Virgin Media 2009 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2009 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INVESTMENT HOLDINGS LIMITED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

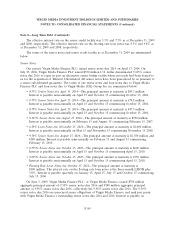

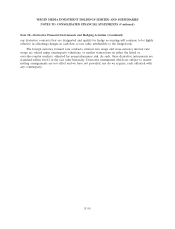

Note 10—Derivative Financial Instruments and Hedging Activities (Continued)

effective amount of gain or (loss) recognized in other comprehensive income and amounts reclassified

to earnings during the year ended December 31, 2009 (in millions):

Forward foreign

Interest rate Cross-currency exchange Tax

Total swaps interest rate swaps contracts Effect

Balance at December 31, 2008 ...... £ 40.1 £ (7.9) £ 64.0 £ — £(16.0)

Amounts recognized in other

comprehensive income .......... (216.6) (50.6) (165.8) (0.2) —

Amounts reclassified as a result of

cash flow hedge discontinuance .... 6.5 2.0 4.5 — —

Amounts reclassified to earnings

impacting:

Foreign exchange losses ......... 90.6 — 90.6 — —

Interest expense ............... 23.9 24.1 (0.2) — —

Operating costs ................ 0.2 — — 0.2 —

Tax effect recognized ............. — — — — —

Balance at December 31, 2009 ...... £ (55.3) £(32.4) £ (6.9) £ — £(16.0)

Assuming no change in interest rates or foreign exchange rates for the next twelve months, the

amount of pre-tax losses that would be reclassified from other comprehensive income to earnings would

be £30.3 million, nil and nil relating to interest rate swaps, cross-currency interest rate swaps and

forward foreign exchange contracts, respectively.

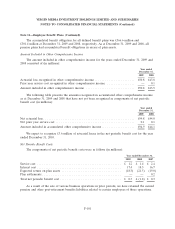

Note 11—Employee Benefit Plans

Defined Benefit Plans

Certain of our subsidiaries operate defined benefit pension plans in the U.K. The assets of the

plans are held separately from those of ourselves and are invested in specialized portfolios under the

management of investment groups. The pension cost is calculated using the projected unit method. Our

policy is to fund amounts to the defined benefit plans necessary to comply with the funding

requirements as prescribed by the laws and regulations in the U.K. Our defined benefit pension plans

use a measurement date of December 31.

Employer Contributions

In April 2007, we agreed with the trustees of one of our pension plans to a new funding

arrangement whereby we will initially be paying £8.6 million per annum towards the deficit for the next

three years. Additionally, in June 2007, we effected a merger of our three other defined benefit plans.

The merger of these plans was subject to the approval of the trustees and, as a condition of trustee

approval, we agreed to make a specific one-time contribution of £4.5 million. The funding

arrangements with respect to this plan included an agreement to pay a further £2.6 million to fund the

deficit for each of the next seven years. For the year ended December 31, 2009, we contributed

£13.4 million to our pension plans. We anticipate contributing a total of £17.2 million to fund our

pension plans in 2010.

F-99