WeightWatchers 2010 Annual Report Download - page 49

Download and view the complete annual report

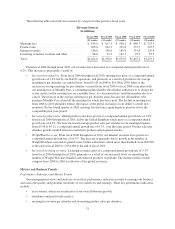

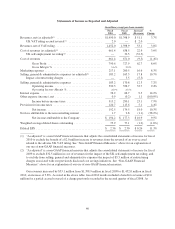

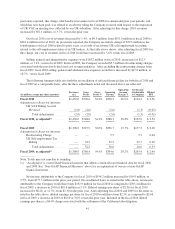

Please find page 49 of the 2010 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.attendance essentially approximated growth in meeting paid weeks. However, as of fiscal 2010, approximately

76

% of meeting paid weeks was attributable to commitment plans and therefore attendance and paid weeks are

no longer directly correlated. For Weight Watchers Online, paid weeks is the total paid Weight Watchers Onlin

e

subscriber weeks for a given period.

A

s shown in the table above, our worldwide meetin

g

paid weeks

g

rew from

6

8.8 million in fiscal 200

6

to

8

7.9 million in fiscal 2010, an increase of 27.8%, or

6

.3% on a compound annual

g

rowth rate basis. The

difference between meetin

g

paid weeks and attendance widened

y

ear-over-

y

ear primaril

y

due to

g

rowth in ne

w

Monthl

y

Pass subscribers as Monthl

y

Pass penetration expanded

g

loball

y

. In NACO, where Monthl

y

Pass i

s

hi

g

hl

y

penetrated, fiscal 2010 meetin

g

paid weeks of 55.3 million exceeded meetin

g

attendance of 30.3 million

b

y

82.3%. Wei

g

ht Watchers Online paid weeks

g

rew at a compound annual rate of 20.1% from 200

6

to 2010

,

increasin

g

from 25.2 million to 52.5 million.

A

ss

h

own

i

nt

h

eta

bl

ea

b

ove, our wor

ld

w

id

e annua

l

meet

i

ng atten

d

ance

i

n our Company-owne

d

operat

i

ons

has declined from 61.1 million for fiscal 2006 to

5

1.0 million for fiscal 2010, a decline of 4.4% on a compound

annua

l

growt

h

rate

b

as

i

s. Our wor

ld

w

id

e average meet

i

ng revenue per atten

d

ee,

h

owever,

h

as

i

ncrease

d

over t

h

e

same per

i

o

d

,

l

arge

l

y as a resu

l

to

f

Mont

hl

y Pass’ grow

i

ng penetrat

i

on

i

n NACO an

d

ot

h

er mar

k

ets, an

d

growt

hi

n

p

ro

d

uct sa

l

es per atten

d

ee.

Nort

h

America Meeting Metrics an

d

Business Tren

d

s

N

ACO meetin

g

paid weeks

g

rew si

g

nificantl

y

from 200

6

to 2008, b

y

42.9%, as a result of the 200

6

introduction and rapid penetration of Monthl

y

Pass into the North American meetin

g

s business. Attendance over

the same period

g

rew moderatel

y

, primaril

y

as a result of franchise acquisitions, up from 35.4 million in 2006 to

36

.

5

million in 2

008

.

I

n 2008 an

d

2009, t

h

e wea

k

econom

yi

nt

h

eUn

i

te

d

States

h

a

d

as

ig

n

ifi

cant

i

mpact on our meet

i

n

gs

business. In 2008, we were able to maintain

g

rowth in paid weeks, which increased 4.5% over the prior

y

ear,

l

ar

g

e

ly

as a resu

l

to

fi

ncrease

d

Mont

hly

Pass penetrat

i

on,

b

ut

i

n 2009, pa

id

wee

k

s

d

ec

li

ne

dby

8.4% versus t

he

2008 level. Meetin

g

attendance, however, declined for the full

y

ear 2008 b

y

4.3% (6.2% excludin

g

the impact o

f

f

ranc

hi

se acqu

i

s

i

t

i

ons), an

dd

ec

li

ne

dby

a

f

urt

h

er 11.8%

i

nt

h

e

f

u

ll y

ear 2009. T

h

e econom

i

c recess

i

on, coup

l

e

d

w

i

t

h

re

d

uce

d

cre

di

t ava

il

a

bili

t

y

,a

d

verse

ly i

mpacte

d

consumer spen

di

n

g

. We saw t

h

e

i

mpact most acute

ly i

n

enro

ll

ments, part

i

cu

l

ar

ly

o

f

new mem

b

ers w

h

o

h

a

d

never

b

een to We

igh

t Watc

h

ers. In a

ddi

t

i

on to t

h

e econom

ic

f

actors a

ff

ect

i

n

g

t

h

ese two

y

ears, t

h

e

l

ac

k

o

f

a mean

i

n

gf

u

l

pro

g

ram

i

nnovat

i

on

i

n NACO

f

or severa

ly

ear

s

contr

ib

ute

d

to t

h

e

d

ec

li

ne

i

nt

h

e NACO meet

i

n

g

s

b

us

i

ness

.

F

or the full year fiscal 2010, NACO meeting paid weeks declined 1.0% and attendance declined

5

.7%, as

a

r

esult of performance weakness in the early part of the year. First quarter meeting paid weeks declined 8.0% an

d

attendance was down 16.0%, com

p

ared to first

q

uarter 2009. The

p

erformance weakness was the result of a

marketing campaign that was ineffective at recruiting customers, coupled with the impact of very poor weathe

r

conditions in the quarter, which resulted in some meeting closures and low attendance in the remaining meeting

s

in weather-affected areas. In the spring, NACO launched a new marketing strategy and campaign focused o

n

member experience, featuring Jennifer Hudson as its new spokesperson. With this change, business performanc

e

began an improvement trend in the second quarter that continued through the rest of the year. Compared to prio

r

y

ear periods, second quarter 2010 paid weeks and attendance declined 1.8% and 4.9%, respectively, while in th

e

third quarter, paid weeks increased by 2.8% and attendance improved to a decline of 3.8%

.

I

n addition to the benefits realized from the new marketin

g

strate

gy

, NACO initiated other

g

rowth strate

g

ies

durin

g

fiscal 2010, includin

g

revampin

g

the retail structure in select markets, with a focus on a new look and feel

f

or the meetin

g

centers, and consolidatin

g

meetin

g

s toward stron

g

er locations and better performin

g

leaders.

T

hese new strate

g

ies coupled with the launch of the ne

w

P

o

int

s

P

l

u

s

p

ro

g

ram in late November resulted in

a

33