Virgin Media 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2007, the principal uses of cash were the partial repayments of our senior credit facility and capital

lease payments, totaling £1,170.8 million, and the principal components of cash provided by financing

activities were new borrowings under our senior credit facility, net of financing fees, of £874.5 million.

See further discussion under Liquidity and Capital Resources—Senior Credit Facility.

Liquidity and Capital Resources

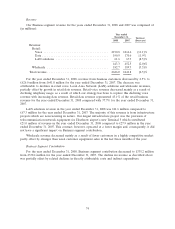

As of December 31, 2009, we had £5,974.7 million of debt outstanding, compared to

£5,972.0 million as of September 30, 2009 and £6,170.1 million as of December 31, 2008, and

£430.5 million of cash and cash equivalents, compared to £351.6 million as of September 30, 2009 and

£181.6 million as of December 31, 2008. The decrease in debt from December 31, 2008 is primarily due

to movements in exchange rates.

Our business is capital intensive and we are highly leveraged. We have significant cash

requirements for operating costs, capital expenditures and interest expense. The level of our capital

expenditures and operating expenditures are affected by the significant amounts of capital required to

connect customers to our network, expand and upgrade our network and offer new services. We expect

that our cash on hand, together with cash from operations and amounts undrawn on our revolving

credit facility, will be sufficient for our cash requirements through December 31, 2010. However, our

cash requirements after December 31, 2010 may exceed these sources of cash. We have significant

principal payments due in 2012 under our senior credit facility that could require a partial or

comprehensive refinancing of our remaining senior credit facility, and the possible use of other debt

instruments. Our ability to implement such a refinancing successfully would be significantly dependent

on stable debt capital markets.

On January 19, 2010, we issued approximately £1.5 billion equivalent aggregate principal amount

of senior secured notes in a private placement to qualified institutional buyers pursuant to Rule 144A

under the Securities Act, and outside the United States to certain non-U.S. persons pursuant to

Regulation S under the Securities Act. The notes were issued by our wholly owned subsidiary Virgin

Media Secured Finance PLC in two tranches: $1.0 billion of 6.50% senior secured notes due 2018 and

£875 million of 7.00% senior secured notes due 2018, collectively referred to as the senior secured

notes. For more information see ‘‘—Senior Secured Notes’’ below. The net proceeds from the issuance

of the senior secured notes were used to repay £1,453.0 million of our obligations under our senior

credit facility.

Our long term debt was issued by Virgin Media Inc. and certain of its subsidiaries that have no

independent operations or significant assets other than investments in their respective subsidiaries. As a

result, they will depend upon the receipt of sufficient funds from their respective subsidiaries to meet

their obligations. In addition, the terms of our existing and future indebtedness and the laws of the

jurisdictions under which our subsidiaries are organized limit the payment of dividends, loan

repayments and other distributions from them under many circumstances.

Our debt agreements contain restrictions on our ability to transfer cash between groups of our

subsidiaries. As a result of these restrictions, although our overall liquidity may be sufficient to satisfy

our obligations, we may be limited by covenants in some of our debt agreements from transferring cash

to other subsidiaries that might require funds. In addition, cross default provisions in our other

indebtedness may be triggered if we default on any of these debt agreements.

Senior Credit Facility

Our senior credit facility, which matures in March 2013, is comprised of amortizing Tranche A

term loan facilities, bullet repayment Tranche B and Tranche C term loan facilities and multi-currency

revolving loan facilities. In June 2009, certain amendments to our senior credit facility became effective,

including (i) the deferral of the remaining principal payments due to consenting lenders under existing

77