WeightWatchers 2010 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2010 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

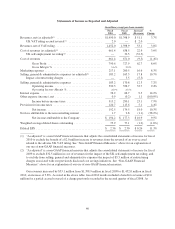

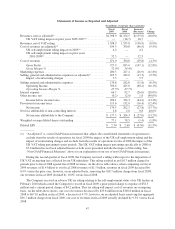

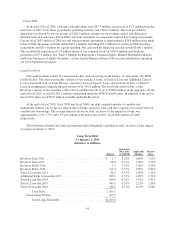

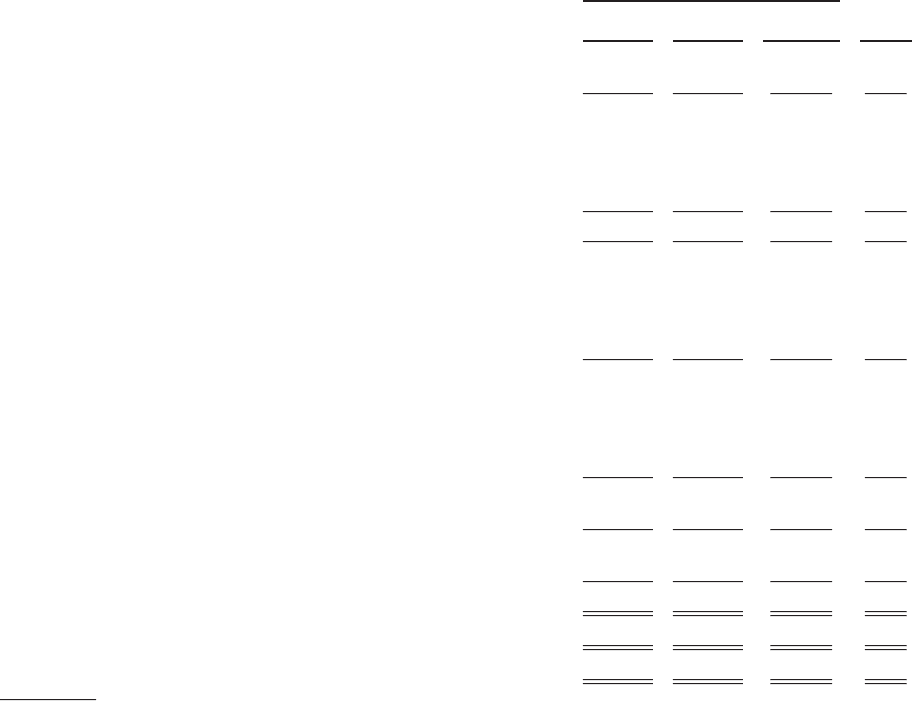

Statements of Income as Re

p

orted and Adjusted

(

In millions, except per share amounts

)

F

i

scal

2

009

F

i

scal

2

008

Increase

/

(

Decrease)

%

C

hang

e

R

evenues, net (as a

dj

uste

d

)

(1)

................................

$

1,398.9 $1,554.5 $(155.6) (10.0%)

UK VAT ruling impact on prior years 200

5

-200

7

(

1

)

...........

—

(18

.7

)18

.

7

R

evenues, net o

f

VAT ru

li

ng

.................................

1

,398.9 1,

5

3

5

.8

(

136.9

)(

8.9%

)

Cost of revenues (as adjusted

)

(

1

)

..............................

634.3 700.8 (66.

5

) (9.

5

%)

UK se

lf

-emp

l

o

y

ment ru

li

n

gi

mpact on 200

9

(1)

...............

4

.

2— 4

.2

UK se

lf

-emp

l

oyment ru

li

ng

i

mpact on pr

i

or year

s

2001

-

2008

(

1

)

........................................

3

2.

5

— 32.

5

Cost of revenues

..........................................

6

71.0 700.8 (29.8) (4.3%)

Gross Profi

t

..........................................

727.9 83

5

.0 (107.1) (12.8%)

Gross Mar

g

in

%

......................................

52.0% 54.4%

Mar

k

et

i

ng expense

s

.

.......................................

2

00.

5

227.4

(

26.9

)(

11.8%

)

Selling, general and administrative expenses (as adjusted)

(1)

........

1

6

5

.3 182.6 (17.3) (9.

5

%)

I

mpact o

f

restructur

i

n

g

c

h

ar

g

e

s

...........................

5

.

5

—

5

.

5

Se

lli

n

g

,

g

enera

l

an

d

a

d

m

i

n

i

strat

i

ve expenses

....................

1

70.8 182.6 (11.8) (6.5%)

Operat

i

ng Incom

e

.....................................

3

5

6.6 42

5

.0

(

68.4

)(

16.1%

)

O

perating Income Margin

%

............................

2

5.5

%2

7.7

%

I

nterest expense

...........................................

66

.7 92.7 (2

6

.0) (28.0%)

Ot

h

er

i

ncome

,

ne

t

.........................................

(0

.

2) (2

.

0) 1

.

8 (90

.

0%)

I

ncome

b

e

f

ore

i

ncome taxe

s

.............................

290

.

1 334

.

3 (44

.

2) (13

.

2%)

Provision for income taxes

..................................

1

1

5

.6 132.0 (16.4) (12.4%)

N

et incom

e

...........................................

1

74.

5

202.3 (27.8) (13.7%)

Net

l

oss attr

ib

uta

bl

e to non-contro

lli

n

gi

nterest .................. 2.

8

2.

00

.

8

40

.

0%

N

et

i

ncome attr

ib

uta

bl

etot

h

e Compan

y

....................

$

1

77.3 $ 204.3 $ (27.0) (13.2%)

W

e

i

g

h

te

d

average

dil

ute

d

s

h

ares outstan

di

n

g

....................

77.1 78.

5(

1.4

)(

1.8%

)

Diluted EPS

.

.............................................

$

2.30

$

2.60

$

(0.30) (11.5%)

(1) “As adjusted” is a non-GAAP financial measure that adjusts the consolidated statements of operations to

exclude from the results of operations for fiscal 2009 the impact of the UK self-employment ruling and th

e

impact of restructuring charges and exclude from the results of operations for fiscal 2008 the impact of th

e

UK VAT ruling pertaining to prior periods. The UK VAT ruling impact pertaining specifically to 2008 of

$

7.8 million has not been adjusted herein as both years presented include the impact of this ruling. Se

e

“Non-GAAP Financial Measures” above for an ex

p

lanation of our use of non-GAAP financial measures.

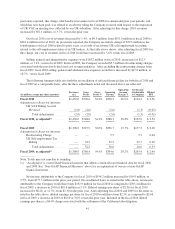

Dur

i

ng t

h

e secon

d

quarter o

ffi

sca

l

2008, t

h

e Company rece

i

ve

d

aru

li

ng w

i

t

h

respect to t

h

e

i

mpos

i

t

i

on o

f

U

K VAT on meeting fees collected by our UK subsidiary. This ruling resulted in an

$

18.7 million charge for

p

er

i

o

d

spr

i

or to

fi

sca

l

2008 aga

i

nst

fi

sca

l

2008 revenues. As t

h

ea

b

ove ta

bl

es

h

ows, w

h

en compar

i

ng our

fi

sca

l

2009 revenues of

$

1.4 billion to our fiscal 2008 revenues of

$

1.5 billion, revenues in fiscal 2009 decreased by

8

.9% versus the prior year; however, on an adjusted basis, removing the

$

18.7 million charge from fiscal 2008,

o

ur revenues

i

n

fi

sca

l

2009

d

ec

li

ne

db

y 10.0% versus

fi

sca

l

2008.

T

h

e Compan

y

rece

i

ve

d

an a

d

verse UK tax ru

li

n

g

re

l

at

i

n

g

to t

h

ese

lf

-emp

l

o

y

ment status o

fi

ts UK

l

ea

d

ers

i

n

Februar

y

2010 which caused the Compan

y

to record in fiscal 2009 a prior period char

g

e to expense of $32.5

million and a current period char

g

e of $4.2 million. This tax rulin

g

will impact cost of revenues on an on

g

oin

g

basis. As the table above shows, our cost of revenues decreased b

y

$29.8 million from $700.8 million in fisca

l

2008 to $671.0 million in fiscal 2009, a decrease of 4.3%; however, on an ad

j

usted basis, removin

g

the a

gg

re

g

ate

$

36.7 million char

g

e from fiscal 2009, our cost of revenues in fiscal 2009 actuall

y

declined b

y

9.5% versus fiscal

2

008

.

4

7