WeightWatchers 2010 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2010 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.I

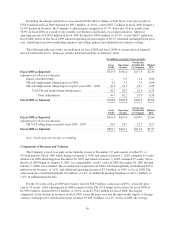

nterest ex

p

ense was

$

76.2 million for fiscal 2010, an increase of

$

9.5 million, or 14.2%, from

$

66.7 million

in fiscal 2009. Higher interest expense was driven by increases in our credit spread resulting from our recent deb

t

extension and by increases in the average notional value of our interest rate swaps, as well as by highe

r

amortization of transaction fees. The impact of these factors was partially offset by lower LIBOR and a decrease

in the average debt outstanding in fiscal 2010 versus fiscal 2009. The average credit spread increased from 1.1

6%

in fiscal 2009 to 1.

6

4% in fiscal 2010. The average notional value of our interest rate swaps increased from

$

900.0 million in fiscal 2009 to

$

1,244.0 million in fiscal 2010. The resultant effective interest rate increased by

8

4 basis points from 4.17% in fiscal 2009 to

5

.01% in fiscal 2010. The average value of debt outstandin

g

decreased from

$

1,547.9 million in fiscal 2009 to

$

1,414.7 million in fiscal 2010

.

We re

p

orted other ex

p

ense of

$

0.9 million in fiscal 2010 as com

p

ared to

$

0.2 million of income in fiscal

2009. Other expense (income) primarily resulted from the impact of foreign currency exchange rates o

n

intercompany transactions

.

The effective tax rate was 38.

5

% on our results for fiscal 2010 and 3

9

.8% on our results for fiscal 200

9

.Th

e

tax rate in fiscal 2009 was inflated due to charges associated with the UK self-employment tax ruling which

r

esulted in a change in the geographic mix of our taxable income toward higher taxing jurisdictions, notably th

e

U

nited States. Excluding the impact of the UK self-employment tax ruling, the effective tax rate was 38.7% i

n

f

iscal 200

9.

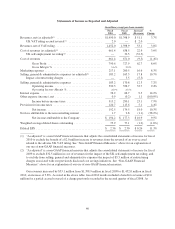

R

ESULTS OF OPERATIONS FOR FISCAL 2009

(

52 weeks

)

COMPARED TO FISCAL 2008

(

53 weeks

)

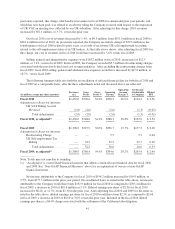

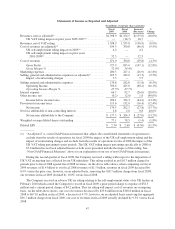

Two adverse UK tax rulings caused the Company to record prior period adjustments that negativel

y

impacted certain key metrics in both fiscal 2009 and fiscal 2008. We discuss these UK rulings in further detail in

“Item 3. Legal Proceedings—UK Self-Employment Matter and—UK VAT Matter” in Part I of this Annua

l

R

e

p

ort on Form 10-K. The table below shows our consolidated results for fiscal 2009 versus fiscal 2008 on bot

h

a GAAP basis and on an adjusted basis to show the impact of these rulings on both years and to exclude the

r

estructuring charges associated with our cost savings initiatives in fiscal 2009

.

4

6