Virgin Media 2009 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2009 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Note 11—Stock-Based Compensation Plans (Continued)

For performance based option grants the performance objectives are set by the Compensation

Committee of the Board of Directors based upon quantitative and qualitative objectives, including

earnings and stock price performance, amongst others. These objectives may be absolute or relative to

prior performance or to the performance of other entities, indices or benchmarks and may be

expressed in terms of progression within a specific range.

The aggregate intrinsic value of options outstanding as at December 31, 2009 was £60.3 million

with a weighted average remaining contractual term of 7.4 years. The aggregate intrinsic value of

options exercisable as at December 31, 2009 was £10.2 million with a weighted average remaining

contractual term of 6.3 years.

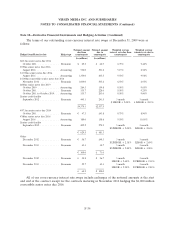

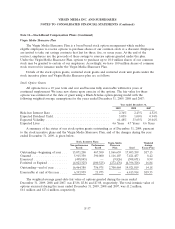

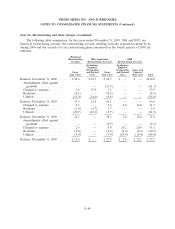

Restricted Stock Grants

A summary of the status of our non-vested shares of restricted stock as of December 31, 2009, and

of changes during the year ended December 31, 2009, is given below.

Weighted Average

Non-performance Performance Grant-date

Based Based Total Fair value

Non-vested—beginning of year . . . 64,167 791,667 855,834 $23.46

Granted .................... 230,000 1,150,000 1,380,000 10.37

Earned at end 2008, distributed in

2009 ..................... — (547,642) (547,642) 25.32

Vested ..................... (64,167) — (64,167) 25.32

Forfeited or Expired ........... — (244,025) (244,025) 18.78

Non-vested—end of year ....... 230,000 1,150,000 1,380,000 $10.37

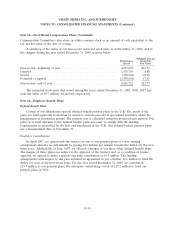

As of December 31, 2009, there was £6.9 million of total unrecognized compensation cost related

to non-vested shares of restricted stock granted for which a measurement date has been established.

That cost is expected to be recognized over a weighted-average period of 1.5 years. In addition, the

non-vested shares of restricted stock in the table above include 125,000 shares for which the

measurement date criteria under the Compensation—Stock Compensation Topic of the FASB ASC 718

have not yet been established and consequently no compensation cost has been determined.

For performance based restricted stock grants, the performance objectives are set by the

Compensation Committee of the Board of Directors based upon quantitative and qualitative objectives,

including earnings, operational performance and achievement of strategic goals, amongst others. These

objectives may be absolute or relative to prior performance or to the performance of other entities,

indices or benchmarks and may be expressed in terms of progression within a specific range.

The total fair value of shares of restricted stock vested during the years ended December 31, 2009,

2008 and 2007, was £0.4 million, £2.9 million and £7.9 million, respectively.

Restricted Stock Unit Grants

Participants in the our long term incentive plans are awarded restricted stock units which vest after

a three year period dependent on the achievement of certain long term performance targets and

continued employment. The final number of restricted stock units vesting will be settled, at the

F-38