Virgin Media 2009 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2009 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tranche A term loan facilities, through the transfer of those lenders’ participations to new term loan

facilities which mature in June 2012 and have no amortization payments prior to final maturity; (ii) the

extension of the maturity of the existing revolving facility in respect of consenting lenders from March

2011 to June 2012, through the transfer of those lenders’ participations to a new revolving facility, and

(iii) the reset of certain financial covenant ratios. Lenders who did not individually consent to transfer

their participations to the new A tranches and revolving facility remained in the existing A tranches

and revolving facility.

On October 30, 2009, we further amended our senior credit facility to, among other things, permit

the issuance of an unlimited amount of senior secured notes, provided that 100% of the net proceeds

of any issuance of senior secured notes are applied to repay debt under the senior credit facility. Any

senior secured notes rank pari passu with the debt outstanding under the senior credit facility and the

borrowers and guarantors under the senior credit facility are permitted to grant guarantees and security

in respect of any senior secured notes. A covenant was also added to the senior credit facility that

requires us to maintain outstandings and commitments under the senior credit facility in an aggregate

principal amount of not less than £1.0 billion. Certain additional potential amendments were outlined

in the senior credit facility, and those amendments became effective on January 19, 2010.

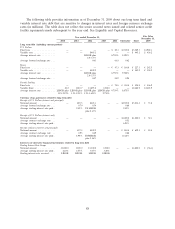

Principal Amortization

The amortization schedule under our senior credit facility as of December 31, 2009 was

(in millions):

Date Amount

September 30, 2010 ............................................ £ 0.2

March 3, 2011 ................................................ 285.7

June 3, 2012 ................................................. 677.4

September 3, 2012 ............................................ 1,849.5

March 3, 2013 ................................................ 300.0

Total ...................................................... £3,112.8

Following the repayment of obligations under our senior credit facility from the proceeds of the

senior secured note issuance in January 2010, the remaining principal payments on our senior credit

facility were scheduled as follows: September 2012—£1,327.3 million (Tranches B7, B8, B9, B10, B11

and B12) and March 2013—£300.0 million (Tranche C).

Mandatory Prepayments

Our senior credit facility must be prepaid in certain circumstances by certain amounts, including:

• 50% of excess cash flow in each financial year in excess of £25 million, which percentage may be

reduced to 25% or 0% if certain leverage ratios are met;

• 50% of the net cash proceeds of any issuance of certain debt greater than £10 million subject to

specified exceptions, including indebtedness raised under this offering of notes, 100% of the net

cash proceeds of which must be used in prepayment of loans under our senior credit facility;

• 50% of the net cash proceeds of any issuance of equity greater than £10 million subject to

customary exceptions, which percentage may be reduced to 25% or 0% if certain leverage ratios

are met;

• from the net proceeds of insurance claims subject to minimum thresholds and customary

exceptions;

78