WeightWatchers 2010 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2010 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIE

S

NO

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

(

IN THOUSANDS, EXCEPT PER SHARE AMOUNTS

)

On June 19, 2008, the Company acquired substantially all of the assets of two of its franchisees, Weigh

t

W

atchers of Syracuse, Inc. and Dieters of the Southern Tier, Inc., for a combined net purchase price of

$

20,935,

p

lus assumed liabilities and transaction costs of

$

164. The total

p

urchase

p

rice has been allocated to franchis

e

r

ights acquired (

$

20,948), fixed assets (

$

36), inventory (

$

56) and prepaid expenses (

$

59).

T

h

ee

ff

ects o

f

t

h

ese

f

ranc

hi

se acqu

i

s

i

t

i

ons,

i

n

di

v

id

ua

lly

or

i

nt

h

ea

gg

re

g

ate, were not mater

i

a

l

to t

he

Compan

y

’s conso

lid

ate

dfi

nanc

i

a

l

pos

i

t

i

on, resu

l

ts o

f

operat

i

ons, or operat

i

n

g

cas

hfl

ows

i

nan

y

o

f

t

h

e per

i

o

ds

p

resente

d

.

4. Jo

i

nt Venture

On February

5

, 2008, Weight Watchers Asia Holdings Ltd. (“Weight Watchers Asia”), a direct, wholly-

o

wned subsidiary of the Company, and Danone Dairy Asia, an indirect, wholly-owned subsidiary of Groupe

DANONE S.A., entered into a joint venture agreement to establish a weight management business in th

e

People’s Republic of China. Pursuant to the terms of the joint venture agreement, Weight Watchers Asia and

Danone Dairy Asia own

5

1% and 49%, respectively, of the joint venture entity, Weight Watchers Danone China

Limited.

Because t

h

e Compan

yh

as a

di

rect contro

lli

n

gfi

nanc

i

a

li

nterest

i

nt

h

eJo

i

nt Venture,

i

t

b

e

g

an to conso

lid

at

e

t

hi

s ent

i

t

yi

nt

h

e

fi

rst quarter o

ffi

sca

l

2008.

5.

G

oodw

i

ll and

O

ther Intang

i

ble Asset

s

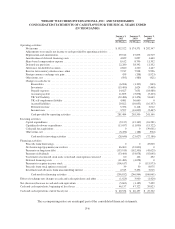

The Company performed its annual impairment review of goodwill and other indefinite-lived intangible

assets as of January 1, 2011 and January 2, 2010 and determined that no impairment existed. Goodwill is du

e

mainly to the acquisition of the Company by H.J. Heinz Company (“Heinz”) in 1978 and the acquisition o

f

W

W.com in 200

5

. For the year ended January 1, 2011, the change in goodwill is due to foreign currency

f

luctuations. Franchise rights acquired are due to acquisitions of the Company’s franchised territories. For the

y

ear ended January 1, 2011, franchise rights acquired increased due to foreign currency fluctuations.

The Compan

y

’s

g

oodwill b

y

reportable se

g

ment at the end of fiscal 2010 and fiscal 2009 was $25,225 an

d

$

25,173, respectivel

y

, related to the WWI se

g

ment and $26,200 related to the WW.com se

g

ment for both

y

ears,

totalin

g

$51,425 and $51,373, respectivel

y

.

A

ggregate amortization expense for finite-lived intangible assets was recorded in the amounts of

$

14,894,

$

13,664 and

$

11,167 for the fiscal years ended January 1, 2011, January 2, 2010 and January 3, 2009,

r

espect

i

ve

l

y.

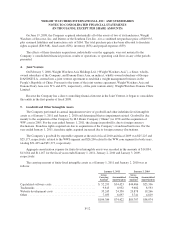

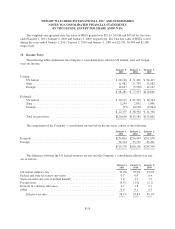

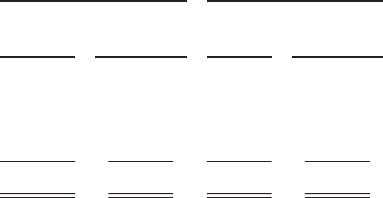

The carrying amount of finite-lived intangible assets as of January 1, 2011 and January 2, 2010 was as

f

ollows:

January

1

,

2011

J

anuary

2

,

2010

G

ross

Carryin

g

A

mount

Accu

m

u

l

a

t

ed

Amortization

G

ros

s

C

arryin

g

A

mount

Accu

m

u

l

a

t

ed

A

mortizatio

n

Ca

p

italized software costs .............................

$

52,293

$

34,423

$

44,486

$

25,39

6

T

r

ade

m

a

rk

s

.........................................

9,813 8,9

5

2 9,602 8,

5

9

3

W

ebsite develo

p

ment cost

s

............................

35

,24

5

24,3

5

0 29,878 19,26

6

Other

..............................................

7

,033 6,697

5

,741 4,81

9

$

104

,

384 $74

,

422 $89

,

707 $58

,

074

F-

12