Virgin Media 2009 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2009 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

information attained regarding comparable companies and transactions. Discounting the terminal

value back to the present and adding the present values of the future cash flows yields

indications of the reporting unit’s fair value.

The discount rate employed was determined using market assumptions (including U.K. Gilt yields,

equity risk premiums and comparable company betas) as well as Ibbotson’s research (including size

decile betas and size risk premiums). The determination of the discount rate also utilized information

regarding the cost of debt and capital structures of comparable companies along with other general

market reference materials from companies such as Bloomberg, Standard & Poors and Morningstar.

All of these techniques are reliant on our long range cash flow forecasts. In estimating cash flows,

we use financial assumptions in our internal forecasting model such as projected customer numbers,

projected product sales mix and price changes, projected changes in prices we pay for purchases of

fixed assets and services as well as projected labor costs. Considerable management judgment is

necessary to estimate discounted future cash flows and those estimates include inherent uncertainties,

including those relating to the timing and amount of future cash flows and the discount rate used in

the calculation. Assumptions used in these cash flow projections are consistent with our internal

forecasts. If actual results differ from the assumptions used in the impairment review, we may incur

additional impairment charges in the future. Assumptions made about levels of competition and rates

of growth (or decline) in the economy on a longer term basis could impact the valuation to be used in

future annual impairment testing.

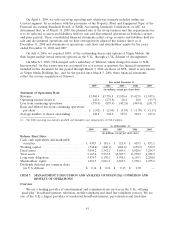

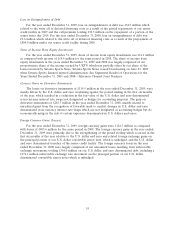

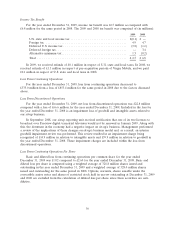

The table below presents the goodwill and indefinite-lived intangible assets allocated to our

Consumer and Business reporting units, and the significant inputs utilized in developing our estimate of

fair value for the annual impairment tests performed in 2009 for each of these reporting units.

Consumer Business

Goodwill and indefinite-lived intangibles as at December 31,

2009 ....................................... £1,812.0 million £205.9 million

Market multiples inputs:

Number of comparable companies .................. Nine Six

EBITDA multiples of comparable companies .......... 4.2 to 8.4 times 2.7 to 5.6 times

Revenue multiples of comparable companies .......... 1.15 to 4.10 times 0.55 to 1.72 times

Comparable transactions inputs:

Number of transactions .......................... Twenty Ten

EBITDA multiples of comparable transactions ......... 3.5 to 16.0 times 4.7 to 16.8 times

Revenue multiples of comparable transactions ......... 0.39 to 4.31 times 0.63 to 4.65 times

Discounted cash flow approach:

Discount rate applied ........................... 9% 11%

For our Content reporting unit, goodwill and indefinite-lived intangible assets totaling £54.0 million

were tested for impairment utilizing a discounted cash flow approach with a discount rate of 10.5% in

2009.

Fixed Assets

Labor and overhead costs directly related to the construction and installation of fixed assets,

including payroll and related costs of some employees and related rent and other occupancy costs, are

capitalized. The payroll and related costs of some employees that are directly related to construction

and installation activities are capitalized based on specific time devoted to these activities where

identifiable. In cases where the time devoted to these activities is not specifically identifiable, we

capitalize costs based upon estimated allocations. Costs associated with initial customer installations are

49