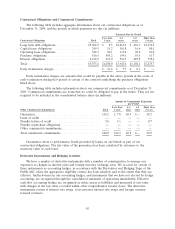

Virgin Media 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Consolidated Statement of Cash Flows

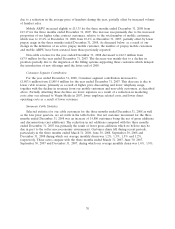

Years Ended December 31, 2009 and 2008

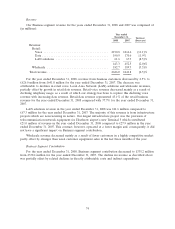

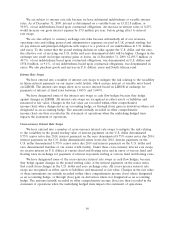

For the year ended December 31, 2009, cash provided by operating activities increased to

£900.6 million from £758.7 million for the year ended December 31, 2008. This increase was

attributable to the improvements in operating results and lower cash interest payments. For the year

ended December 31, 2009, cash paid for interest, exclusive of amounts capitalized, decreased to

£404.2 million from £515.8 million during the same period in 2008. This decrease resulted from lower

interest rates, lower debt levels due to repayments in 2008 and differences in the timing of interest

payments under our senior credit facility.

For the year ended December 31, 2009, cash used in investing activities increased to £572.3 million

from £468.7 million for the year ended December 31, 2008. The cash used in investing activities in the

years ended December 31, 2009 and 2008 mainly represented purchases of fixed assets. Purchases of

fixed and intangible assets increased to £569.0 million for the year ended December 31, 2009 from

£477.9 million for the same period in 2008, primarily due to lower use of finance leases for the

acquisition of capital equipment together with increased scaleable infrastructure costs relating to

broadband speed upgrades.

Cash used in financing activities for the year ended December 31, 2009 was £69.7 million

compared with cash used in financing activities of £427.3 million for the year ended December 31,

2008. For the year ended December 31, 2009, the principal uses of cash were the partial repayments

under our senior credit facility and our senior notes due 2014, and capital lease payments, totaling

£1,737.4 million, and the principal components of cash provided by financing activities were new

borrowings from the issuance of our senior notes due 2016 and our senior notes due 2019, net of

financing fees, of £1,610.2 million. For the year ended December 31, 2008, the principal uses of cash

were the partial repayments under our senior credit facility and capital lease payments, totaling

£846.3 million, and the principal components of cash provided by financing activities were new

borrowings from the issuance of our convertible senior notes, net of financing fees, of £447.7 million.

See further discussion under Liquidity and Capital Resources—Senior Credit Facility.

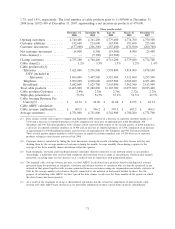

Years Ended December 31, 2008 and 2007

For the year ended December 31, 2008, cash provided by operating activities increased to

£758.7 million from £710.8 million for the year ended December 31, 2007. This increase was primarily

attributable to an improvement in working capital, partially offset by an increase in cash paid for

interest. For the year ended December 31, 2008, cash paid for interest, exclusive of amounts

capitalized, increased to £515.8 million from £486.9 million during the same period in 2007. This

increase resulted from changes in the timing of interest payments under our senior credit facility.

For the year ended December 31, 2008, cash used in investing activities was £468.7 million

compared with cash used in investing activities of £507.3 million for the year ended December 31, 2007.

The cash used in investing activities in the years ended December 31, 2008 and 2007 mainly

represented purchases of fixed assets. Purchases of fixed and intangible assets decreased to

£477.9 million for the year ended December 31, 2008 from £533.7 million for the same period in 2007,

reflecting a higher utilization of finance leases.

Cash used in financing activities for the year ended December 31, 2008 was £427.3 million

compared with cash used in financing activities of £302.5 million for the year ended December 31,

2007. For the year ended December 31, 2008, the principal uses of cash were the partial repayments

under our senior credit facility and capital lease payments, totaling £846.3 million, and the principal

components of cash provided by financing activities were new borrowings from the issuance of our

convertible senior notes, net of financing fees, of £447.7 million. For the year ended December 31,

76