014 (or 2013, u

p

on the occurrence of certain events described in the

W

WI Credit Facility agreement), including a proportionate amount of their outstanding Revolver I loans int

o

R

evolver II loans. Following these conversions of a total of

$

1,029,002 of loans and commitments, at April 8,

2010, the Company had the same amount of debt outstanding under the WWI Credit Facility and amount of

availability under the Revolver as it had immediately prior to such conversions. In connection, with this loa

n

modification offer, the Company incurred fees of approximately

$

11,500 during the second quarter of fisca

l

2010

.

Matur

i

t

i

e

s

A

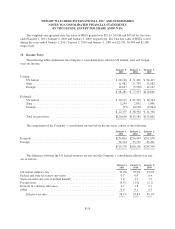

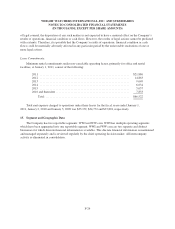

t January 1, 2011, the aggregate amounts of the Company’s existing long-term debt maturing in each o

f

the next five years and thereafter are as follows

:

2011

...........................................................

$

197,

5

2

4

2012

...........................................................

124,93

5

2013

...........................................................

8

6,01

4

2014

...........................................................

3

73,40

5

201

5

...........................................................

35

4,64

1

2016 and thereafter

...............................................

228,

5

6

6

$

1

,

365

,

08

5

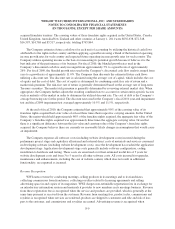

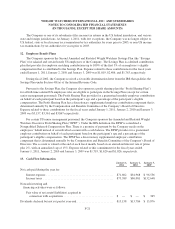

8. Treasury

S

toc

k

On Octo

b

er 9, 2003, t

h

e Company, at t

h

e

di

rect

i

on o

fi

ts Boar

d

o

f

D

i

rectors, aut

h

or

i

ze

d

an

d

announce

d

a

p

rogram to repurchase up to

$

250,000 of the Company’s outstanding common stock. On each of June 13, 2005,

May 25, 2006 and October 21, 2010, the Company, at the direction of its Board of Directors, authorized and

announced adding

$

250,000 to this program. The repurchase program allows for shares to be purchased fro

m

t

i

me to t

i

me

i

nt

h

e open mar

k

et or t

h

roug

h

pr

i

vate

l

y negot

i

ate

d

transact

i

ons. No s

h

ares w

ill b

e purc

h

ase

df

ro

m

Arta

l

un

d

er t

h

e program. T

h

e repurc

h

ase program current

l

y

h

as no exp

i

rat

i

on

d

ate

.

On December 18, 2006, the Company commenced a tender offer in which it sought to acquire up to 8,300

shares of its common stock at a price between

$

47.00 and

$

54.00 per share (the “Tender Offer”). Prior to th

e

T

en

d

er O

ff

er, t

h

e Company entere

di

nto an agreement w

i

t

h

Arta

l

w

h

ere

b

y Arta

l

agree

d

to se

ll

to t

h

e Company, a

t

t

h

e same pr

i

ce as was

d

eterm

i

ne

di

nt

h

e Ten

d

er O

ff

er, t

h

e num

b

er o

fi

ts s

h

ares o

f

t

h

e Company’s common stoc

k

necessary to

k

eep

i

ts percentage owners

hi

p

i

nt

h

e Company at su

b

stant

i

a

ll

yt

h

e same

l

eve

l

a

f

ter t

h

e Ten

d

er O

ff

er.

Arta

l

a

l

so agree

d

not to part

i

c

i

pate

i

nt

h

e Ten

d

er O

ff

er so t

h

at

i

t wou

ld

not a

ff

ect t

h

e

d

eterm

i

nat

i

on o

f

t

h

epr

i

ce

in

t

h

e Ten

d

er O

ff

er.

The Tender Offer expired at midnight on January 18, 2007, and on January 26, 2007 the Compan

y

r

epurchased approximately 8,548 shares at a price of

$

54.00 per share. These repurchased shares were comprised

of

8,300 s

h

ares t

h

at t

h

e Company o

ff

ere

d

to purc

h

ase an

d

approx

i

mate

l

y 248 s

h

ares purc

h

ase

d

pursuant to t

h

e

Compan

y

’s ri

g

ht to purchase up to an additional 2% of the outstandin

g

shares as of November 30, 2006. On

Februar

y

2, 2007, the Compan

y

repurchased approximatel

y

10,511 of Artal’s shares at a purchase price of $54.00

p

er s

h

are pursuant to

i

ts pr

i

or a

g

reement w

i

t

h

Arta

l

. In Januar

y

2007, t

h

e Compan

y

amen

d

e

d

an

d

supp

l

emente

d

t

h

e WWI Cre

di

t Fac

ili

t

y

to

fi

nance t

h

ese repurc

h

ases.

F-1

5