Virgin Media 2009 Annual Report Download - page 214

Download and view the complete annual report

Please find page 214 of the 2009 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

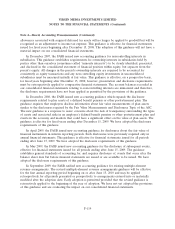

VIRGIN MEDIA INVESTMENTS LIMITED

NOTES TO THE FINANCIAL STATEMENTS (Continued)

Note 3—Subsequent Events (Continued)

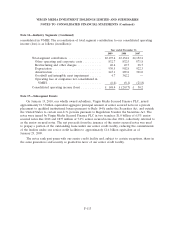

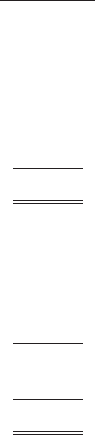

The following table presents the pro forma condensed consolidated balance sheet as if the group

reorganization had occurred on December 31, 2009.

December 31,

2009

(in millions)

Assets

Current assets ...................................................... £ 722.1

Fixed assets, net .................................................... 4,925.3

Goodwill and other indefinite-lived assets .................................. 2,081.0

Other assets, net .................................................... 1,013.5

Due from group companies ............................................ 1,080.7

Total assets ........................................................ £9,822.6

Liabilities and shareholders’ equity

Current liabilities .................................................... £1,443.4

Long term debt, net of current portion .................................... 1,440.5

Long term debt due to group companies ................................... 5,120.0

Other liabilities ..................................................... 370.5

Total liabilities ...................................................... 8,374.4

Shareholders’ equity ................................................. 1,448.2

Total liabilities and shareholders’ equity ................................... £9,822.6

Note 4—Recent Accounting Pronouncements

Subsequent to the reorganization discussed in note 3, our consolidated financial results are

impacted by recent accounting guidance issued by the Financial Accounting Standards Board, or FASB,

as discussed in the following paragraphs.

In June 2009, the FASB issued guidance relating to the FASB Accounting Standards Codification,

or ASC. Effective for interim or annual financial periods ending after September 15, 2009, the ASC

became the single official source of authoritative U.S. GAAP (other than guidance issued by the SEC),

superseding existing FASB, American Institute of Certified Public Accountants, Emerging Issues Task

Force (EITF), and related literature. After September 15, 2009, only one level of authoritative

U.S. GAAP exists. All other literature is considered non-authoritative. The ASC does not change

U.S. GAAP; instead, it introduces a new structure that is organized in an easily accessible, user-friendly

online research system. We have adopted the disclosure requirements of this guidance.

In December 2007, the FASB issued new accounting guidance for business combinations. This

guidance requires the acquiring entity in a business combination to prospectively recognize the full fair

value of assets acquired and liabilities assumed in the transaction (whether a full or partial acquisition);

establishes the acquisition-date fair value as the measurement objective for all assets acquired and

liabilities assumed; requires expensing of most transaction and restructuring costs; and requires the

acquirer to disclose to investors and other users all of the information needed to evaluate and

understand the nature and financial effect of the business combination. Further, regardless of the

business combination date, any subsequent changes to acquired uncertain tax positions and valuation

F-118