Virgin Media 2009 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2009 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INVESTMENT HOLDINGS LIMITED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

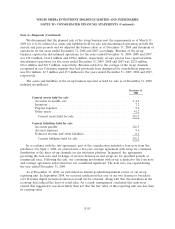

Note 4—Disposals (Continued)

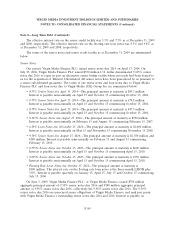

We determined that the planned sale of the sit-up business met the requirements as of March 31,

2009 for it to be reflected as assets and liabilities held for sale and discontinued operations in both the

current and prior periods and we adjusted the balance sheet as of December 31, 2008 and statement of

operations for the years ended December 31, 2008 and 2007 accordingly. Revenue of the sit-up

business, reported in discontinued operations, for the years ended December 31, 2009, 2008 and 2007

was £38.9 million, £241.8 million and £238.6 million, respectively. sit-up’s pre-tax loss, reported within

discontinued operations, for the years ended December 31, 2009, 2008 and 2007 was £22.8 million,

£66.6 million and £10.7 million, respectively. Revenue related to the carriage of the sit-up channels

recognized in our Consumer segment that had previously been eliminated for consolidation purposes

was £0.6 million, £2.7 million and £3.5 million for the years ended December 31, 2009, 2008 and 2007,

respectively.

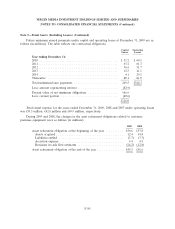

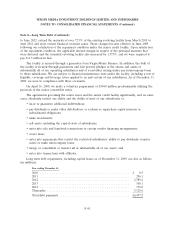

The assets and liabilities of the sit-up business reported as held for sale as of December 31, 2008

included (in millions):

December 31,

2008

Current assets held for sale

Accounts receivable, net ................................. £ 2.4

Inventory ............................................ 7.2

Prepaid expenses ...................................... 5.4

Other assets .......................................... 41.2

Current assets held for sale ............................. £56.2

Current liabilities held for sale

Accounts payable ...................................... £26.5

Accrued expenses ...................................... 9.6

Deferred revenue and other liabilities ....................... 0.1

Current liabilities held for sale ........................... £36.2

In accordance with the sale agreement, part of the consideration included a loan note from the

purchaser. On April 1, 2009, we entered into a five-year carriage agreement with sit-up for continued

distribution of the three sit-up channels on our television platform. In general, the agreements

governing the loan note and exchange of services between us and sit-up are for specified periods at

commercial rates. Following the sale, our continuing involvement with sit-up is limited to the loan note

and carriage agreement and is therefore not considered significant. The loan note was repaid during

the year ended December 31, 2009.

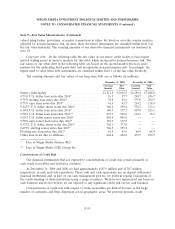

As at December 31, 2008, we performed an interim goodwill impairment review of our sit-up

reporting unit. In September 2008, we received notification that one of our two licenses to broadcast

over Freeview digital terrestrial television would not be renewed. Along with this, the downturn in the

economy had reduced the level of retail sales. As a result, management concluded that indicators

existed that suggested it was more likely than not that the fair value of this reporting unit was less than

its carrying value.

F-83