Virgin Media 2009 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2009 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

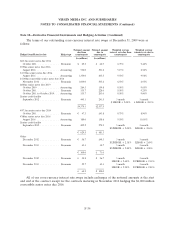

Note 8—Long Term Debt (Continued)

the same guarantees and security which has been granted in favor of our senior credit facility. We used

the net proceeds to make repayments totaling £1,453.0 million under our senior credit facility.

Convertible Senior Notes

On April 16, 2008, Virgin Media Inc. issued U.S. dollar denominated 6.50% convertible senior

notes due 2016 with a principal amount outstanding of $1.0 billion and used the proceeds and cash on

hand to repay £504.0 million of our obligations under our senior credit facility that were originally

scheduled to be paid in 2009, 2010 and 2012. The convertible senior notes are unsecured senior

obligations of Virgin Media Inc. and, consequently, are subordinated to our obligations under the

senior credit facility and rank equally with Virgin Media Inc.’s guarantees of our senior notes. The

convertible senior notes bear interest at an annual rate of 6.50% payable semi-annually on May 15 and

November 15 of each year, beginning November 15, 2008. The convertible senior notes mature on

November 15, 2016 and may not be redeemed by us prior to their maturity date. Upon conversion, we

may elect to settle in cash, shares of common stock or a combination of cash and shares of our

common stock.

Holders of convertible senior notes may tender their notes for conversion at any time on or after

August 15, 2016 through to the second scheduled trading date preceding the maturity date. Prior to

August 15, 2016, holders may convert their notes, at their option, only under the following

circumstances: (i) in any quarter, if the closing sale price of Virgin Media Inc.’s common stock during

at least 20 of the last 30 trading days of the prior quarter was more than 120% of the applicable

conversion price per share of common stock on the last day of such prior quarter; (ii) if, for five

consecutive trading days, the trading price per $1,000 principal amount of notes was less than 98% of

the product of the closing price of our common stock and the then applicable conversion rate; (iii) if a

specified corporate event occurs, such as a merger, recapitalization, reclassification, binding share

exchange or conveyance of all, or substantially all, of Virgin Media Inc.’s assets; (iv) the declaration by

Virgin Media Inc. of the distribution of certain rights, warrants, assets or debt securities to all, or

substantially all, holders of Virgin Media Inc.’s common stock; or (v) if Virgin Media Inc. undergoes a

fundamental change (as defined in the indenture governing the convertible senior notes), such as a

change in control, merger, consolidation, dissolution or delisting.

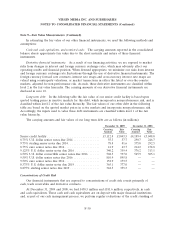

The initial conversion rate is equal to 52.0291 shares of Virgin Media Inc.’s common stock per

$1,000 of convertible senior notes, which represents an initial conversion price of approximately

$19.22 per share of common stock. The conversion rate is subject to adjustment for stock splits, stock

dividends or distributions, the issuance of certain rights or warrants, certain cash dividends or

distributions or stock repurchases where the price exceeds market values. In the event of specified

fundamental changes relating to Virgin Media Inc., referred to as ‘‘make whole’’ fundamental changes,

the conversion rate will be increased as provided by a formula set forth in the indenture governing the

convertible senior notes.

Holders may also require us to repurchase the convertible senior notes for cash in the event of a

fundamental change for a purchase price equal to 100% of the principal amount, plus accrued but

unpaid interest to the purchase date.

In May 2008, the FASB issued new guidance which requires that the liability and equity

components of convertible debt instruments that may be settled in cash upon conversion (including

partial cash settlement) be separately accounted for in a manner that reflects an issuer’s nonconvertible

F-26