Virgin Media 2009 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2009 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232

|

|

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

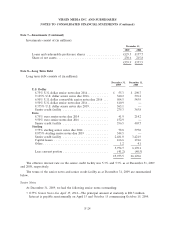

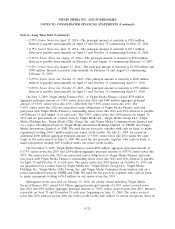

Note 8—Long Term Debt (Continued)

facilities are repayable in full on their maturity dates, which are September 3, 2012 and March 3, 2013.

We are also required to make principal repayments out of excess cash flows if certain criteria are met.

On November 10, 2008, we amended our senior credit facility. Among other things, this

amendment allowed us to defer over 70.3% of the remaining principal payments due in 2010 and 2011

to June 2012, extend the maturity of over 72.3% of the existing revolving facility from March 2011 to

June 2012 and reset certain financial covenant ratios. These changes became effective in June 2009

following our satisfaction of the repayment condition under the senior credit facility. Upon satisfaction

of the repayment condition, the applicable interest margin in respect of the principal amounts that

were deferred and the extended revolving facility also increased by 1.375%, and we were required to

pay £11.5 million in fees.

The facility is secured through a guarantee from Virgin Media Finance. In addition, the bulk of

the facility is secured through guarantees and first priority pledges of the shares and assets of

substantially all of the operating subsidiaries of VMIH, and of receivables arising under any

intercompany loans to those subsidiaries. We are subject to financial maintenance tests under the

facility, including a test of liquidity, coverage and leverage ratios applied to us and certain of our

subsidiaries. As of December 31, 2009, we were in compliance with these covenants.

The agreements governing the senior notes and the senior credit facility significantly restrict the

ability of our subsidiaries to transfer funds to us in the form of cash dividends, loans or advances. In

addition, the agreements significantly, and, in some cases, absolutely restrict our ability and the ability

of most of our subsidiaries to:

• incur or guarantee additional indebtedness;

• pay dividends or make other distributions, or redeem or repurchase equity interests or

subordinated obligations;

• make investments;

• sell assets, including the capital stock of subsidiaries;

• enter into sale and leaseback transactions or certain vendor financing arrangements;

• create liens;

• enter into agreements that restrict the restricted subsidiaries’ ability to pay dividends, transfer

assets or make intercompany loans;

• merge or consolidate or transfer all or substantially all of our assets; and

• enter into transactions with affiliates.

F-28