Virgin Media 2009 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2009 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Note 14—Income Taxes (Continued)

operating loss carryforwards relates to dual resident companies, of which the U.S. net operating loss

carryforward amount is £1.5 billion that expires between 2010 and 2029. Section 382 may severely limit

our ability to utilize these losses for U.S. purposes. We also have U.K. capital loss carryforwards of

£12.3 billion that have no expiration date. However, we do not expect to realize any significant benefit

from these capital losses, which can only be used to the extent we generate U.K. taxable capital gain

income in the future from assets held by subsidiaries owned by the group prior to the merger with

Telewest.

At December 31, 2009, we had fixed assets on which future U.K. tax deductions can be claimed of

£12.6 billion. The maximum amount that can be claimed in any one year is 20% of the remaining

balance, after additions, disposals and prior claims.

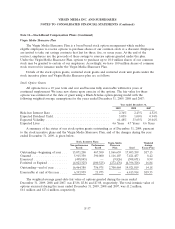

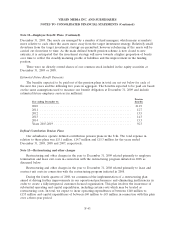

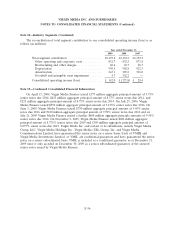

The reconciliation of income taxes computed at U.S. federal statutory rates to income tax benefit

(expense) is as follows (in millions):

Year ended December 31,

2009 2008 2007

Benefit at federal statutory rate (35%) ............. £118.1 £ 301.1 £ 157.6

Add:

Permanent book-tax differences .................. (24.6) (139.0) (19.7)

Foreign losses with no benefit .................... (72.7) (103.4) (119.5)

U.S. losses with no benefit ...................... 2.0 — —

Difference between U.S. and foreign tax rates ........ (22.1) (55.2) (21.4)

State and local income tax ...................... (0.1) — 0.6

Foreign tax benefit offsetting OCI tax expense ........ — 3.4 —

Other ..................................... 1.9 (0.1) (0.1)

Benefit (provision) for income taxes ............... £ 2.5 £ 6.8 £ (2.5)

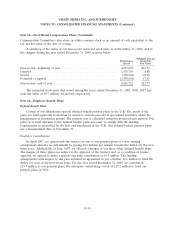

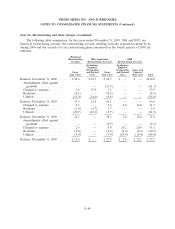

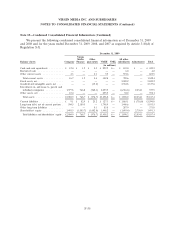

A reconciliation of the beginning and ending amounts of unrecognized tax benefits is as follows

(in millions):

2009 2008

Balance at January 1, ................................... £20.4 £15.0

Additions based on tax positions related to the current year ..... — —

Additions for tax provisions of prior years .................. 1.6 5.4

Reductions for tax provisions of prior years ................. (0.8) —

Reductions for lapse of applicable statute of limitation ......... (11.2) —

Settlements .......................................... — —

Balance at December 31, ................................ £10.0 £20.4

The total amount of unrecognized tax benefits as of December 31, 2009 and 2008 was

£10.0 million and £20.4 million, respectively. Included in the balance of unrecognized tax benefits as of

December 31, 2009 and 2008 were £0.5 million and £1.0 million, respectively, that, if recognized, would

impact the effective tax rate.

We recognize interest and penalties related to unrecognized tax benefits in income tax expense. We

have accrued interest in respect of unrecognized tax benefits of £0.2 million and £0.5 million at

F-47