Virgin Media 2009 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2009 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Note 8—Long Term Debt (Continued)

debt borrowing rate. As a result, the liability component is recorded at a discount reflecting its below

market coupon interest rate, and is subsequently accreted to its par value over its expected life, with

the rate of interest that reflects the market rate at issuance being reflected in the results of operations.

We adopted the guidance on January 1, 2009 as our convertible senior notes are within the scope of

the guidance and we have applied it on a retrospective basis, whereby our prior period results have

been adjusted.

We applied a nonconvertible borrowing rate of 10.35% which resulted in the recognition of a

discount on the convertible senior notes totaling £108.2 million, with the offsetting amount recognized

as a component of additional paid-in capital. In addition, a cumulative translation adjustment of

£36.1 million was recognized in relation to prior periods due to the decrease in the foreign

denominated debt balance subject to translation during 2008.

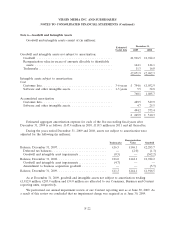

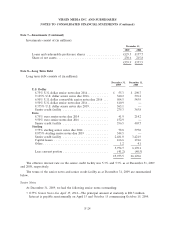

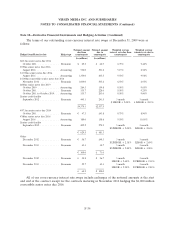

As of December 31, 2009 and 2008, the equity component of the convertible senior notes was

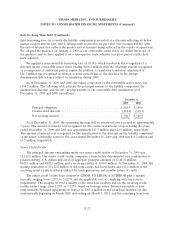

£108.2 million. The following table presents the principal amount of the liability component, the

unamortized discount, and the net carrying amount of our convertible debt instruments as of

December 31, 2009 and 2008 (in millions):

December 31,

2009 2008

Principal obligation .................................. £618.5 £ 684.0

Unamortized discount ................................ (114.0) (138.1)

Net carrying amount ................................. £504.5 £ 545.9

As of December 31, 2009, the remaining discount will be amortized over a period of approximately

7 years. The amount of interest cost recognized for the contractual interest coupon during the years

ended December 31, 2009 and 2008 was approximately £41.5 million and £24.9 million, respectively.

The amount of interest cost recognized for the amortization of the discount on the liability component

of the senior convertible notes for the years ended December 31, 2009 and 2008 was £11.2 million and

£6.2 million, respectively.

Senior Credit Facility

The principal amount outstanding under our senior credit facility at December 31, 2009 was

£3,112.8 million. Our senior credit facility comprises a term facility denominated in a combination of

pounds sterling, U.S. dollars and euros in aggregate principal amounts of £2,481.0 million,

$445.1 million and A402.1 million, and a revolving facility of £100.0 million. At December 31, 2009, the

sterling equivalent of £3,112.8 million of the term facility had been drawn and £11.6 million of the

revolving credit facility had been utilized for bank guarantees and standby letters of credit.

The senior credit facility bears interest at LIBOR, US LIBOR or EURIBOR plus a margin

currently ranging from 1.25% to 3.625% and the applicable cost of complying with any reserve

requirement. The margins on £963.4 million of the term loan facilities and on the revolving credit

facility ratchet range from 1.25% to 3.125% based on leverage ratios. Interest is payable at least

semi-annually. Principal repayments in respect of £963.4 million of the term loan facilities are due

semi-annually beginning in March 2010 and ending on March 3, 2011, and the remaining term loan

F-27