Virgin Media 2009 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2009 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

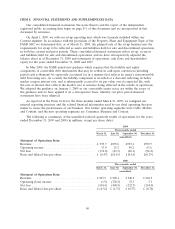

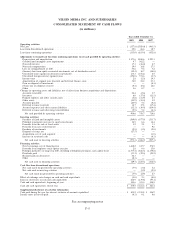

VIRGIN MEDIA INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CASH FLOWS

(in millions)

Year ended December 31,

2009 2008 2007

Operating activities:

Net Loss ............................................................. £ (357.8) £(920.0) £ (463.5)

Loss from discontinued operations ............................................. 22.8 66.6 10.7

Loss from continuing operations .............................................. (335.0) (853.4) (452.8)

Adjustments to reconcile net loss from continuing operations to net cash provided by operating activities:

Depreciation and amortization .............................................. 1,173.6 1,188.6 1,223.3

Goodwill and intangible asset impairments ....................................... 4.7 362.2 —

Non-cash interest ...................................................... 17.3 (46.4) 2.7

Non-cash compensation .................................................. 19.4 16.8 17.5

Loss on extinguishment of debt .............................................. 53.6 9.6 3.2

(Income) loss from equity accounted investments, net of dividends received ................... (12.4) 10.7 (10.8)

Unrealized losses (gains) on derivative instruments .................................. 133.3 (278.1) 2.5

Unrealized foreign currency (gains) losses ....................................... (158.8) 371.6 (2.7)

Income taxes ......................................................... 2.8 (2.3) 14.3

Amortization of original issue discount and deferred finance costs ........................ 34.0 24.4 23.1

Gain on disposal of investments ............................................. — — (8.1)

(Gain) loss on disposal of assets ............................................. (0.4) (0.1) 18.8

Other ............................................................. 1.6 0.7 —

Changes in operating assets and liabilities, net of effect from business acquisitions and dispositions:

Accounts receivable ..................................................... 26.4 (2.6) 4.7

Inventory ........................................................... 6.0 (17.4) (11.5)

Prepaid expenses and other current assets ....................................... (4.8) (11.9) 8.7

Other assets ......................................................... (14.9) (11.0) 4.2

Accounts payable ...................................................... (24.9) 5.2 (0.2)

Deferred revenue (current) ................................................ 16.7 17.8 (17.4)

Accrued expenses and other current liabilities ..................................... (32.1) (30.9) (104.4)

Deferred revenue and other long term liabilities ................................... (5.5) 5.2 (4.3)

Net cash provided by operating activities ...................................... 900.6 758.7 710.8

Investing activities:

Purchase of fixed and intangible assets ......................................... (569.0) (477.9) (533.7)

Principal repayments on loans to equity investments ................................. 12.5 8.6 16.4

Proceeds from the sale of fixed assets .......................................... 4.2 2.1 3.3

Proceeds from sale of investments ............................................ — — 9.8

Purchase of investments .................................................. (2.5) (1.5) (2.0)

Disposal of sit-up, net ................................................... (17.5) — —

Acquisitions, net of cash acquired ............................................ — — (1.0)

Increase in restricted cash ................................................. — — (0.1)

Net cash used in investing activities .......................................... (572.3) (468.7) (507.3)

Financing activities:

New borrowings, net of financing fees .......................................... 1,610.2 447.7 874.5

Proceeds from employee stock option exercises .................................... 2.8 0.6 15.0

Principal payments on long term debt, including redemption premiums, and capital leases .......... (1,737.4) (846.3) (1,170.8)

Dividends paid ........................................................ (33.3) (29.3) (21.2)

Realized gain on derivatives ................................................ 88.3 — —

Other ............................................................. (0.3) — —

Net cash used in financing activities ......................................... (69.7) (427.3) (302.5)

Cash flow from discontinued operations:

Net cash (used in) provided by operating activities .................................. (7.9) (3.0) 5.2

Net cash used in investing activities ........................................... — (1.9) (2.5)

Net cash (used in) provided by operating activities ................................. (7.9) (4.9) 2.7

Effect of exchange rate changes on cash and cash equivalents ............................. (1.8) 2.4 (0.8)

Increase (decrease) in cash and cash equivalents ..................................... 248.9 (139.8) (97.1)

Cash and cash equivalents, beginning of year ....................................... 181.6 321.4 418.5

Cash and cash equivalents, end of year .......................................... £ 430.5 £ 181.6 £ 321.4

Supplemental disclosure of cash flow information

Cash paid during the year for interest exclusive of amounts capitalized ....................... £ 404.2 £ 515.8 £ 486.9

Income taxes (received) paid ................................................. (0.1) 0.1 0.6

See accompanying notes

F-5