Virgin Media 2009 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2009 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232

|

|

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

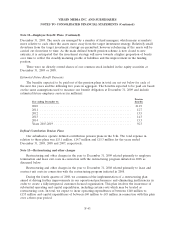

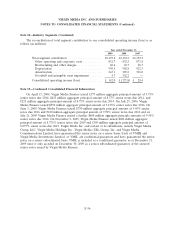

Note 14—Income Taxes (Continued)

Deferred income taxes reflect the net tax effects of temporary differences between the carrying

amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax

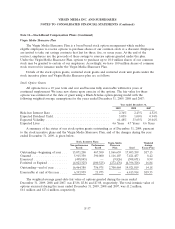

purposes. Significant components of deferred tax liabilities and assets are as follows (in millions):

December 31,

2009 2008

Deferred tax liabilities:

Intangibles .................................... £ 74.0 £ 142.5

Equity investments .............................. 83.0 79.2

Convertible senior notes .......................... 39.9 48.3

Derivative instruments ........................... — 15.7

Unrealized foreign exchange differences ............... 1.1 0.6

Total deferred tax liabilities .......................... 198.0 286.3

Deferred tax assets:

Net operating losses ............................. 1,030.6 1,108.7

Capital losses .................................. 3,442.1 3,390.0

Depreciation and amortization ...................... 2,218.3 2,097.2

Accrued expenses ............................... 83.5 91.7

Derivative instruments ........................... 11.0 —

Capital costs and other ........................... 105.2 112.4

Total deferred tax assets ............................ 6,890.7 6,800.0

Valuation allowance for deferred tax assets .............. (6,775.7) (6,592.9)

Net deferred tax assets ............................. 115.0 207.1

Net deferred tax liabilities .......................... £ 83.0 £ 79.2

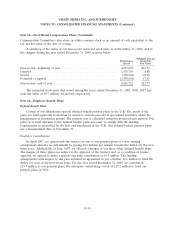

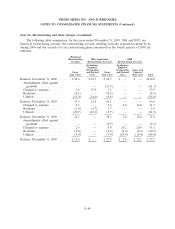

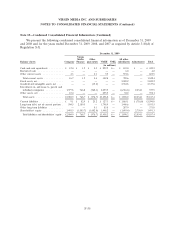

The following table summarizes the movements in our deferred tax valuation allowance during the

years ended December 31, 2009, 2008 and 2007 (in millions):

Year ended December 31,

2009 2008 2007

Balance, January 1 ......................... £6,592.9 £6,554.1 £6,705.2

Effect of changes in tax rates ................ — — (444.9)

Increase in UK and US deferred tax attributes,

inclusive of foreign exchange movements ...... 182.8 38.8 293.8

Balance, December 31 ....................... £6,775.7 £6,592.9 £6,554.1

A valuation allowance is recorded to reduce the deferred tax asset to an amount that is more

likely than not to be realized. To the extent that the portion of the valuation allowance is reduced, the

benefit will be recognized as a reduction of income tax expense.

At December 31, 2009, we had net operating loss carryforwards for U.S. federal income tax

purposes of £304 million that expire between 2018 and 2027. We have U.K. net operating loss

carryforwards of £3.3 billion that have no expiration date. Pursuant to U.K. law, these losses are only

available to offset income of the separate entity that generated the loss. A portion of the U.K. net

F-46