Virgin Media 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

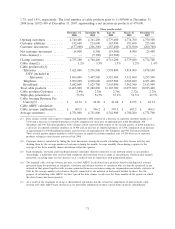

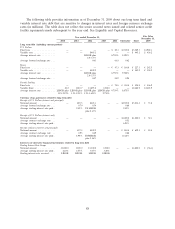

The minimum required ratios are outlined below:

Debt

Interest Service

Leverage Coverage Coverage

Quarter Date Ratio Ratio Ratio

December 31, 2009 .............................. 4.25:1 2.60:1 1:1

March 31, 2010 ................................. 4.25:1 2.60:1 1:1

June 30, 2010 .................................. 4.10:1 2.65:1 1:1

September 30, 2010 .............................. 4.00:1 2.70:1 1:1

December 31, 2010 .............................. 3.90:1 2.75:1 1:1

March 31, 2011 ................................. 3.75:1 2.85:1 1:1

June 30, 2011 .................................. 3.70:1 2.90:1 1:1

September 30, 2011 .............................. 3.60:1 3.00:1 1:1

December 31, 2011 .............................. 3.50:1 3.05:1 1:1

March 31, 2012 ................................. 3.50:1 3.10:1 1:1

June 30, 2012 .................................. 3.00:1 3.20:1 1:1

September 30, 2012 .............................. 3.00:1 4.00:1 1:1

December 31, 2012 and thereafter ................... 3.00:1 4.00:1 1:1

As shown in the table above, the required levels become more restrictive over time. As a result, we

will need to continue to improve our operating performance over the next several years to meet these

levels. Failure to meet these covenant levels would result in a default under our senior credit facility.

As of December 31, 2009, we were in compliance with these covenants.

Events of Default

The occurrence of events of default specified in our senior credit facility entitle the lenders to

cancel any undrawn portion of that facility, require the immediate payment of all amounts outstanding

under that facility and enforce or direct the enforcement of the security interests that have been

granted. These events of default include, among other things:

• failure to make payments of principal or interest when due;

• breaches of representations;

• breaches of obligations and undertakings under our senior credit facility and related finance

documents, including failure to meet financial covenants;

• cross defaults;

• the occurrence of insolvency contingencies affecting Virgin Media Inc., the issuer, any borrower

under our senior credit facility or any guarantor that is a material subsidiary;

• repudiation of our senior credit facility and the other finance documents;

• illegality; and

• the occurrence of any event or circumstance which would have a material adverse effect on the

business, assets or financial condition of the obligors under our senior credit facility taken as a

whole or any obligor’s payment or other material obligations under our senior credit facility or

related finance documents.

Senior Unsecured Notes

In November 2009, Virgin Media Finance issued U.S. dollar denominated 8.375% senior notes due

2019 with a principal amount outstanding of $600 million and sterling denominated 8.875% senior

81