Virgin Media 2009 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2009 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

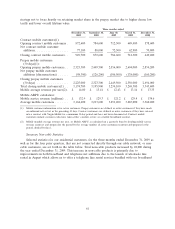

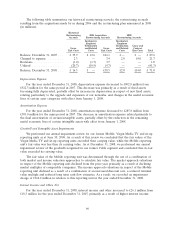

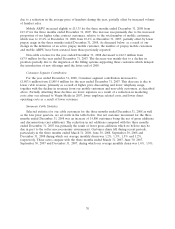

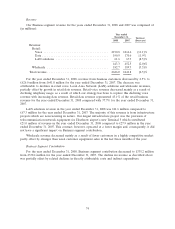

The following table summarizes our historical restructuring accruals, the restructuring accruals

resulting from the acquisitions made by us during 2006 and the restructuring plan announced in 2008

(in millions):

Historical

Restructuring 2006 Acquisition 2008

Accruals Restructuring Accruals Restructuring Accruals

Involuntary Involuntary

Employee Employee

Termination Termination Lease and

Lease and Related Lease and Related Contract

Exit Costs Costs Exit Costs Costs Exit Costs Total

Balance, December 31, 2007 . . . £ 35.9 £ 12.6 £41.1 £ — £ — £ 89.6

Charged to expense ......... 2.3 — 3.4 2.0 14.0 21.7

Revisions ................. (1.0) (1.7) 3.7 — — 1.0

Utilized .................. (20.7) (10.9) (9.7) — — (41.3)

Balance, December 31, 2008 . . . £ 16.5 £ — £38.5 £2.0 £14.0 £ 71.0

Depreciation Expense

For the year ended December 31, 2008, depreciation expense decreased to £902.8 million from

£922.3 million for the same period in 2007. This decrease was primarily as a result of fixed assets

becoming fully depreciated, partially offset by increases in depreciation in respect of new fixed assets,

relating particularly to the upgrade and expansion of our networks, and changes in the useful economic

lives of certain asset categories with effect from January 1, 2008.

Amortization Expense

For the year ended December 31, 2008, amortization expense decreased to £285.8 million from

£301.0 million for the same period in 2007. The decrease in amortization expense related primarily to

the final amortization of certain intangible assets, partially offset by the reduction in the remaining

useful economic lives of certain intangible assets with effect from January 1, 2008.

Goodwill and Intangible Asset Impairments

We performed our annual impairment review for our former Mobile, Virgin Media TV and sit-up

reporting units as at June 30, 2008. As a result of this review we concluded that the fair values of the

Virgin Media TV and sit-up reporting units exceeded their carrying value, while the Mobile reporting

unit’s fair value was less than its carrying value. As at December 31, 2008, we performed our annual

impairment review of the goodwill recognized in our former Cable segment and concluded that its fair

value exceeded its carrying value.

The fair value of the Mobile reporting unit was determined through the use of a combination of

both market and income valuation approaches to calculate fair value. The market approach valuations

in respect of the Mobile reporting unit declined from the prior year primarily as a result of declining

market multiples of comparable companies. The income approach valuations in respect of the Mobile

reporting unit declined as a result of a combination of an increased discount rate, a reduced terminal

value multiple and reduced long term cash flow estimates. As a result, we recorded an impairment

charge of £362.2 million in relation to this reporting unit in the year ended December 31, 2008.

Interest Income and Other, Net

For the year ended December 31, 2008, interest income and other increased to £26.1 million from

£18.3 million for the year ended December 31, 2007, primarily as a result of higher interest income

66