Virgin Media 2009 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2009 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232

|

|

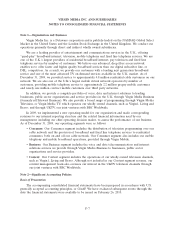

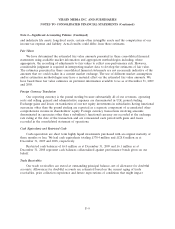

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Note 2—Significant Accounting Policies (Continued)

and indefinite life assets, long-lived assets, certain other intangible assets and the computation of our

income tax expense and liability. Actual results could differ from those estimates.

Fair Values

We have determined the estimated fair value amounts presented in these consolidated financial

statements using available market information and appropriate methodologies including, where

appropriate, the recording of adjustments to fair values to reflect non-performance risk. However,

considerable judgment is required in interpreting market data to develop the estimates of fair value.

The estimates presented in these consolidated financial statements are not necessarily indicative of the

amounts that we could realize in a current market exchange. The use of different market assumptions

and/or estimation methodologies may have a material effect on the estimated fair value amounts. We

have based these fair value estimates on pertinent information available to us as of December 31, 2009

and 2008.

Foreign Currency Translation

Our reporting currency is the pound sterling because substantially all of our revenues, operating

costs and selling, general and administrative expenses are denominated in U.K. pound sterling.

Exchange gains and losses on translation of our net equity investments in subsidiaries having functional

currencies other than the pound sterling are reported as a separate component of accumulated other

comprehensive income in shareholders’ equity. Foreign currency transactions involving amounts

denominated in currencies other than a subsidiary’s functional currency are recorded at the exchange

rate ruling at the date of the transaction and are remeasured each period with gains and losses

recorded in the consolidated statement of operations.

Cash Equivalents and Restricted Cash

Cash equivalents are short term highly liquid investments purchased with an original maturity of

three months or less. We had cash equivalents totaling £370.4 million and £128.8 million as at

December 31, 2009 and 2008, respectively.

Restricted cash balances of £6.0 million as at December 31, 2009 and £6.1 million as at

December 31, 2008 represent cash balances collateralized against performance bonds given on our

behalf.

Trade Receivables

Our trade receivables are stated at outstanding principal balance, net of allowance for doubtful

accounts. Allowances for doubtful accounts are estimated based on the current aging of trade

receivables, prior collection experience and future expectations of conditions that might impact

F-9