Virgin Media 2009 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2009 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232

|

|

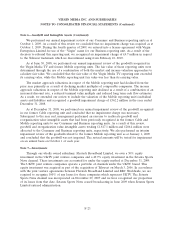

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

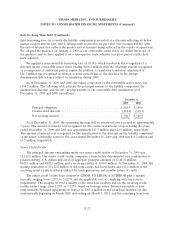

Note 4—Disposals (Continued)

In accordance with the sale agreement, part of the consideration included a loan note from the

purchasers. On April 1, 2009, we entered into a five-year carriage agreement with sit-up for continued

distribution of the three sit-up channels on our television platform. In general, the agreements

governing the loan note and exchange of services between us and sit-up are for specified periods at

commercial rates. Following the sale, our continuing involvement with sit-up is limited to the loan note

and carriage agreement and is therefore not considered significant. The loan note was repaid during

the year ended December 31, 2009.

As at December 31, 2008, we performed an interim goodwill impairment review of our sit-up

reporting unit. In September 2008, we received notification that one of our two licenses to broadcast

over Freeview digital terrestrial television would not be renewed. Along with this, the downturn in the

economy had reduced the level of retail sales. As a result, management concluded that indicators

existed that suggested it was more likely than not that the fair value of this reporting unit was less than

its carrying value.

The fair value of the sit-up reporting unit, which was determined through the use of a combination

of both the market and income approaches to calculate fair value, was found to be less than the

carrying value. The market and income approaches declined from the goodwill impairment test we

performed as at June 30, 2008 as a result of reduced long term cash flow estimates. As a result, we

extended our review to include the valuation of the reporting unit’s individual assets and liabilities and

recognized a goodwill impairment charge of £39.9 million. During the year ended December 31, 2008,

we impaired intangible assets relating to our sit-up reporting unit totaling £14.9 million. Subsequent to

the year end, in accordance with the provisions of the Property, Plant, and Equipment Topic of the

FASB ASC, we wrote down the assets held for sale to fair value based upon the agreed purchase

consideration. This resulted in a £19.0 million impairment charge, which was recognized in the loss

from discontinued operations for the year ended December 31, 2009.

F-19