Virgin Media 2009 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2009 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Note 9—Fair Value Measurements (Continued)

In estimating the fair value of our other financial instruments, we used the following methods and

assumptions:

Cash and cash equivalents, and restricted cash: The carrying amounts reported in the consolidated

balance sheets approximate fair value due to the short maturity and nature of these financial

instruments.

Derivative financial instruments: As a result of our financing activities, we are exposed to market

risks from changes in interest and foreign currency exchange rates, which may adversely affect our

operating results and financial position. When deemed appropriate, we minimize our risks from interest

and foreign currency exchange rate fluctuations through the use of derivative financial instruments. The

foreign currency forward rate contracts, interest rate swaps and cross-currency interest rate swaps are

valued using counterparty valuations, or market transactions in either the listed or over-the-counter

markets, adjusted for non-performance risk. As such, these derivative instruments are classified within

level 2 in the fair value hierarchy. The carrying amounts of our derivative financial instruments are

disclosed in note 10.

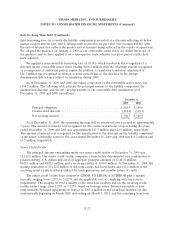

Long term debt: In the following table the fair value of our senior credit facility is based upon

quoted trading prices in inactive markets for this debt, which incorporates non-performance risk, and is

classified within level 2 of the fair value hierarchy. The fair values of our other debt in the following

table are based on the quoted market prices in active markets and incorporate non-performance risk.

Accordingly, the inputs used to value these debt instruments are classified within level 1 of the fair

value hierarchy.

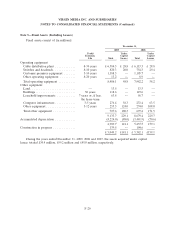

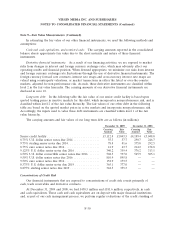

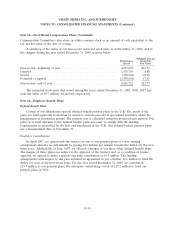

The carrying amounts and fair values of our long term debt are as follows (in millions):

December 31, 2009 December 31, 2008

Carrying Fair Carrying Fair

Amount Value Amount Value

Senior credit facility .............................. £3,112.8 £3,043.5 £4,189.4 £3,048.0

8.75% U.S. dollar senior notes due 2014 ............... 55.3 57.7 290.7 246.7

9.75% sterling senior notes due 2014 .................. 78.8 81.6 375.0 292.5

8.75% euro senior notes due 2014 .................... 41.9 43.7 214.2 158.8

9.125% U.S. dollar senior notes due 2016 .............. 340.2 359.4 376.2 313.1

6.50% U.S. dollar convertible senior notes due 2016 ...... 504.5 737.0 545.9 305.1

9.50% U.S. dollar senior notes due 2016 ............... 810.9 895.8 — —

9.50% euro senior notes due 2016 .................... 152.9 173.5 — —

8.375% U.S. dollar senior notes due 2019 .............. 365.1 377.0 — —

8.875% sterling senior notes due 2019 ................. 344.5 355.3 — —

Concentrations of Credit Risk

Our financial instruments that are exposed to concentrations of credit risk consist primarily of

cash, trade receivables and derivative contracts.

At December 31, 2009 and 2008, we had £430.5 million and £181.6 million, respectively, in cash

and cash equivalents. These cash and cash equivalents are on deposit with major financial institutions

and, as part of our cash management process, we perform regular evaluations of the credit standing of

F-30