Virgin Media 2009 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2009 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• facility-related costs, such as rent, utilities and rates;

• costs associated with providing customer services; and

• allowances for doubtful accounts.

Disposal of Business Units

Disposal of sit-up

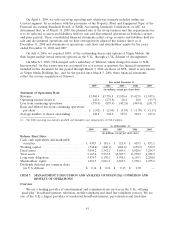

On April 1, 2009, we sold our sit-up reporting unit, which was formerly included within our

Content segment. sit-up provided a variety of retail consumer products through three interactive

auction-based television channels: price-drop tv, bid tv and speed auction tv.

In accordance with the provisions of the Property, Plant and Equipment Topic of the ASC, we

determined that, as of March 31, 2009, the planned sale of the sit-up business met the requirements for

it to be reflected as assets and liabilities held for sale and discontinued operations in both the current

and prior periods as of March 31, 2009. These consolidated financial statements reflect sit-up as assets

and liabilities held for sale and discontinued operations and we have retrospectively adjusted the

balance sheet as of December 31, 2008 and statements of operations, cash flows and shareholders’

equity for the years ended December 31, 2008 and 2007.

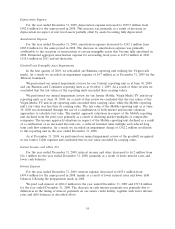

Revenue of the sit-up business, reported in discontinued operations, for the years ended

December 31, 2009, 2008 and 2007 was £38.9 million, £241.8 million and £238.6 million, respectively.

sit-up’s pre-tax loss, reported within discontinued operations, for the years ended December 31, 2009,

2008 and 2007 was £22.8 million, £66.6 million and £10.7 million, respectively. Revenue related to the

carriage of the sit-up channels recognized in our Consumer segment that had previously been

eliminated for consolidation purposes was £0.6 million, £2.7 million and £3.5 million for the years

ended December 31, 2009, 2008 and 2007, respectively.

Factors Affecting Our Business

A number of factors affect the performance of our business, at both a general and segment level.

General

Factors that affect all of the segments in which we operate are as follows:

General Macroeconomic Factors. General macroeconomic factors in the U.K. have an impact on

our business. For example, during an economic slowdown, potential and existing customers may be less

willing, or able to purchase our products or upgrade their services. We may also experience increased

churn and higher bad debt expense. In addition, expenditures by advertisers are sensitive to economic

conditions and tend to decline in recessionary periods and other periods of uncertainty. We have

experienced a decrease in advertising revenues generated through our television programming and

broadband internet platforms, except to the extent offset by an increase in our share of the advertising

market.

Currency Movements. We encounter currency exchange rate risks because substantially all of our

revenue and operating costs are earned and paid primarily in U.K. pounds sterling, but we pay interest

and principal obligations with respect to a portion of our existing indebtedness in U.S. dollars and

euros. We have in place hedging programs that seek to mitigate the risk from these exposures. While

the objective of these programs is to reduce the volatility of our cash flows and earnings caused by

changes in underlying currency exchange rates, not all of our exposures are hedged, and not all of our

hedges are designated as such for accounting purposes. Additionally, we do not hedge the principal

portion of our convertible senior notes. We also purchase goods and services in U.S. dollars, euros and

44